Edelweiss Business Cycle Fund is an open-ended equity thematic mutual fund launched by Edelweiss Mutual Fund. The fund aims for long-term capital appreciation by investing in equity and equity-related securities. The fund managers will strategically allocate and rotate investments across sectors based on their position in the business cycle to potentially minimize volatility. The New Fund Offer (NFO) is open for subscription from July 9, 2024, to July 23, 2024, with a minimum investment of Rs. 5,000. There is an exit load of 1% if redeemed within 90 days from the date of allotment, and nil thereafter.

Edelweiss Business Cycle Fund seeks to generate long-term capital appreciation by investing predominantly in equity and equity-related securities with a focus on navigating business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy. There is no assurance that the investment objective of the Scheme will be achieved.

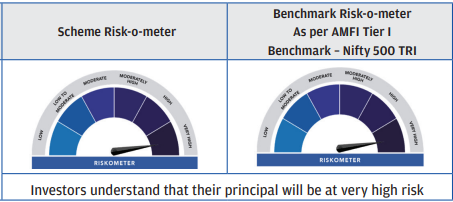

This NFO of Edelweiss Business Cycle Fund is suitable for investors who are seeking long-term capital appreciation and Investment in equity and equity-related instruments with a focus on navigating business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy.

| Instruments | Indicative allocations (% of total assets) |

| Equity and Equity related instruments selected based on business cycle | 100 – 80 |

| Other Equity & Equity related instruments | 20 – 0 |

| Debt and money market instruments | 20 – 0 |

| Units issued by REITs and InvITs | 10 – 0 |

The performance of the Edelweiss Business Cycle Fund will be benchmarked to the performance of the NIFTY 500 TRI.

Mr. Bhavesh Jain, 38, holds an MMS degree in finance and brings over 14 years of experience in the equity market. He has been with the AMC for more than 11 years, currently serving as the co-head of hybrid and solution funds, managing various schemes, and being a key individual in the organization. Previously, he worked at Edelweiss Securities Limited as an SGX Nifty Arbitrage Trader.

Mr. Bharat Lahoti has accumulated 17 years of experience in the research function within the financial services sector. He joined the AMC in September 2015. Before his tenure as a Fund Manager – Equity and a key individual at Edelweiss Asset Management Limited, he served as a Senior Manager – Fundamental Research at D.E. Shaw India Software Pvt. Ltd.

Mr. Amit Vora, a Bachelor of Commerce from the University of Mumbai, has over 16 years of experience in the financial services sector as a Trader. Before his current role at Edelweiss Asset Management Limited, he held positions at Antique Stock Broking Ltd., D.E. Shaw India Securities Pvt. Ltd., Derivium Tradition Securities India Pvt. Ltd., and Tower Capital and Securities Pvt. Ltd.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Ret (%) |

| HSBC Business Cycles Fund | 856.13 | 2.35 | 53.38 | 26.6 | 22.17 | 15.66 |

| Tata Business Cycle Fund | 2311.19 | 1.95 | 51.02 | – | – | 25.64 |

| ICICI Prudential Business Cycle | 9663.24 | 1.78 | 47.86 | 25.41 | – | 26.86 |

| Axis Business Cycles Fund | 2699.44 | 1.95 | 41.51 | – | – | 42.44 |

| Kotak Business Cycle Fund | 2470.51 | 1.95 | 36.37 | – | – | 25.83 |

| ABSL Business Cycle Fund | 1701.46 | 2.09 | 34.9 | – | – | 16.57 |

| HDFC Business Cycle Fund | 2906.75 | 1.95 | 31.34 | – | – | 25.18 |

| Union Business Cycle | 485.07 | 2.43 | – | – | – | 15.53 |

Data As of July 08, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 9, 2024, 6:35 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates