Helios Mutual Fund is launching a new fund called Helios Financial Services Fund. This fund aims to grow your money over the long term by investing mainly in stocks and similar securities of companies in the financial services sector like banks, insurance companies, etc. There is no guarantee it’ll achieve its goal, but that’s the idea. The good news is there is no upfront fee to invest (entry load), and if you hold your investment for more than 3 months, you can redeem your money without any penalty (exit load). However, if you take out your money within 3 months, there might be a small fee depending on how much you take out. The minimum amount you can invest is Rs. 5000 and you can add more. The fund opens for subscription today, May 31st, 2024, and closes for new investors on June 14th.

The investment objective of the Helios Financial Services Fund is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity-related securities of companies engaged in financial services. However, there can be no assurance that the investment objective of the Scheme will be realized.

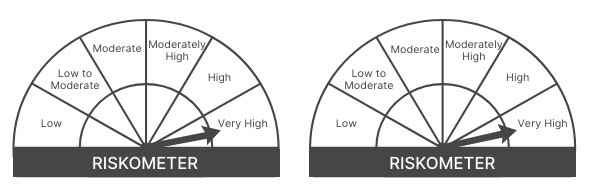

This NFO of Helios Financial Services Fund is suitable for investors who are seeking long-term wealth creation and an open-ended equity scheme that aims for capital appreciation by investing predominantly in equity & equity related securities of financial services.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related instrument^ of companies engaged in financial services sector | Very High | 80 | 100 |

| Equity and equity-related instruments of companies other than the above | Very High | 0 | 20 |

| Debt Securities$ and Money Market Instruments, | Low to Medium | 0 | 20 |

The performance of the Helios Financial Services Fund is benchmarked against Nifty Financial Services Total Return Index (TRI).

Mr. Alok Bahl, 60, holds an undergraduate degree in Commerce from Punjab University, Chandigarh, a Post Graduate Diploma in Financial Management from K.C. College of Management, and a Post Graduate Certificate in Business Management from XLRI Jamshedpur. With over 32 years of experience, Mr. Bahl has been associated with the Helios Group since 2005. He recently joined Helios Capital Asset Management (India) Private Limited as CIO in April 2023, after serving as a senior member of the investments team at Helios Capital Management Pte. Ltd., Singapore for 18 years. Before joining the Helios Group, he worked in sales for various sell-side firms in India for over 14 years.

Mr. Pratik Singh, 34, has an MBA in Finance from Welingkar Institute, Mumbai, and a BE in Mechanical Engineering from the University of Pune. He has over 10 years of experience and has been with Helios Capital Asset Management (India) Private Limited since February 2024 as a Fund Manager – Equities. Previously, from December 2021 to January 2024, he was an Equity Research Analyst with the same firm. Prior to joining Helios, Mr. Singh worked with Motilal Oswal’s institutional equity research team, focusing on the capital goods and consumer durables sectors, and has five years of sell-side research experience. He also worked in an auto ancillary for three years before pursuing his MBA.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 30-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Category: Sectoral-Banking and Financial Services | – | – | – | 3.77 | 20.97 | 14.59 | 15.41 | -0.69 |

| NiftyFinancialServices TRI | – | – | – | 1.25 | 14.31 | 10.47 | 14.55 | 4.74 |

| ICICI Pru Banking and Fin Services | 05-08-2008 | 7423.85 | 1.84 | 2.05 | 17.87 | 11.95 | 23.46 | -5.53 |

| Nippon India Banking and Financial Services Fund | 01-05-2003 | 5541.72 | 1.9 | 2.18 | 24.16 | 20.7 | 29.73 | -10.57 |

| SBI Banking and Fin Service | 01-02-2015 | 5326.55 | 1.85 | 8.64 | 18.6 | 13.52 | 12.08 | 4.84 |

| HDFC Banking and Financial Services Fund | 05-06-2021 | 3369.81 | 1.9 | 2.47 | 21.45 | 15.13 | – | – |

| ABSL Banking and Fin Services | 01-12-2013 | 3177.63 | 1.98 | 2.24 | 21.75 | 11.46 | 16.81 | 1.14 |

Data as of May 30, 2024

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 31, 2024, 5:04 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates