In recent years, the allure of Indian equities has been largely driven by the promise of robust policy reforms and economic growth under Prime Minister Narendra Modi. This optimism has justified the record premium Indian stocks hold over their emerging-market peers. However, the landscape has shifted following the national election, where Modi’s party achieved a weaker-than-expected mandate, leading to coalition politics. This outcome has cast doubt on the sustainability of the premium, with investors now demanding proof of policy continuity.

The formation of a coalition government has heightened concerns about the potential for policy disruptions. Investors are particularly wary of the possibility that Modi may resort to populist measures to regain public support, which could compromise fiscal discipline—a hallmark of his decade in power. The forthcoming budget will be a critical test for the new government, as it will signal its commitment to maintaining fiscal prudence. Global money managers are adopting a cautious stance, awaiting clarity on future policies and the trade-offs required in coalition governance.

Foreign investor scepticism is evident in the recent market activity. Between June 4 and June 6, 2024, foreign investors sold over Rs 24,466 crore worth of shares on a net basis. Despite this, local funds and retail investors buoyed the NSE Nifty 50 Index to a new record on Friday, recovering from the initial shock of the election results. The sustained buying by domestic investors reflects confidence in India’s long-term growth prospects, despite near-term uncertainties.

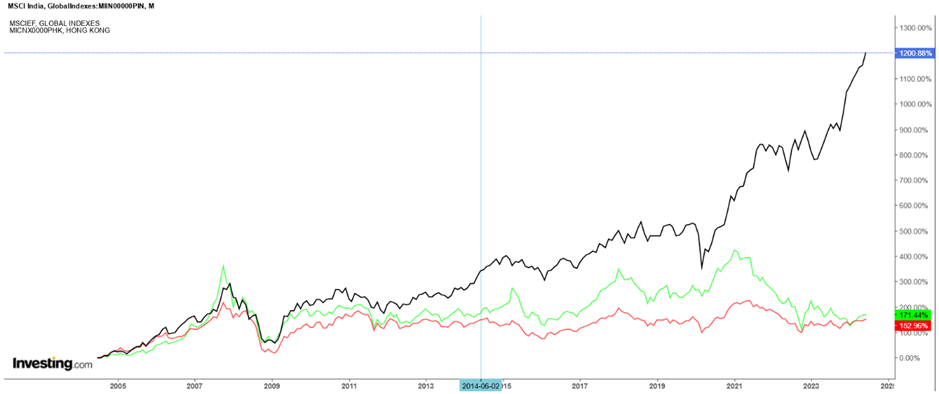

The chart illustrates the performance of three stock indexes over time: the MSCI India Index (black line), the MSCI China Index (green line), and the MSCI Emerging Markets Index (red line). The vertical blue line marks the period before and after Prime Minister Modi took office. In the period following Modi’s tenure since 2014, the MSCI India Index has shown a notable increase compared to the MSCI China Index and the MSCI Emerging Markets Index, indicating a relatively strong performance of Indian stocks.

The election results have also influenced sectoral performances within the market. Shares of consumer goods companies have emerged as strong performers, driven by expectations of increased welfare spending under a weaker government. The Nifty FMCG Index rose by as much as 5% since June 4, making it the highest-gaining index, followed by the Nifty Realty Index. Notable gainers include Balrampur Chini Mills Ltd, which surged 9.97%, and liquor-makers like Radico Khaitan Ltd and United Spirits Ltd, which advanced by 9.29% and 8.6% respectively. This trend reflects investor anticipation of heightened consumer demand spurred by welfare measures.

| Sr.No | Company Name | Returns from June 4 to June 7, 2024 (%) |

| 1 | Balrampur Chini Mills Ltd. | 9.97% |

| 2 | Radico Khaitan Ltd. | 9.29% |

| 3 | United Spirits Ltd. | 8.60% |

| 4 | United Breweries Ltd. | 7.55% |

| 5 | Varun Beverages Ltd. | 7.44% |

| 6 | Marico Ltd. | 6.26% |

| 7 | Dabur India Ltd. | 6.04% |

| 8 | Godrej Consumer Products Ltd. | 5.89% |

| 9 | ITC Ltd. | 5.77% |

| 10 | Colgate-Palmolive (India) Ltd. | 5.47% |

| 11 | Tata Consumer Products Ltd. | 4.48% |

| 12 | Procter & Gamble Hygiene and Health Care Ltd. | 4.02% |

| 13 | Hindustan Unilever Ltd. | 3.26% |

| 14 | Nestle India Ltd. | 3.08% |

| 15 | Britannia Industries Ltd. | 2.60% |

Conclusion

The recent election results have brought the premium for Indian stocks under scrutiny, as investors seek assurance of policy continuity amidst coalition politics. While foreign investors have shown scepticism by offloading shares, domestic investors remain optimistic, driven by India’s long-term growth potential. The performance of FMCG stocks highlights expectations of increased welfare spending, which could boost consumer demand. As the new government prepares its first budget, all eyes will be on its ability to maintain fiscal discipline and continue with growth-oriented reforms.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 11, 2024, 11:09 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates