Large central banks are adding gold to their reserve portfolios. China and India's leading gold purchases are impacting the world's financial dynamics.

Gold has emerged as the star performer in 2024, defying expectations and delivering substantial returns for investors.

Price Surge

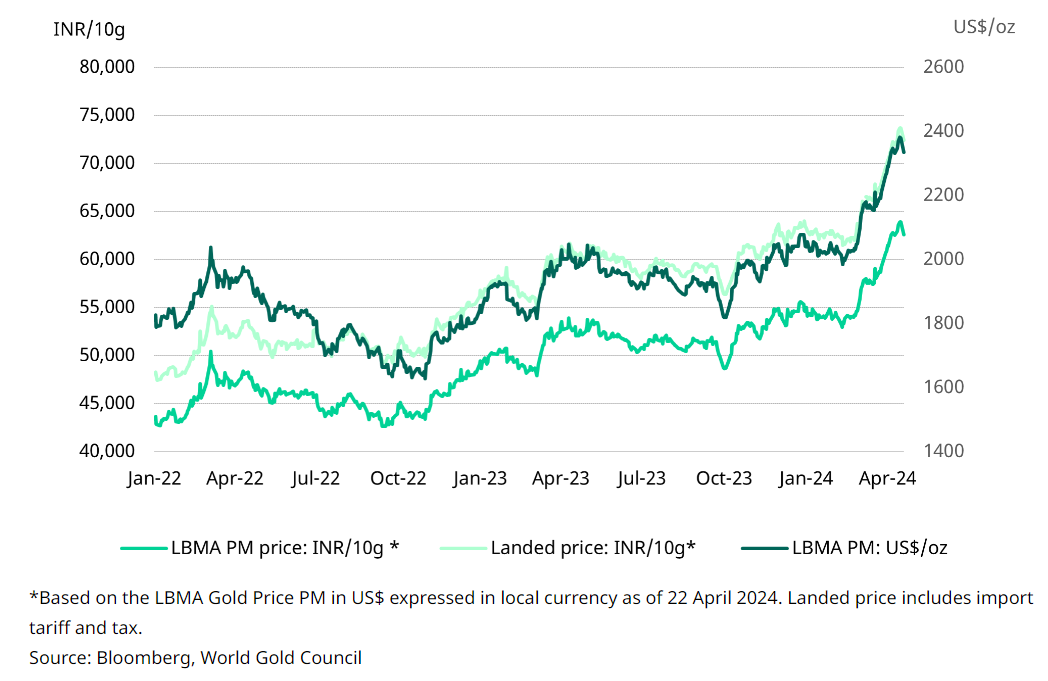

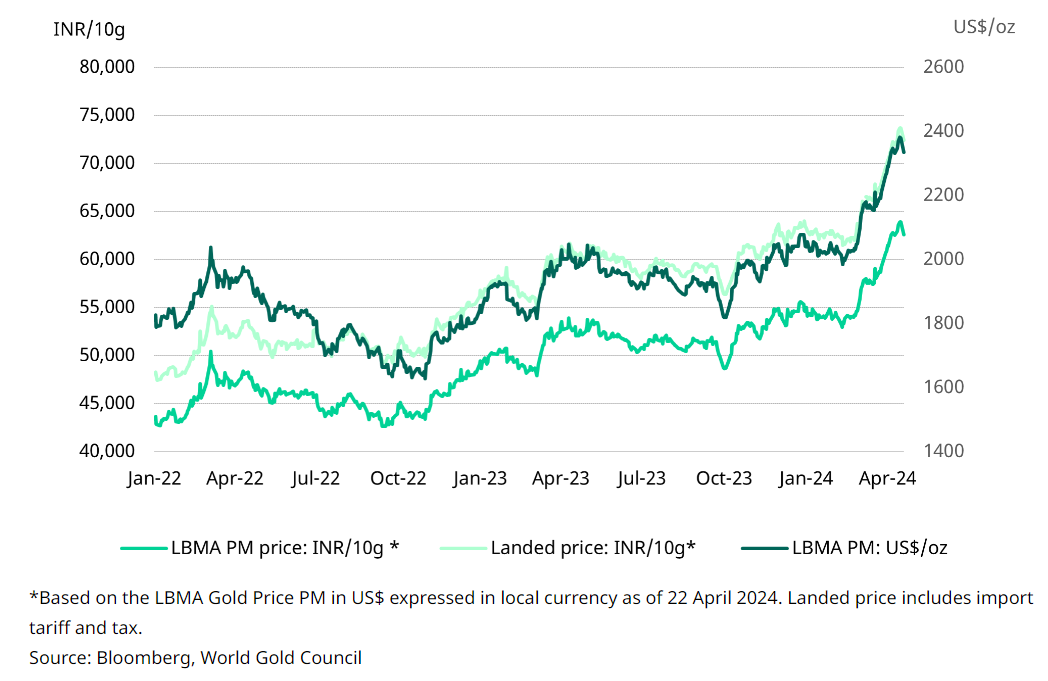

- Year-to-date, the price of spot gold has soared by 16%, reaching $2,391 per ounce, up from $2,062 at the start of the year.

- Domestic prices mirrored the trend, climbing from ₹63,225 per 10 grams to ₹72,958. In May, a record high of ₹74,442 was reached.

Factors Fueling the Rally

- Geopolitical Tensions: The ongoing conflicts in the Middle East and Ukraine have created a climate of uncertainty, making gold a safe-haven asset.

- Lower US Interest Rates: The prospect of a more dovish Federal Reserve has lowered the opportunity cost of holding gold compared to interest-bearing investments.

- Strong Demand: Relentless demand from China and India, driven by retail investors, institutional funds, and central banks, has put upward pressure on prices.

- Diversification of Reserves: Major central banks, particularly in Asia, are diversifying away from the U.S. dollar and increasing their gold holdings.

- Weakening US Dollar: The decline of the U.S. dollar as the dominant reserve currency makes gold a more attractive alternative.

Central Banks Lead the Charge

- China has been a major player, reducing its holdings of U.S. Treasuries and acquiring significant amounts of gold. The PBoC’s gold buying streak continued for 17 months, adding another 27.06 tonnes in Q1 2024.

- India also ramped up purchases, acquiring 19 tonnes in Q1 FY24, exceeding its total for 2023. The RBI repatriated 100 tonnes of gold from the UK.

- Many central banks are expected to continue buying gold as geopolitical and financial risks persist.

Shifting Global Landscape

China and Russia are challenging the U.S. dollar’s dominance in global trade, particularly after the U.S. imposed sanctions on Russia. The recent expiration of the “petrodollar” system highlights a potential shift in global financial power.

Looking Ahead

Gold’s strong performance in 2024 reflects a confluence of factors. Whether the rally continues will depend on the evolution of these factors, particularly the trajectory of geopolitical tensions, central bank actions, and the strength of the U.S. dollar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.