In a landmark move, the Indian government concluded its 23-year association with Maruti Udyog, the country’s largest carmaker on May 10, 2007. The government successfully divested its residual 10.3% stake, amounting to 2,96,79,709 shares, for an impressive Rs 2,368 crore. The shares were sold at an average price of Rs 797 each. This strategic move marked the end of the government’s majority ownership, a journey that began with the formation of Maruti Udyog as a joint venture with Suzuki Motor Corporation.

LIC emerged as the clear winner in the bidding process, securing over one crore shares at a bidding price of Rs 800. This substantial acquisition positioned LIC as the second-largest shareholder, potentially making it eligible for a board position within Maruti Udyog. Noteworthy winners also included PNB, HDFC Mutual Fund, and State Bank of India Mutual Fund, among 32 institutions and mutual funds that submitted successful financial bids.

Corporation Bank and Exim Bank secured the highest bids at Rs 850 per share, obtaining 5.88 lakh and 1.18 lakh shares, respectively. Bank of Baroda followed as the second-highest bidder at Rs 826 per share. Aggressive bidding from Reliance Mutual Fund and HDFC Mutual Fund resulted in them acquiring 20 lakh and 10 lakh shares, respectively, at Rs 790 and Rs 782 apiece.

The successful completion of this stake sale position made Maruti Udyog an attractive investment, evidenced by the aggressive bidding from various financial institutions and mutual funds. The shift in ownership dynamics, with LIC becoming a major stakeholder, adds a new dimension to Maruti’s governance structure.

The shares sold during this transaction contributed to the end of the government’s role in Maruti, which initially began with majority ownership and control. The divestment strategy, while marking the end of an era, sets the stage for potential further developments in Maruti’s corporate journey.

Despite uncertainties about Maruti’s future in alternative scenarios, its strategic decisions fortified its ability to endure challenges. The reforms in the 1990s exposed India’s market to international competition, affecting Maruti’s market share. However, this led to a more accessible and vibrant automobile market. By 2007-08, the government fully divested its 10.3% stake in Maruti, generating approximately Rs 6,000 crore. This marked a significant return on the initial investment of about Rs 57 crore in the 1981-82 joint venture.

In the 1980s, the Indian automobile sector was dominated by outdated technology and hindered by government regulations. Recognizing the need for a modern car for the masses, the Indian government partnered with Japan’s Suzuki Motor to establish Maruti Suzuki in 1981. Despite initial challenges, Maruti Suzuki achieved profitability within five years and became a public-sector success story.

As Maruti Suzuki’s popularity grew, Suzuki increased its stake in the joint venture, leading to tensions over management control. Under the Vajpayee government’s disinvestment focus, the Indian government gradually sold its stake in Maruti Suzuki, culminating in a complete exit in 2007. This strategic move ensured Maruti Suzuki’s resilience in the face of market liberalization and global competition.

Today, Maruti Suzuki stands as a testament to the power of strategic partnerships and the transformative impact of market reforms. With its market cap skyrocketing to Rs 3.15 lakh crore, Maruti Suzuki remains a dominant force in India’s automotive sector, a testament to its enduring success in an ever-evolving industry.

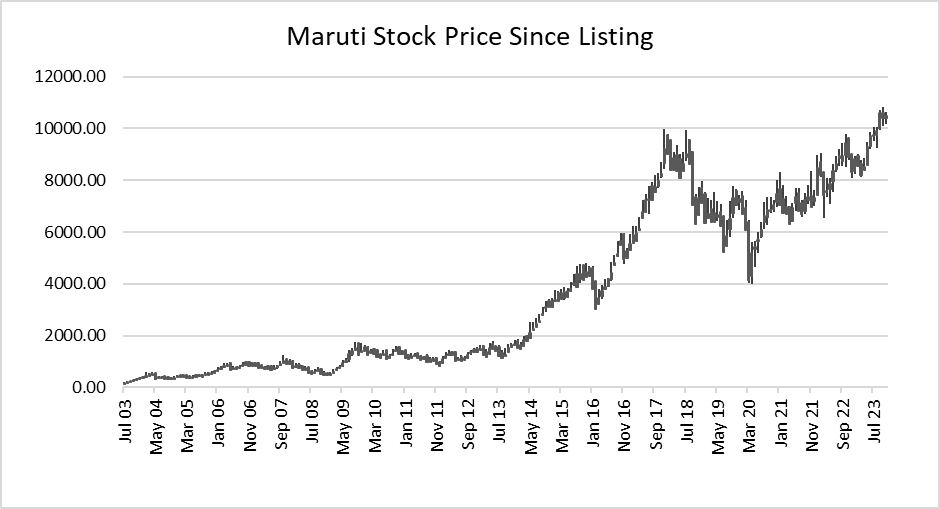

In 2003, Maruti Suzuki went public with an IPO issue price of Rs 125. Fast forward to November 23, 2023, the current share price stands impressively at Rs 10,448.50.

This remarkable journey of 20 years reflects an extraordinary gain of 8250.8%. Since its initial public offering, Maruti’s share prices have surged, marking an incredible 82.5-fold increase.

This substantial growth not only underscores the company’s strong performance but also highlights the attractive returns it has delivered to its investors over the years.

Remarkably, this translates into a compounded annual growth rate (CAGR) of 24.79% over the past two decades, showcasing the consistent and impressive financial performance of Maruti Suzuki.

The government’s strategic divestment from Maruti Udyog not only marked the end of a longstanding era but also paved the way for the company’s continued success in a rapidly evolving automotive landscape. The returns generated from this strategic move not only benefited the government but also strengthened Maruti’s financial foundation.

The impact of government divestment was evident in Maruti’s ability to navigate challenges, adapt to market reforms, and emerge as a powerhouse in the Indian automotive sector. The shift in ownership dynamics, with LIC becoming a major stakeholder, has added a new chapter to Maruti’s corporate journey.

As the company’s market cap soars to new heights, Maruti Suzuki stands as a shining example of resilience, adaptability, and strategic foresight. The remarkable surge in share prices, with an 82.5-fold increase since the IPO, underscores the investor confidence and robust financial performance of Maruti Suzuki. With a stellar CAGR of 24.79%, the company’s consistent growth over the past two decades cements its position as a leader in India’s automotive industry.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Nov 24, 2023, 3:36 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates