ELSS stands for Equity Linked Savings Scheme. ELSS funds are a category of mutual funds that primarily invest in equity and equity-related instruments. They are known for their tax-saving benefits under Section 80C of the Income Tax Act in India. ELSS funds offer investors the dual benefit of potential capital appreciation from investing in equity markets along with the advantage of tax savings. These funds come with a mandatory lock-in period of three years, which is the shortest lock-in period among all tax-saving investment options under Section 80C.

If we invest in these funds, then we are allowed to avail tax exemption of the invested amount up to a limit of Rs 1.5 lakh. Further, the income that you earn under this scheme at the end of the three-year tenure will be considered as Long-Term Capital Gain (LTCG) and will be taxed at 10% (if the income is above Rs. 1 lakh).

In this article, we are going to explore the fund that has yielded a positive return every year in the past decade, according to the data updated yesterday, April 03, 2024.

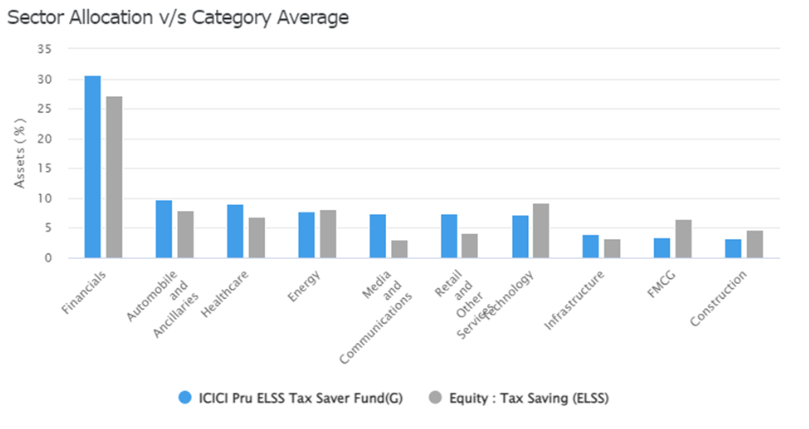

The ICICI Pru ELSS Tax Saver Fund, managed by Sharmila D’mello and Mittul Kalawadia, was launched in January 2013. As per the latest update, it has an expense ratio of 1.03%, slightly higher than the category average of 0.94%. The fund’s benchmark is the Nifty 500 TRI. The fund has invested in domestic equities, with 95.83% allocation, of which 61.61% is in Large Cap stocks, 10.82% in Mid Cap stocks, and 7.77% in Small Cap stocks.

| Company | Sector | Asset % |

| ICICI Bank | Financials | 7.91 |

| Bharti Airtel | Media And Communications | 5.73 |

| HDFC Bank | Financials | 5.29 |

| Maruti Suzuki | Automobile And Ancillaries | 4.93 |

| Avenue Supermarts | Retail And Other Services | 4.72 |

The total AUM size stands at Rs 12,894.8 crore as per the latest data, with the NAV at Rs 800.82. The AMC owns approximately 62 stocks in total in this fund.

| Year >> | Returns % | ||||

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Benchmark | 8.98 | 18.41 | 31.63 | 4.77 | 26.55 |

| ICICI Pru ELSS Tax Saver Fund(G) | 8.81 | 13.60 | 33.73 | 2.32 | 23.24 |

| Average ELSS Funds Returns | 8.05 | 16.16 | 32.02 | 2.19 | 28.14 |

Reviewing the returns comparison provided above, it’s evident that the fund has only managed to outperform its benchmark in the year 2021. However, in the past five years, it fell short of beating the benchmark in the remaining four years.

| Scheme Name | Returns % | |||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Nippon India ELSS Tax Saver Fund(G) | 83.00 | -2.92 | 4.24 | 46.04 | -20.68 | 1.49 | -0.45 | 37.59 | 6.91 | 28.62 |

| Axis ELSS Tax Saver Fund Reg(G) | 66.18 | 6.70 | -0.69 | 37.44 | 2.67 | 14.83 | 20.52 | 24.54 | -11.97 | 21.96 |

| Quant ELSS Tax Saver Fund(G) | 60.92 | 10.00 | 13.67 | 36.23 | -4.24 | 2.97 | 46.92 | 59.83 | 12.25 | 30.44 |

| Franklin India ELSS Tax Saver Fund(G) | 56.92 | 4.05 | 4.72 | 29.11 | -3.03 | 5.13 | 9.81 | 36.70 | 5.40 | 31.21 |

| Kotak ELSS Tax Saver Fund(G) | 56.61 | 1.48 | 7.46 | 33.76 | -3.80 | 12.67 | 14.95 | 33.24 | 6.92 | 23.62 |

| HDFC ELSS Tax saver(G) | 56.36 | -6.24 | 7.57 | 38.66 | -10.94 | 3.73 | 5.76 | 35.28 | 10.47 | 33.20 |

| JM ELSS Tax Saver Fund(G) | 54.86 | -0.63 | 5.20 | 42.59 | -4.57 | 14.94 | 18.27 | 32.16 | 0.54 | 30.91 |

| Aditya Birla SL ELSS Tax Saver Fund(G) | 54.55 | 9.19 | 3.38 | 43.17 | -4.54 | 4.27 | 15.21 | 12.69 | -1.43 | 18.89 |

| Invesco India ELSS Tax Saver Fund(G) | 54.30 | 5.81 | 3.42 | 35.74 | -1.25 | 9.43 | 19.16 | 32.55 | -7.65 | 30.90 |

| Baroda BNP Paribas ELSS Tax Saver Fund Reg(G) | 53.02 | 7.72 | -6.62 | 42.34 | -9.31 | 14.25 | 17.78 | 23.57 | -2.07 | 31.27 |

| HSBC Tax Saver Equity Fund(G) | 52.37 | 0.19 | 5.70 | 42.69 | -11.62 | 8.19 | 13.03 | 32.16 | -0.34 | 25.94 |

| DSP ELSS Tax Saver Fund Reg(G) | 52.21 | 4.40 | 11.27 | 36.29 | -7.64 | 14.83 | 15.05 | 35.12 | 4.50 | 29.98 |

| ICICI Pru ELSS Tax Saver Fund(G) | 50.82 | 4.33 | 3.92 | 26.00 | 0.50 | 8.81 | 13.60 | 33.73 | 2.32 | 23.24 |

| Sundaram ELSS Tax Saver Fund Reg(G) | 49.45 | 2.70 | 6.19 | 48.80 | -9.19 | 2.47 | 18.89 | 32.07 | 4.34 | 24.46 |

| SBI Long Term Equity Fund Reg(G) | 49.14 | 3.20 | 2.10 | 33.02 | -8.34 | 4.00 | 18.87 | 31.04 | 6.93 | 40.00 |

| LIC MF ELSS Tax Saver Reg(G) | 49.05 | -3.01 | 3.26 | 37.28 | -1.09 | 11.86 | 8.92 | 26.23 | -1.61 | 26.27 |

| Sundaram Diversified Equity(G) | 45.72 | 3.12 | 6.84 | 38.44 | -10.61 | 6.17 | 9.85 | 31.53 | 4.03 | 23.31 |

| Canara Rob ELSS Tax Saver Reg(G) | 45.19 | 0.60 | -0.04 | 31.96 | 2.68 | 10.74 | 27.36 | 35.13 | -0.17 | 23.70 |

| HSBC ELSS Tax saver Fund Reg(G) | 44.75 | 2.90 | 8.13 | 42.27 | -8.08 | 4.65 | 13.45 | 30.27 | -3.03 | 28.37 |

| Union ELSS Tax Saver Fund(G) | 44.47 | -3.53 | -1.17 | 26.11 | -5.19 | 10.47 | 21.60 | 35.88 | 1.51 | 26.41 |

| Bank of India ELSS Tax Saver Reg(G) | 44.00 | 2.06 | -1.24 | 57.66 | -16.34 | 14.61 | 31.20 | 41.45 | -1.25 | 34.77 |

| Bandhan ELSS Tax Saver Fund Reg(G) | 42.21 | 6.90 | 0.42 | 53.35 | -9.40 | 1.95 | 18.70 | 49.20 | 4.20 | 28.30 |

| UTI ELSS Tax Saver Fund Reg(G) | 40.73 | 2.62 | 3.31 | 33.10 | -6.47 | 10.35 | 20.18 | 33.10 | -3.49 | 24.26 |

| Edelweiss ELSS Tax saver Fund Reg(G) | 40.47 | 6.66 | -1.12 | 37.74 | -9.05 | 9.18 | 13.67 | 30.36 | -0.08 | 26.77 |

| Quantum ELSS Tax Saver Fund Reg(G) | 39.67 | 2.20 | 12.34 | 22.02 | 0.19 | -1.35 | 13.03 | 24.56 | 7.21 | 26.64 |

As evident from the data provided, our analysis of 26 funds within the same category, each with a history of over a decade, reveals that only the ICICI Pru ELSS Tax Saver Fund has consistently generated positive returns every year in the past decade as per the last updated data as on April 03, 2024. Additionally, we have compared the returns of these funds with the benchmark returns in the previous section.

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 4, 2024, 2:32 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates