This article delves into Fineotex Chemical Ltd, examining its credit upgrades as well as its strengths and challenges.

The Fineotex Group includes Fineotex Chemical Limited (FCL), established as a public limited company in 2004. FCL, listed on both the Bombay Stock Exchange (since March 2011) and the National Stock Exchange (since January 2015), is a key player in the speciality chemicals and enzymes manufacturing sector, offering a wide range of products for various industries across 70 countries. Presently, Sanjay Tibrewala oversees day-to-day operations, while Surendra focuses on strategic decisions. FCL operates three manufacturing facilities in Navi Mumbai, Selangor (Malaysia), and Ambernath.

Over the past three years, Fineotex Chemical Limited (FCL) has demonstrated impressive financial performance, with a compounded sales growth rate of 38%. Notably, the company’s profits have surged with a compounded growth rate of 64%, reflecting its operational efficiency. FCL’s stock price has exhibited remarkable growth, with a CAGR of 111%, indicating investor confidence. Furthermore, the company’s robust return on equity, averaging 25% over the same period, underscores its ability to generate strong returns for shareholders. These financial metrics depict FCL’s promising growth trajectory and financial strength.

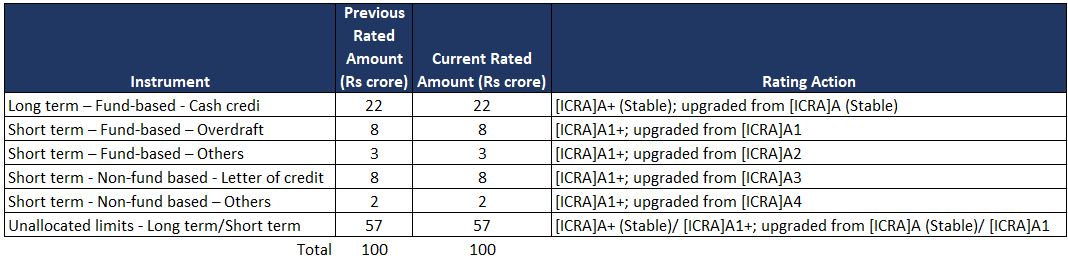

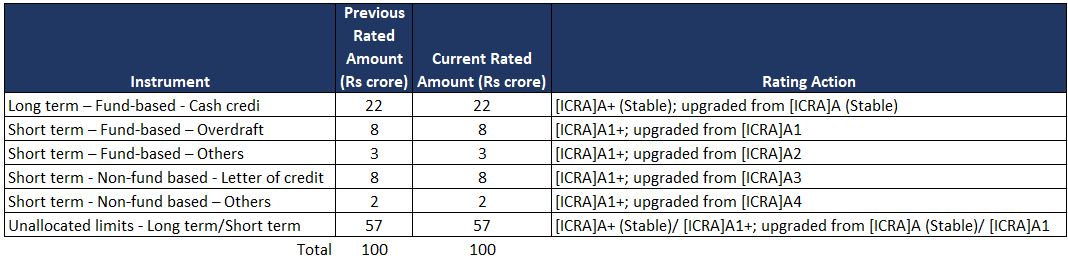

Synopsis of the Rating Update

According to ICRA, Fineotex Chemical Limited (FCL) demonstrates substantial credit strengths.

- The company holds a prominent position in the speciality textile chemicals sector, bolstered by its experienced promoters and strong relationships with esteemed clients globally.

- FCL’s unwavering focus on speciality chemicals and customized solutions has not only led to the acquisition of new clients but has also sustained healthy profit margins.

- With a presence in around 70 countries and exports contributing to approximately 23% of its FY2023 revenue, FCL maintains a robust global footprint.

- Moreover, FCL has adeptly diversified its revenue streams into the health and hygiene segment through in-house research and development capabilities and strategic joint ventures, reducing earnings cyclicality.

- The company’s financial risk profile remains strong, characterized by consistent profit margins and a sturdy capital structure.

- Over the FY2020 to FY2023 period, FCL achieved a remarkable compound annual growth rate (CAGR) of about 38% in consolidated entity revenue, with FY2023 witnessing a remarkable YoY revenue growth of 40.4%, primarily driven by the increased volumes from newly added capacities.

- With operational profit margins (OPM) consistently ranging between 18-22% over the past five years, FCL sustains a resilient financial risk profile. This is further reinforced by its minimal debt exposure and robust cash generation, collectively contributing to a solid overall credit profile.

According to the ICRA report, Fineotex Chemical Limited (FCL) faces significant credit challenges. ICRA has highlighted the following challenges for the company:

- FCL operates in an intensely competitive landscape, contending with both domestic and multinational companies equipped with established brands and substantial capital bases.

- To navigate this challenge, the company must maintain a consistent focus on tailoring solutions to customer needs, fostering innovation through new product development, and exploring opportunities for expansion into new market segments.

- Another significant challenge pointed out by ICRA is FCL’s vulnerability to fluctuations in raw material prices. This vulnerability arises from the company’s reliance on a diverse range of raw materials, the costs of which can vary due to factors like demand-supply dynamics and fluctuations in crude oil prices.

- Although FCL has demonstrated its ability to effectively manage and pass on these cost fluctuations, maintaining a healthy Operational Profit Margin (OPM) within the 18-22% range over the past five years, the absence of a well-defined hedging policy exposes the company to foreign exchange rate volatility.

These challenges, as outlined by ICRA, underscore the importance of FCL’s strategies in order to sustain competitiveness and effectively manage the inherent risks associated with raw material costs and foreign exchange rate fluctuations.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.