Franklin Templeton Mutual Fund introduces the Franklin India Multi Cap Fund, an open-ended equity scheme designed to generate long-term capital appreciation. This fund invests in a diversified portfolio of equity and equity-related securities across large-cap, mid-cap, and small-cap companies. Although the fund aims for substantial long-term growth, there is no assurance that the investment objective will be achieved. The New Fund Offer (NFO) launches on 8th July 2024 and closes on 22nd July 2024. The minimum subscription amount for this fund is ₹5,000.

An exit load of 1% applies if units are redeemed or switched out within one year of allotment. This load structure is subject to change by the Trustee/AMC on a prospective basis, following regulatory guidelines. Investors should note that this fund falls under the Equity Scheme category, specifically a Multi Cap Fund.

The investment objective of the Franklin India Multi Cap Fund is to generate long-term capital appreciation by investing in a portfolio of equity and equity-related securities of large-cap, midcap, and small-cap companies. There is no assurance that the investment objective of the Scheme will be achieved

This NFO of Franklin India Multi Cap Fund is suitable for investors who are seeking long-term capital appreciation and a fund that invests predominantly in equity and equity-related securities across large-cap, midcap, and small-cap stocks

| Instruments | Indicative allocations (% of total assets) |

| Equity and Equity related securities of large

cap, midcap and small cap companies of which; |

100 – 75 |

| Large Cap companies | 50 – 25 |

| Midcap companies | 50 – 25 |

| Small cap companies | 50 – 25 |

| Debt & Money Market Instruments, cash & cash

equivalent |

25 – 0 |

| Units issued by REITs and InvITs | 10 – 0 |

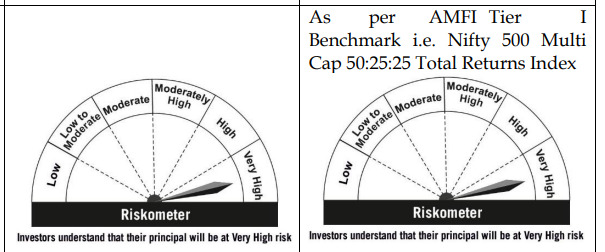

The performance of the Franklin India Multi Cap Fund will be benchmarked to the performance of the Tier 1: Nifty 500 Multi Cap 50:25:25 Total Returns Index

Kiran Sebastian, aged 43, is a seasoned professional with a robust academic foundation, holding an MBA from the University of Oxford and a B.Tech from the University of Calicut. With 19 years of experience, he has been a key player in strategic planning and investment decision-making. His diverse expertise spans various facets of financial management and technology integration, contributing significantly to the organization’s success.

Akhil Kalluri, aged 35, combines a strong technical and managerial background, having earned his MBA from IIM Lucknow and a B.Tech in Electronics and Communications Engineering from Andhra University. With 12 years of experience, he brings a comprehensive understanding of the technological advancements and market dynamics. Kalluri’s role involves innovative investment strategies and the implementation of cutting-edge financial solutions.

Sandeep Manam, aged 36, has built a solid career foundation with a PGDM from IIM Ahmedabad and a B.Tech in Electronics and Communication Engineering from the National Institute of Technology Calicut. With 13 years of experience, Manam has played a pivotal role in optimizing investment portfolios and enhancing operational efficiencies. His contributions are marked by a deep understanding of market trends and strategic investment methodologies.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | 10 Years Returns (%) | Since Launch Ret (%) |

| Sundaram Multi Cap Fund | 2566.74 | 1.98 | 44.14 | 20.52 | 19.8 | 15.17 | 16.21 |

| Baroda BNP Paribas Multi Cap Plan A | 2458.87 | 2.03 | 49.35 | 24.23 | 23.48 | 15.33 | 17.43 |

| ICICI Prudential Multi Cap | 12047.8 | 1.77 | 47.3 | 23.84 | 20.87 | 16.06 | 15.69 |

| Invesco India Multi Cap | 3359.12 | 1.91 | 46.51 | 19.86 | 22.1 | 16.27 | 16.85 |

| Nippon India Multi Cap | 31963.02 | 1.6 | 53.91 | 32.42 | 24 | 16.69 | 19.16 |

| Quant Active Fund | 10204.01 | 1.72 | 54.55 | 25.61 | 31.24 | 21.46 | 20.18 |

| Category Average | – | – | 49.24 | 23.49 | 23.28 | 16.83 | 27.42 |

Data As of July 05, 2024

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 8, 2024, 6:09 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates