Dee Development Ltd raised ₹418 crore via an Initial Public Offering (IPO) that was open from June 19 to June 21, 2024. On Day 3, the Dee Development Ltd IPO witnessed a total subscription of 29.59x. The public issue subscribed 15.57x in the retail category, 13.26x in QIB (Qualified Institutional Buyers), and 83.66x in the NII (Non-Institutional Investor) category by June 21, 2024

On June 26, 2024, Dee Development Ltd’s stock was listed on the NSE and BSE at a price of ₹339.00 per share, reflecting a premium of 67.00% over the IPO issue price of ₹203.00. Since listing, Dee Development Ltd shares have witnessed a return of 13.59%, with a high of ₹400.00 and a low of ₹310.00.

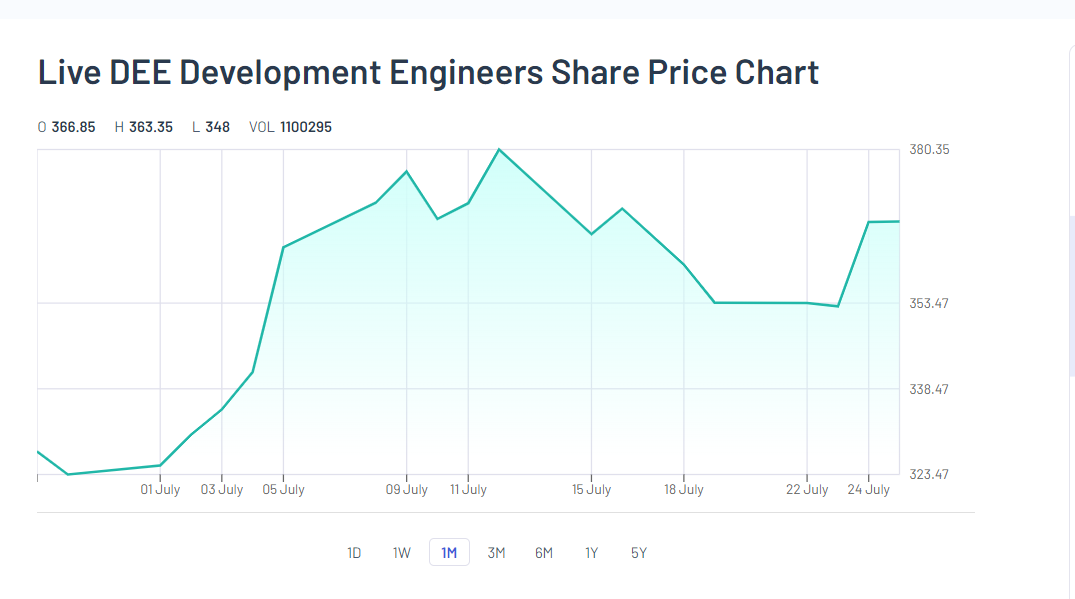

Dee Development Ltd. has returned 17.93% in the last month, with the stock closing at ₹335.30 on June 26, 2024, and ₹381.85 on July 29, 2024. On the listing day, June 26, 2024, the Dee Development Ltd. stock price touched the high price of ₹365.70 and the low price of ₹310.00, giving a listing gain of 67.00%.

Dee Development’s net sales increased from ₹209.62 crore in December 2023 to ₹243.21 crore in March 2024. Profit Before Tax improved from ₹10.76 crore in December 2023 to ₹16.48 crore in March 2024. In addition, operating profit slightly increased from ₹9.03 crore in December 2023 to ₹11.87 crore in March 2024.

Net Profit increased from ₹9.03 crore in December 2023 to ₹11.87 crore in March 2024, and Earnings Per Share (EPS) rose from ₹1.70 in December 2023 to ₹2.24 in March 2024.

Key Ratios

Dee Development Engineers (DDEL) offers expert process piping solutions for various industries, including oil and gas, power (including nuclear), chemicals, and other process sectors. They handle engineering, procurement, and manufacturing.

On July 29, 2024, the share price of Dee Development Engineers Ltd opened at ₹389.00, touching the day’s high of ₹397.80 as of 02:30 PM on the NSE.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 29, 2024, 7:15 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates