Insurance provider Go Digit General Insurance Limited raised ₹2,614.65 crore via an Initial Public Offering (IPO) that was open from May 15 to May 17, 2024. On Day 3, the Go Digit IPO witnessed a total subscription of 9.60x. The public issue subscribed 4.27x in the retail category, 12.56x in QIB, and 7.24x in the NII category by May 17, 2024

On May 23, 2024, the stock of Go Digit General Insurance was listed on the NSE Mainboard segment at a price of ₹286 per share, a premium of 5.15% over the IPO issue price of ₹272. For the day, the upper circuit price has been set at ₹343.20, and the lower circuit price has been set at ₹228.80. On the listing day, Go Digit shares closed at ₹305.75 with a listing day gain of ~12.41%. Since listing, Go Digit shares have witnessed a return of ~12.12% with a high of ₹372.00 and a low of ₹278.55.

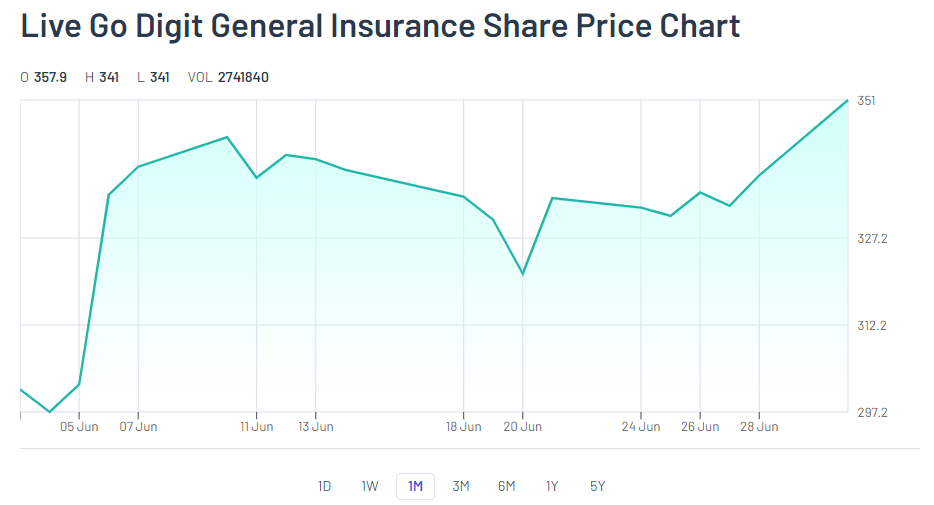

Go Digit IPO delivered a return of ~12.74% in the past month, with the stock closing at ₹301.75 on June 03, 2024, and ₹340.95 on July 02, 2024.

On June 12, 2024, shares of Go Digit soared over 10% during the early trading session after the company reported strong numbers in its first-ever quarterly results.

Go Digit reported a net profit of ₹53 crore for the quarter ended March 31, 2024, which was up 104% from ₹26 crore reported in the year-ago period. The gross written premium for the reported quarter stood at ₹2,336 crore, up from ₹1,955 crore reported in Q4FY23, rising 19% on a year-on-year (YoY) basis.

For FY2024, the Premium Retention Ratio stood at 85.8%, compared to 81.6% in FY2023. In addition, the combined ratio was 108.7%, compared to 107.4% in FY2023.

Following the results, shares of Go Digit General Insurance surged more than 10% to ₹372.35, commanding a total market capitalisation close to ₹35,000 crore.

Go Digit General Insurance Ltd (GDGIL) is one of the leading digital full-stack non-life insurance companies. It leverages its technology to power what the company believes to be an innovative approach to product design, distribution, and customer experience for non-life insurance products. Since the inception of its insurance operations in 2017, it has significantly scaled its business, improved underwriting performance and generated consistent investment returns.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 4, 2024, 4:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates