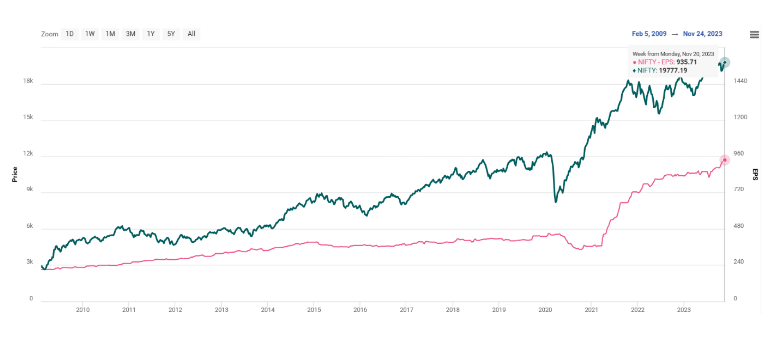

In the financial years spanning from 2020 to 2023, Indian companies, including those listed in the Nifty 50 have demonstrated impressive resilience and recovery in their corporate earnings. Notably, the net profit for Nifty 50 witnessed a substantial compound annual growth rate (CAGR) of 22%. Looking forward to the fiscal year 2025, projected growth of 16% indicates a potential robust phase in corporate earnings, marking a significant departure from the slower growth observed between 2010 and 2020, averaging only 5%.

The deceleration in earnings growth in the preceding decade was influenced by a combination of domestic and global factors affecting crucial sectors such as banking, commodities, capital goods, and real estate. However, the current scenario reflects a positive shift, driven by factors like a resilient banking sector, reduced corporate debt, and a revival in the investment cycle.

The banking sector has played a pivotal role in this improved earnings trajectory, rebounding from a period of substantial write-offs associated with over-leveraged companies in infrastructure and commodities. Additionally, increased commodity prices in recent years have provided a significant boost to the profitability of sectors reliant on substantial capital, such as metals and energy.

Government-led capital expenditure, expected to reach a 17-year high of 3.3% of GDP in the fiscal year 2024, is actively contributing to the expansion of infrastructure. This not only enhances India’s economic competitiveness but also acts as a catalyst for heightened private-sector investments. The real estate sector is experiencing a revival, driven by structural reforms, consolidation efforts, and improved affordability.

The cumulative impact of these factors is a noteworthy reduction in corporate leverage, reaching its lowest point in 15 years. Simultaneously, the banking sector finds itself in its healthiest state in a decade. The twin balance sheet problem, characterized by over-leveraged corporates and stressed bank assets, which previously hindered the investment cycle and earnings, seems to be gradually resolving.

This positive trajectory places India in a favourable position among other emerging markets. The country’s strategic focus on economic revitalization, coupled with a resilient banking sector and proactive government measures, distinguishes it as a standout performer. As India navigates the challenges of a dynamic global economic landscape, its proactive approach to addressing structural issues positions it as a promising player in the emerging market arena

The manufacturing sector’s growth, supported by government initiatives aimed at improving the ease of doing business, is yet another positive driver. Companies diversifying away from China to mitigate supply chain risks are contributing to the growth of sectors like electronics, auto ancillaries, and industrials.

Despite facing global challenges such as supply chain constraints and volatile commodity prices; Indian corporates have displayed resilience by leveraging technology to enhance operational efficiencies. Ongoing efforts to improve the ease of doing business and reduce payment frictions are yielding economy-wide productivity gains.

In the current global growth landscape, India’s corporate earnings have proven to be more resilient compared to other major economies grappling with low growth post the Covid pandemic. This positions India uniquely among emerging markets, presenting an unparalleled opportunity for the country to capitalize on its strengths and continue its upward trajectory.

With the recent softer US inflation print, there’s growing anticipation that the peak of the rate cycle is reached, potentially leading to a pivot by the US Federal Reserve. The lower-than-expected US inflation data on October 15 fueled optimism in Indian markets, with the NSE Nifty 50 and BSE Sensex both surging over 1%. This optimism stems from the belief that the US Federal Reserve might soon start reversing interest-rate hikes.

Looking ahead, the expectations of lower inflation and potential interest rate cuts provide additional strength to Indian equities. India’s solid fundamentals and macroeconomic stability position it favourably among emerging markets.

According to IMF estimates, India is on track to become the world’s third-largest economy by 2027, surpassing Japan and Germany. By 2047, India aspires to achieve developed economy status. The UN report supports these aspirations, projecting India’s economy to grow by 6.7% in the calendar year 2024, supported by resilient domestic demand.

Despite higher interest rates and weaker external demand weighing on investment and exports in 2023, India’s economic growth is expected to remain strong. The country’s inflation is projected to decelerate to 5.5% in 2023, providing room for fiscal expansion and monetary accommodation to support domestic demand.

The global economic outlook, as outlined in the mid-year assessment, presents challenges, with risks of a prolonged period of low growth due to lingering effects of the COVID-19 pandemic, climate change impacts, and macroeconomic structural challenges. In this scenario, India stands out as a bright spot, with its economy expected to outpace many other major economies.

India is set to achieve an all-time high weightage of around 16.3% in MSCI’s Global Standard (Emerging Markets) index, up from the current 15.9%, following the November review by the index provider. This noteworthy increase over the past three years nearly doubles India’s weight in the index. This signals a positive trend, positioning India favorably among other emerging markets. The higher weightage reflects growing confidence in India’s economic performance and attractiveness for global investors.

In conclusion, India’s economic resilience, demonstrated by robust corporate earnings, strategic government initiatives, and favourable global recognition, positions it as a standout among emerging markets. As the country navigates global economic uncertainties, its focus on sustainable growth, coupled with the strength of its domestic demand and investment climate, sets the stage for India to continue its upward trajectory.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 28, 2023, 11:09 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates