Today is the last trading day of the year 2023, and from the beginning of next week, not only do we start a fresh week, but also a fresh year. Throughout the year 2023, we have witnessed a strong bullish momentum, especially during the last two months, namely November and December 2023. The overall sentiment during the year has been bullish and remains very bullish as the month concludes, despite major events and ongoing conflicts between Russia and Ukraine, Israel, and another conflict involving Israel and Hamar.

In this article, we aim to delve into the different sectoral indices listed on the NSE, analysing their performance throughout the year. Our focus will be on identifying the indices that have demonstrated strong performance and surpassed the benchmark set by the Nifty50 Index. Also, the FII/FPI investment trend in the last three years.

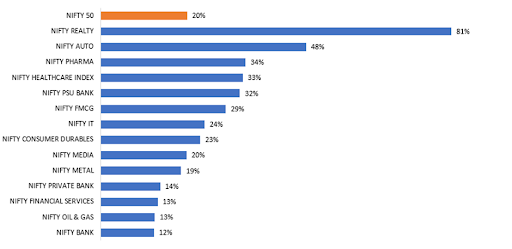

Index Performance:

| Index | 2023 Closing Levels | 2022 Closing Levels | Change | % Return |

| NIFTY 50 | 21731.4 | 18,105.30 | 3,626.10 | 20% |

| NIFTY REALTY | 783.05 | 431.80 | 351.25 | 81% |

| NIFTY AUTO | 18,618.20 | 12,611.70 | 6,006.50 | 48% |

| NIFTY PHARMA | 16,831.80 | 12,597.60 | 4,234.20 | 34% |

| NIFTY HEALTHCARE INDEX | 10,637.80 | 8,001.40 | 2,636.40 | 33% |

| NIFTY PSU BANK | 5,713.45 | 4,318.55 | 1,394.90 | 32% |

| NIFTY FMCG | 56,987.20 | 44,171.45 | 12,815.75 | 29% |

| NIFTY IT | 35,515.00 | 28,621.70 | 6,893.30 | 24% |

| NIFTY CONSUMER DURABLES | 31,132.35 | 25,296.70 | 5,835.65 | 23% |

| NIFTY MEDIA | 2,388.15 | 1,992.05 | 396.10 | 20% |

| NIFTY METAL | 7,978.00 | 6,723.40 | 1,254.60 | 19% |

| NIFTY PRIVATE BANK | 24,875.65 | 21,862.00 | 3,013.65 | 14% |

| NIFTY FINANCIAL SERVICES | 21,487.45 | 18,981.20 | 2,506.25 | 13% |

| NIFTY OIL & GAS | 9,496.15 | 8,438.25 | 1,057.90 | 13% |

| NIFTY BANK | 48,292.25 | 42,986.75 | 5,305.50 | 12% |

Upon reviewing the data above, it’s evident that the Nifty Realty index not only outperformed the Nifty50 but also surpassed all other sectoral indices listed on the NSE, with an impressive 81% surge in returns for the year 2023. Within the Realty space, Prestige Estate notably rewarded its shareholders with an impressive return of 154% during the same period.

The second-best performing sectoral index is the Nifty Auto, which delivered a notable return of 48% in 2023. Among all the stocks listed in the Nifty Auto Index, Tata Motors stood out with a multibagger return of approximately 101% during the year. Notably, Tata Motors stands as the top-performing stock not only within the auto index but also within the Nifty 50, outperforming all its peers.

FIIs Investment:

| FIIs / FPIs Investment (Monthly) Rs in Cr | |||

| Month | 2021 | 2022 | 2023 |

| JAN | 14631.21 | -28526.3 | -26543.75 |

| FEB | 24012.74 | -38068.02 | -4139.12 |

| MAR | 17022.64 | -50067.58 | 5899.21 |

| APR | -8835.9 | -22688.37 | 13544.79 |

| MAY | -1957.8 | -36517.86 | 48329.55 |

| JUN | 12973.97 | -51422.03 | 56257.7 |

| JUL | -7409.99 | 1971.33 | 47977.08 |

| AUG | 16555.95 | 56521.1 | 18337.82 |

| SEP | 27755.71 | -3955.31 | -13810.39 |

| OCT | -12436.92 | -3080.12 | -17875.46 |

| NOV | -2520.76 | 33847.26 | 24546.41 |

| DEC | -29702.19 | 9170.68 | 77691.42 |

| TOTAL | 50088.66 | -132815.22 | 230215.26 |

Upon observing the data presented above for the calendar years 2021, 2022, and 2023, it’s notable that Foreign Portfolio Investors (FPIs) were net buyers, accumulating investments worth Rs 50,088.66 crore encompassing Equity, Debt, and other assets in 2021. However, in the subsequent year, they transformed into net sellers, offloading investments valued at Rs 1,32,815.22 crore. Interestingly, in 2023, FPIs reverted to being net buyers, acquiring investments totalling Rs 2,30,215 crore as per the latest update.

Looking at the past decade, the year 2014 saw Foreign Institutional Investors (FIIs) investing Rs 2,56,211.85 crore. Remarkably, the second-highest investment influx occurred in the year 2023, signifying a remarkable surge in investments. With the hope that the market will remain bullish, we wish that the upcoming year brings greater prosperity in terms of both health and wealth to the world, including the Indian economy.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 29, 2023, 4:58 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates