Shares of Foods and Inns Limited witnessed a significant surge today. The stock opened trading at Rs 165.10, almost flat compared to the previous day’s closing price of Rs 166.55 per share on the BSE. Despite the flat opening, it surged by 16.5% today.

As of writing this article, the stock is trading at Rs 190, which represents a 14.44% increase from its previous closing price of Rs 166.55 on the BSE. What’s more, it has broken out from a continuation pattern with significant volume, and the candle on the daily time frame is a solid green bar, holding the price at the upper levels of the candle.

With a market capitalisation of Rs 1,017 crore, the stock has demonstrated outstanding performance in recent periods, yielding a 104% return in the last year. Furthermore, it has generated an impressive multibagger return of 271% over the last three years.

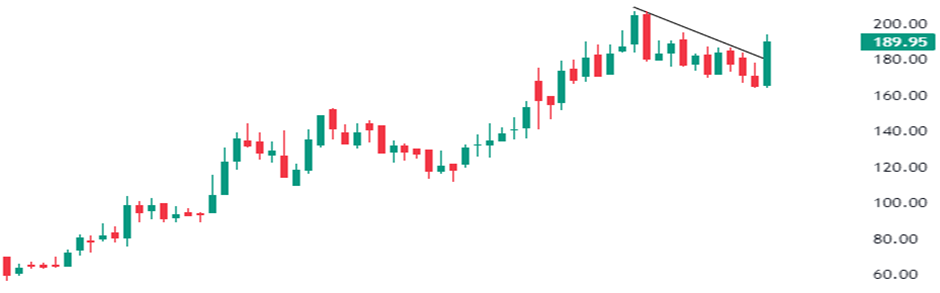

If we observe the daily candlestick chart of the company’s stock, it is evident that it engulfs more than six previous day’s trading candles on the daily time frame, depicting significant bullishness on the chart.

Here is the chart presentation of the company’s shares on the monthly time frame:

Foods and Inns Limited, an India-based food processing company, specializes in the production and sale of a diverse range of processed tropical fruit and vegetable pulps, purees, spices, spray-dried powders, frozen foods, and other value-added food products. The company markets its consumer goods under several well-known brands, including Green Top, Kusum, and Madhu.

The company is recognised as the second-largest processor and exporter of processed fruit and vegetable products in India.

In the June quarter of FY24, the company experienced a significant increase in revenue from operations, with a growth of 31% YoY, rising from Rs 220 crore to Rs 288 crore. The company reported an operating profit of Rs 32 crore, compared to Rs 17 crore in the corresponding quarter of the previous year, resulting in an operating profit margin of 11%.

Meanwhile, the company’s net profit amounted to Rs 14 crore, which doubled compared to the profit of Rs 7 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 15 crore.

The company’s ROE (Return on Equity) and ROCE (Return on Capital Employed) stand at 17.8% and 19.6%, respectively. The price-to-book value ratio is 3.9 times, and the shares are trading at a price-to-earnings ratio of 20.4 times in the market.

Investors should keep an eye on this stock as it looks promising on the chart and could potentially outperform in the future.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 26, 2023, 4:59 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates