In the fast-paced world of global finance, the performance of currencies often mirrors the economic strength and stability of a nation. In the first two months of 2024, one currency stood out among its emerging market peers, showcasing resilience and promise for the year ahead: the Indian rupee.

While many emerging market currencies faced declines against the US dollar, the Indian rupee remained steady, defying the trend. This stability is especially notable given the dollar’s strength during the same period. The rupee’s performance has been buoyed by significant inflows from global funds, with nearly $5 billion flowing into Indian bonds as investors position themselves ahead of the nation’s inclusion in global bond indexes.

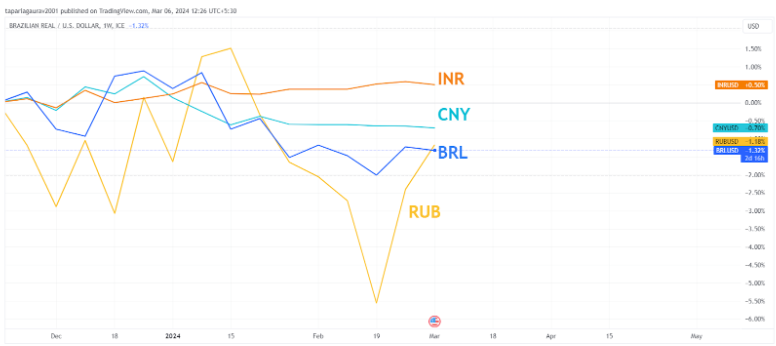

The Indian rupee has demonstrated lower volatility than its emerging market counterparts since December

The rupee’s impressive performance can be attributed to several key factors. Firstly, India’s upcoming inclusion in global bond indexes has sparked investor interest, leading to substantial inflows. Additionally, the rupee’s status as one of the least volatile emerging-market currencies this year has attracted traders seeking stability.

Amidst the rupee’s stability, there has been speculation about the role of the Reserve Bank of India (RBI). The RBI may have used a portion of India’s substantial foreign exchange reserves, which stand at $619 billion, to limit the currency’s volatility. This intervention has helped maintain the rupee’s steady performance in the face of global market fluctuations.

Looking ahead, a mild appreciation of the rupee, driven by continued inflows related to its inclusion in global indexes. Despite this, volatility is expected to remain low, further enhancing the attractiveness of the rupee for investors.

The Indian rupee’s standout performance in the first two months of 2024 is a testament to the nation’s economic resilience and attractiveness to global investors. With its stability and potential for appreciation, the rupee is poised to continue its strong performance throughout the year, offering investors a promising opportunity in the world of emerging market currencies.

The Indian rupee’s performance in 2024 has been impressive, driven by inflows from global funds and its upcoming inclusion in global bond indexes. With the currency remaining stable and volatility low, the rupee’s outlook appears bright, offering investors an attractive option in the emerging market landscape.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 6, 2024, 3:32 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates