One of the long-awaited events is the June 4th General Election Indian’s result. It goes back to history as an event that has had a great impact on market volatility. On the day of announcing the election results, there are often massive movements in the stock exchange that can take place circuit limits. In case of a good outcome of elections, an upper circuit limit may be observed similar to what happened in 2009 when there were two upper circuits in one single day trading. Conversely, it may lead to a lower circuit limit if it turns out not so well.

The necessity of enforcing price bands, or circuit limits, is to prohibit great price fluctuations that might lead to panic buying or selling and cause market instability. These controls ensure market stability by reducing excessive volatility.

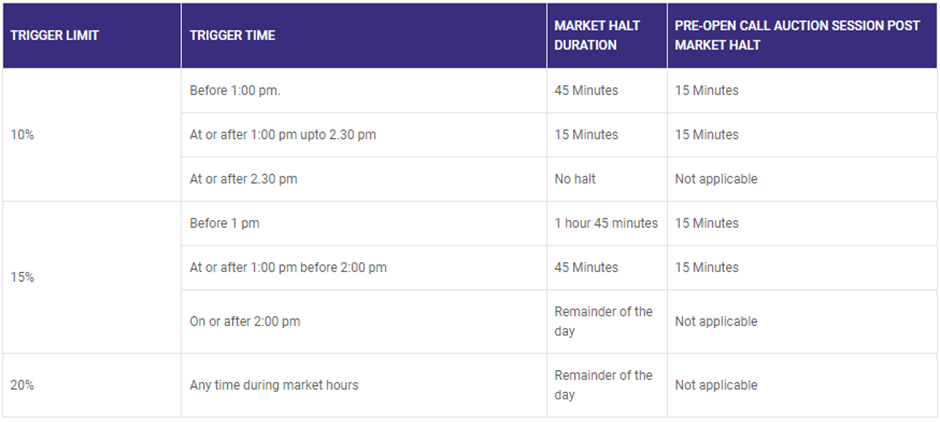

In June 2001, the Securities and Exchange Board of India (SEBI) introduced index-based market-wide circuit limits to safeguard investors from severe losses and avert market crashes. The NSE benchmark Nifty 50 index has circuit breaker limits set at 10%, 15%, and 20%. When these limits are triggered, trading is halted across the index. Similarly, when an individual stock hits its circuit limit, trading of that stock is paused.

Here’s a detailed look at how the circuit breaker system works for the Nifty 50 index:

10% Circuit Limit Trigger:

15% Circuit Limit Trigger:

20% Circuit Limit Trigger:

Investors need to understand these mechanisms, particularly during periods of high volatility like the announcement of election results. Apprehending circuit limits can help investors avoid extreme market movements and keep their investments safe.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: May 30, 2024, 6:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates