The Indian Media and Entertainment (M&E) industry is a dynamic and burgeoning sector, experiencing remarkable growth driven by factors like widespread access to affordable high-speed internet, increasing disposable incomes, and a surge in consumer durables purchases. This unique industry stands out for its massive scale, escalating Average Revenue Per User (ARPU), and growing presence in the global VFX market.

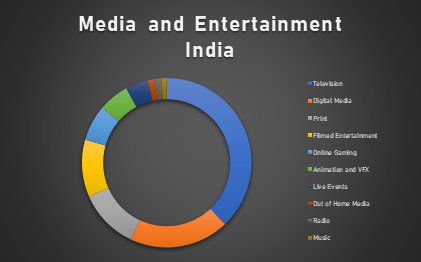

| Source | Media and Entertainment Contribution |

| Television | 37.9% |

| Digital Media | 19.0% |

| 11.5% | |

| Filmed Entertainment | 10.9% |

| Online Gaming | 6.9% |

| Animation and VFX | 5.8% |

| Live Events | 4.3% |

| Out of Home Media | 1.4% |

| Radio | 1.2% |

| Music | 1.0% |

India’s Media and Entertainment (M&E) industry is poised for significant expansion, with projections indicating substantial growth. The industry is expected to reach Rs. 2.34 trillion (USD 29.2 billion) and maintain a Compound Annual Growth Rate (CAGR) of 10%, reaching Rs 2.83 trillion (USD 35.4 billion) by 2025. Advertising revenue is rising, with expectations of reaching Rs. 394 billion (USD 5.42 billion) by 2024.

The digital segment is a major growth driver, set to increase by 29%, reaching Rs. 35,809 crore (USD 4.35 billion) by 2023. This segment is expected to contribute 38% to India’s overall advertising industry, rivalling traditional media.

The Over-The-Top (OTT) sector is experiencing remarkable growth, with a projected CAGR of 14.1%, expected to reach Rs. 21,032 crore (USD 2.55 billion) in 2026. Subscription services are the key revenue source, accounting for 95% by 2026.

Private equity and venture capital (PE/VC) investments have played a significant role, leading 77% of deals in 2022 and contributing to 57% of the total funding. Additionally, Foreign Direct Investment (FDI) inflows in the information and broadcasting sector reached USD 10.04 billion by December 2022.

India’s audience for Subscription Video-On-Demand (SVOD) services reached 130.2 million in 2022, and the music industry is expected to double its revenue by 2025. Smart TVs and short-form video consumption are on the rise, with 600-650 million Indians expected to consume short-form videos regularly by 2025.

The OTT market is projected to post a CAGR of 29.52% and reach USD 5.12 billion by FY26, driven by evolving online platforms and growing demand for quality content.

Source: IBEF

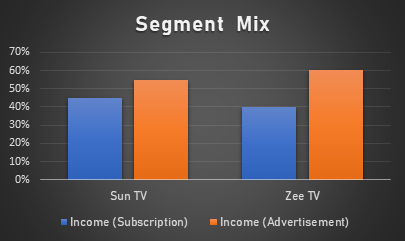

For TV broadcasters, understanding the subscription vs. advertisement revenue mix is critical. This analysis evaluates the revenue sources: subscriptions for stable, recurring income and advertisements for more cyclical earnings. Overreliance on advertisement revenue may lead to income instability.

In the context of multiplex industries, assessing performance involves considering several factors. These include the number of screens, occupancy rate (percentage of seats filled), average ticket prices, and spending per customer. Here’s a general analysis of PVR INOX.

| PVR INOX | |

| Screens | 1704 |

| Occupancy Rate | 23% |

| Average Ticket Price (Rs.) | 246 |

| Spend per Head (Rs.) | 285-911 |

Topline (Revenue) Growth – 3 years CAGR

Measures the compound annual growth rate of a company’s total revenue over the past three years, indicating the rate of sales growth.

Bottomline (Net Profit) Growth – 3 years CAGR

Evaluates the compound annual growth rate of a company’s net profit over the last three years, reflecting the growth in earnings.

Debt/Equity Ratio

Assesses the level of financial leverage by comparing a company’s debt to its shareholders’ equity, providing insights into its capital structure and financial risk.

Return on Equity (ROE) (%)

Indicates the profitability of a company by measuring the percentage of net income generated in relation to shareholders’ equity.

Return on Capital Employed (ROCE) (%)

Measures the efficiency of capital utilization by calculating the percentage return on the total capital employed in the business, including both debt and equity.

Price/Earnings (P/E) Ratio

Reflects the market’s valuation of a company by comparing its stock price to its earnings per share, helping investors gauge whether a stock is overvalued or undervalued.

Dividend Yield (%)

Expresses the annual dividend payment as a percentage of a stock’s current market price, indicating the return on investment through dividends.

The Indian Media & Entertainment industry’s robust growth, fueled by rising incomes and digital adoption, is set to outpace global averages. Retail advertising is poised for expansion, driven by E-commerce and rural market penetration. India’s focus on 5G and digital outreach promises abundant opportunities for industry advancement and market capture.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 16, 2023, 1:47 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates