Foreign Portfolio Investors (FPIs) play a crucial role in the Indian stock market. Their investment decisions can significantly impact market volatility and overall health.

Our analysis reveals a mixed picture. While there’s no clear, consistent pattern across all elections, the data suggests some interesting trends. In the 2014 elections, FPI net total flows were positive before the election and even higher three months after, indicating investor confidence in the post-election scenario. Conversely, the 2009 election witnessed negative net flows before the election, followed by a positive swing afterward. This could be attributed to the global financial crisis that year, impacting overall investor sentiment. In the 2004 elections, FPI inflows reduced significantly three months after the elections, indicating reduced interest by FPIs in Indian markets.

The following table illustrates the FPI net total flows data three months before the starting month of elections and three months after the end of the election month. Net total flows encompass both equity and debt inflows and outflows.

| Elections | FPI Net Total Flows (Rs crore) | ||

| From | To | Before 3 months | After 3 Months |

| 19 April, 2024 | 01 June, 2024 | 77,220 | – |

| 11 April, 2019 | 19 May, 2019 | 55,248 | 4,237 |

| 07 April, 2014 | 12 May, 2014 | 57,727 | 88,885 |

| 16 April, 2009 | 13 May, 2009 | -12,454 | 22,610 |

| 20 April, 2004 | 10 May, 2004 | 12,986 | 2,966 |

The upcoming 2024 election presents a unique case. Data for the pre-election period (three months before) shows positive net inflows, potentially reflecting optimism about the Indian economy and a stable government post-election. However, data for the post-election period is yet to be available. But according to GDP growth estimates of various brokerages, IMF and RBI the fund inflows are expected to be positive given the outperformance of the Indian economy despite geopolitical issues prevailing in the global markets.

Understanding FPI behavior requires considering various factors beyond just election timing. Here are some key influences:

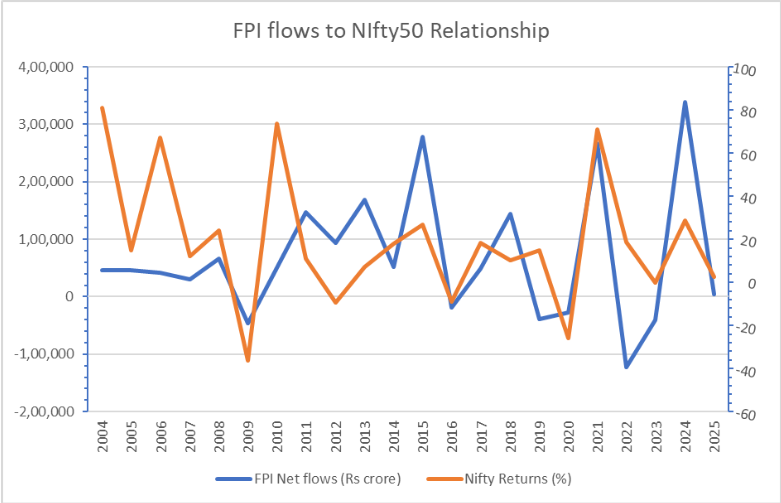

The FPI net flows relationship with Nifty50 is somewhat directly related as FPI flows increase the Nifty50 returns increase but at a lower proportion

In recent years, there has been a significant shift in the ownership of Indian companies. Foreign Institutional Investors (FIIs) have been steadily decreasing their holdings, while Domestic Institutional Investors (DIIs) have been aggressively buying. This trend is evident in the record inflows into mutual funds and pension funds. Fueled by this domestic financialization

According to the data from primeinfobase.com, DII holdings have been on the rise, while foreign ownership has dropped in the past 10 years. Domestic institutional holdings in NSE-listed companies increased to 15.96% in December 2023 as against 13.77% in December 2018 or 10.49% in December 2013. Foreign holdings in NSE-listed companies were at 18.19% as of December 2023 down from 19.66% in December 2018 or 19.36% as of December 2013. FIIs holding hit a peak of 21.21% in December 2020.

This narrowing gap, with DIIs just 12.23% behind FIIs, suggests a potential future where domestic investors hold a larger sway in the Indian market. This shift in ownership has a crucial implication: the impact of FII inflows and outflows, which previously caused significant market volatility, is likely to be dampened as DIIs become a more prominent and stable source of investment.

Conclusion

In conclusion, while no consistent pattern emerges across all elections, the analysis reveals nuanced dynamics influenced by global and domestic factors. Moreover, the discussion on the evolving ownership landscape, with DIIs gaining prominence over FIIs, underscores the shifting dynamics of the Indian stock market. As DIIs continue to assert their influence, the impact of FII inflows and outflows on market volatility is expected to diminish.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 18, 2024, 6:11 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates