HDFC Mutual Fund has launched a new open-ended equity scheme called HDFC Manufacturing Fund. This fund aims to provide long-term capital appreciation by primarily investing in stocks and related securities of companies involved in manufacturing activities. Thematic in nature, the scheme falls under the Equity Scheme category. HDFC Manufacturing Fund has a new fund offer (NFO) period from April 26, 2024, to May 10, 2024. There is no entry load for this scheme, and the minimum investment amount is Rs 100.

The investment objective of the HDFC Manufacturing Fund is to provide long-term capital appreciation by investing predominantly in equity and equity-related securities of companies engaged in manufacturing activity.

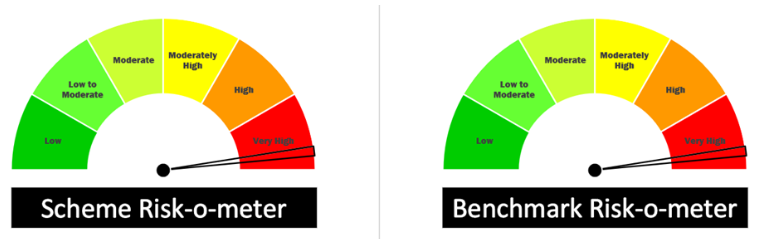

This NFO of HDFC Manufacturing Fund is suitable for investors who are seeking to generate long-term capital appreciation Investment predominantly in equity & equity-related securities of companies engaged in the manufacturing theme. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity related instruments of companies engaged in manufacturing theme | Very High | 80 | 100 |

| Equity and Equity related instruments of companies other than the above | Very High | 0 | 20 |

| Units of REITs and InvITs | Medium to High | 0 | 10 |

| Debt securities, money market instruments and fixed-income derivatives | Low to Medium | 0 | 20 |

| Units of Mutual Fund | Low to High | 0 | 20 |

The performance of the HDFC Manufacturing Fund is benchmarked against the NIFTY India Manufacturing Index.

Mr. Rakesh Sethia the fund manager of the HDFC Manufacturing Fund, joined the team on April 1, 2024. At 42 years old, he brings a wealth of knowledge and experience, with over 17 years in equity research. Mr. Sethia is highly qualified, holding a CFA, FRM, MBA, and BBM.

Mr. Dhruv Muchhal serves as the dedicated Fund Manager for overseas investments within the HDFC Manufacturing Fund. At 36 years old, he has accumulated over 13 years of experience in equity research and understanding of international markets. He is a CFA charter holder, a Chartered Accountant, and holds a Bachelor of Commerce degree from the University of Mumbai.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 6 Months Returns (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | YTD Ret (%) | Since Launch Ret (%) |

| ICICI Pru Manufacturing Fund Cum | 3373.45 | 1.9 | 39.17 | 68.46 | 32.67 | 24.76 | 16.94 | 23.01 |

| ABSL Manufacturing Equity | 872.99 | 2.37 | 31.72 | 53.32 | 19.7 | 17.75 | 12.59 | 12.26 |

| Kotak Manufacture in India Fund | 1812.52 | 2.03 | 28.42 | 49.98 | – | – | 13.28 | 26.37 |

| quant Manufacturing Fund | 549.38 | 2.37 | 43.12 | – | – | – | 18.66 | 47.82 |

| Axis India Manufacturing | 4360.55 | 1.85 | – | – | – | – | 18.32 | 19.25 |

| Canara Robeco Manufacturing | 1123.40 | 2.13 | – | – | – | – | – | 8.52 |

| Category Average | – | – | 35.61 | 57.25 | 26.19 | 21.26 | 15.96 | 22.87 |

All of the above funds are recently launched.

Sector/Theme Focus: These funds invest in a specific sector (e.g., technology, healthcare) or a theme (e.g., electric vehicles, clean energy).

High Potential Returns: They aim to capture the outperformance of a particular sector or theme, offering the chance for higher returns than diversified funds.

Concentration Risk: By focusing on a narrow area, they are more susceptible to downturns in that sector or theme compared to broader funds.

Active Management: These funds are typically actively managed by fund managers who select stocks based on their outlook for the chosen sector or theme.

Market Capitalization Variation: Thematic/Sectoral funds can invest across large-cap, mid-cap, and small-cap stocks within their chosen area.

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 26, 2024, 1:01 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates