HDFC Mutual Fund launched a new open ended index fund named HDFC NIFTY100 Low Volatility 30 Index Fund on June 21st, 2024. This fund aims to track the performance of the NIFTY 100 Low Volatility 30 Index (TRI), with the goal of generating returns that are comparable to the index (before accounting for fees and expenses). There is no guarantee that the fund will achieve its investment objective. The minimum subscription amount is Rs 100 and the new fund offer will be closed on July 5th, 2024.

The investment objective of the HDFC NIFTY100 Low Volatility 30 Index Fund is to generate returns that are commensurate (before fees and expenses) with the performance of the NIFTY100 Low Volatility 30 Index (TRI), subject to tracking error. There is no assurance that the investment objective of the Scheme will be achieved.

This NFO of HDFC NIFTY100 Low Volatility 30 Index Fund is suitable for investors who are seeking investment in equity securities covered by the NIFTY100 Low Volatility 30 Index.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

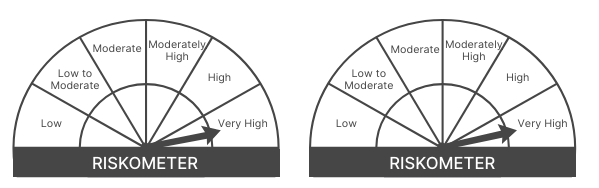

| Securities covered by NIFTY100 Low Volatility 30 Index (TRI) | Very High | 95 | 100 |

| Debt Securities & Money Market Instruments, Units of Debt Schemes of Mutual Funds | Low | 0 | 5 |

The performance of the HDFC NIFTY100 Low Volatility 30 Index Fund will be benchmarked to the performance of NIFTY100 Low Volatility 30 Index (TRI).

Nirman Morakhia

Nirman Morakhia, 39, holds an MBA in Financial Markets from the Institute of Technology and Management in Navi Mumbai and a BMS from Mumbai University. With over 16 years of experience in equity dealing, Nirman has established himself as a seasoned professional in the financial industry. He began his career at Mirae Asset Global Investment Management India Pvt. Ltd., where he worked from November 19, 2007, to March 14, 2018, holding the position of Equity Dealer. Since March 15, 2018, Nirman has been contributing his expertise to HDFC Asset Management Company Limited.

Experience: Collectively over 16 years of experience in equity dealing.

Arun Agarwal

Arun Agarwal, 51, is a Chartered Accountant and holds a B.Com degree. With over 25 years of extensive experience in equity, debt and derivative dealing, fund management, internal audit, and treasury operations, Arun has demonstrated a deep understanding and proficiency in financial management. He has been a part of HDFC Asset Management Company Limited since September 16, 2010, where he continues to apply his comprehensive knowledge and skills to drive the company’s financial success.

Experience: Collectively over 25 years of experience in equity, debt and derivative dealing, fund management, internal audit, and treasury operations.

| Scheme Name | AUM (Crore) | 1 Year Returns (%) |

| Nippon India Nifty Alpha Low Volatility 30 Index Fund | 362.99 | 46.6 |

| UTI S&P BSE Low Volatility Index Fund | 377.42 | 36.36 |

| Motilal Oswal S&P BSE Low Volatility Index Fund | 52.27 | 35.91 |

| Bandhan Nifty100 Low Volatility 30 Index Fund | 709.78 | 29.79 |

| Edelweiss Nifty Alpha Low Volatility 30 Index | 76.99 | – |

| Category Average | – | 27.55 |

Data as of June 20, 2024

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 21, 2024, 5:49 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates