Demonstrating the enduring strength of the Indian equity markets, recent data unveils a significant accomplishment, even in the face of a slight setback in benchmark indices last month. The overall positive market conditions have propelled both the equities cash market segment and the futures and options (F&O) segment to impressive heights.

The average daily turnover (ADTV) for the equities cash market segment has soared to a 22-month high. Combining the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), the ADTV for this segment now stands at a whopping Rs 83,446 crore, marking the highest level since October 2021. This achievement underscores the robust investor confidence in the Indian stock market, driven by a multitude of factors contributing to a favourable trading environment.

The futures and options (F&O) segment, on the other hand, has not only sustained its momentum but has also continued to break records. The ADTV for the F&O segment now stands at an astonishing Rs 314 trillion, reflecting the growing sophistication and diversification of trading strategies it showcases the adaptability and resilience of traders and investors in navigating volatile market conditions.

The Bombay Stock Exchange (BSE) has made significant strides in both the cash and derivatives segments. The relaunch of its Sensex and Bankex derivatives has gained widespread acceptance among traders, further contributing to the exchange’s market share gains. BSE’s growth reflects the increasing preference for diversified trading platforms among market participants.

Despite a 2.3% decline in benchmark indices last month, the market breadth remained positive. On the BSE, 2,126 stocks advanced while 1,955 declined in August, resulting in an advance/decline ratio (ADR) of 1.1. This indicates that, despite the minor setback in benchmark indices, a significant portion of the market continued to experience growth and positive sentiment.

Adding to the optimism, the small- and mid-cap indices have logged strong gains for the fifth consecutive month. This signals a broader-based rally in the Indian equity markets, with investors actively seeking opportunities beyond the large-cap stocks.

Another contributing factor to the heightened trading activity has been the substantial share sales exceeding Rs 60,000 crore by promoters and private equity players. These transactions have injected liquidity into the market and provided traders with ample opportunities to capitalize on market movements.

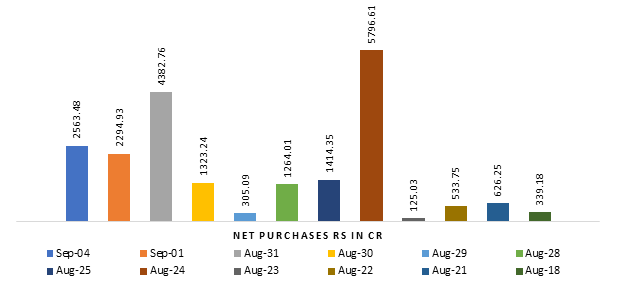

Furthermore, it has been noted that DII’s net buying streak has lasted for 12 sessions over a period of 5 months, as follows:

Published on: Sep 5, 2023, 11:17 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates