The global economy contends with the dual challenges of inflation and diminished growth prospects. Immediate uncertainties lean towards the downside, encompassing geopolitical tensions post-Hamas’ attacks on Israel and the potential magnified impact of monetary policy tightening. Conversely, a more positive trajectory could unfold if households opt to deploy a significant portion of the savings amassed during the pandemic.

The anticipated global GDP growth for 2024 stands at 2.7%, with a marginal uptick to 3.0% projected for 2025. The forecasted OECD headline inflation rate for 2025 is expected to settle at 3.8%. Despite this, the overarching narrative suggests a moderation in global growth, with an estimated 2.9% in 2023 gradually tapering to 2.7% in 2024.

As inflation subsides and real incomes witness an upswing, a resurgence in the world economy is envisaged, reaching a growth rate of 3% in 2025. It’s crucial to note that the trajectory of global growth hinges significantly on the performance of rapidly expanding Asian economies.

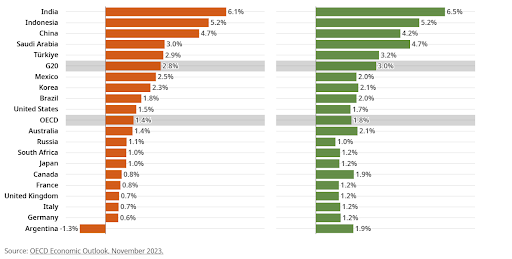

GDP Growth Rate of G20 Countries for 2024 and 2025:

Projections for the upcoming fiscal years indicate a moderation in real GDP growth, slowing to 6.3% in FY 2023-24 and 6.1% in FY 2024-25. Adverse weather events and a challenging international outlook contribute to this deceleration. However, the driving forces of surging services exports and sustained public investment continue to propel the economy forward.

Monetary Policy’s Role

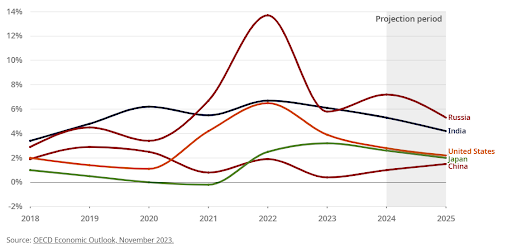

As monetary policy tightens to manage inflation, effective measures in the first half of 2023 control rising food staple prices. Financial institutions show improved results and solvency ratios, thanks to effective regulation and supervision. Additional efforts may be needed to activate recent insolvency reforms and facilitate the exit of non-viable firms. The accompanying chart visually represents

the trajectory of inflation during this period, providing a comprehensive view of the economic landscape.

Despite global tensions, real GDP growth is expected to rebound gently in FY 2025-26. A progressive moderation in inflation, housing prices, and wages provides an optimistic outlook. The Reserve Bank of India (RBI) is anticipated to start lowering interest rates from mid-2024 to 5.5% by the end of 2025. Risks, however, tilt to the downside, considering global uncertainties and the lagged impact of domestic policy tightening.

The global economy presents mixed signals, with better-than-expected growth in the US but signs of a slowdown in the final quarter of 2023. Geopolitical risks, including the Russia-Ukraine war and potential conflicts in the Middle East, pose threats. Manufacturing globally is declining, and financial conditions are tightening. In contrast, India’s GDP momentum is expected to rise in Q3FY24, supported by festival demand and resilient investment.

India’s economic trajectory is navigating through a complex interplay of domestic and global forces. The government’s fiscal consolidation efforts, coupled with strategic monetary policy measures, aim to sustain growth and stability. However, the delicate balance required to address socio-economic indicators, manage global uncertainties, and implement effective policy interventions underscores the need for continued vigilance and adaptive strategies in India’s economic journey.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions

Published on: Dec 1, 2023, 3:16 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates