In the dynamic landscape of investment, where timing is everything, ICICI Prudential Business Cycle Fund stands out as a beacon of strategic prowess. With a keen eye on economic cycles, this equity-oriented offering has consistently delivered impressive results, showcasing the power of astute sectoral allocation and forward-thinking management.

Imagine your investment nearly doubling in just three years. That’s the reality for those who entrusted their funds to ICICI Prudential Business Cycle Fund. Since its inception, investors have witnessed their capital grow at a compounded annual growth rate (CAGR) of 24.31%, significantly outpacing the benchmark’s 20% CAGR. An investment of Rs. 1 lakh made at the fund’s inception would now be worth a staggering Rs. 1.93 lakh, a testament to the fund’s ability to capitalize on market opportunities.

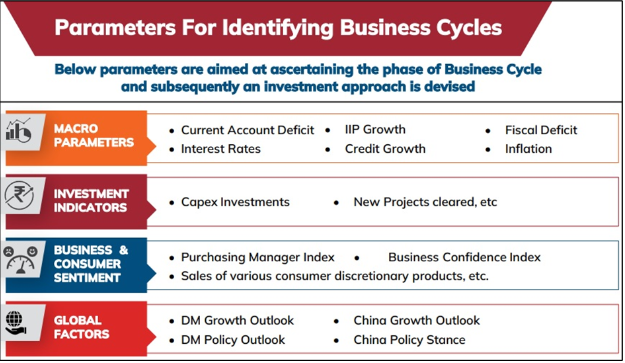

At the heart of the fund’s success lies its unique approach to business cycle-based investing. Led by experienced fund managers Anish Tawakley, Lalit Kumar, and Manish Banthia, the fund adeptly navigates through the various phases of economic cycles, optimizing sectoral allocations to maximize returns. Whether it’s seizing growth opportunities in expansionary phases or adopting defensive strategies during downturns, the fund’s portfolio reflects a dynamic and adaptive investment philosophy.

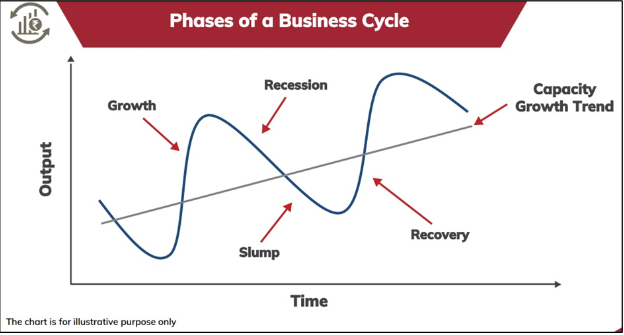

Typically, a business cycle comprises of Growth, Recession, Slump, and Recovery phases.

In the past year alone, the fund has delivered remarkable returns of 40%, outperforming its benchmark by a significant margin. This exceptional performance underscores the fund’s ability to capitalize on market upswings and leverage favorable economic conditions to the benefit of its investors.

In terms of SIP, a monthly investment of Rs 10,000 since inception would amount to a total investment of Rs 3.7 lakh. As of January 31, 2024, the value of that investment would have grown to Rs 5.48 lakh, i.e. a CAGR of 26.5%. A similar investment in the benchmark would have yielded a CAGR of 20.8% for the same period.

With an asset under management (AUM) of Rs 7,951.48 crore, ICICI Prudential Business Cycle Fund maintains a well-diversified portfolio that taps into both domestic and international opportunities. Approximately 51% of the portfolio is allocated to domestic-facing sectors, including banking, automobiles, construction, and telecom, poised to capitalize on India’s robust economic activity. Additionally, strategic exposure to defensive sectors such as Pharma & IT provides stability and resilience against global uncertainties.

ICICI Prudential Business Cycle Fund’s stellar performance and strategic approach to investing serve as a testament to its commitment to delivering long-term value to investors. With a track record of success and a forward-looking investment strategy, the fund continues to be a beacon of excellence in the world of equity-oriented investing.

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Feb 20, 2024, 6:44 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates