The proposed merger between IndusInd Bank and Bharat Financial has been a matter of discussion for a fairly long time. It was seen by many analysts as the perfect fit between the first mile and the last mile of financial services. IndusInd Bank with its strong client base and corporate relationships needed headway into the lucrative rural and semi-urban markets of India. That is where Bharat Financial has built granular expertise over the years. Bharat Financial, on the other hand, needed the support of a large player with a sound balance sheet and a healthy capital adequacy. IndusInd surely fitted the bill. Where there was little by way of surprise in the merger announcement, it would be interesting to understanding the modus operandi of the merger and the mutual synergies accruing to both the parties to the transaction…

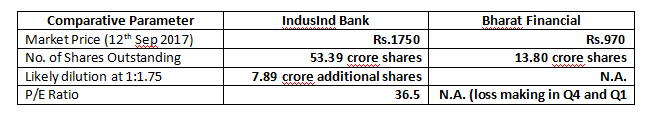

While the merger details are still under negotiation, the broad swap ratio for the deal is becoming clearer. To begin with, there will be no cash payouts involved in the transaction and the entire transaction will be structured through a stock swap deal. Based on the last 6-month average price, the swap ratio is likely to be around 1:1.75 (1 share of IndusInd for 1.75 shares of Bharat Financial).

So, at the current market price and assuming a stock swap ratio of 1.75, IndusInd Bank share capital will be diluted to the extent of another 7.89 shares to be issued to shareholders of Bharat Financial.

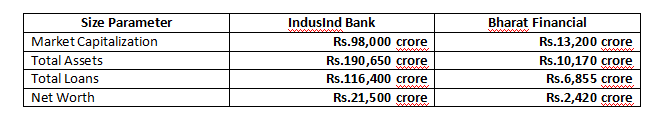

For Bharat Financial, the key benefit is all about size. The way MFIs are being constricted currently due to the predominance of cash usage in their business, they are obviously running a model that is not sustainable. On the one hand, Bharat Financial gets access to IndusInd’s equity which is nearly 10 times that of Bharat Financial. Additionally, the banking license has enabled IndusInd to leverage its equity to create a relatively much larger loan book. That is where Bharat Financial is currently getting constrained and this merger will be a solution that challenge.

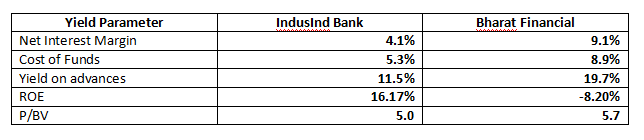

For IndusInd Bank the big advantage is the higher NIM spreads on the Bharat Financial portfolio which is nearly 500 basis points higher than that of IndusInd Bank. Being small ticket loans, Bharat Financial enjoys a very high yield on loans. This higher NIM of Bharat Financial will effectively more than compensate for the equity dilution that shareholders of IndusInd Bank will have to contend with. Of course, ROEs are not strictly comparable but the two P/BVs being around the same level indicates that market is acknowledging this spread advantage that Bharat Financial enjoys. It is for this spread that IndusInd is willing to pay top dollar.

As the demonetization drive clearly demonstrated, most Indian MFIs are extremely vulnerable to macroeconomic shocks. We have seen the value destruction in most MFIs post demonetization when cash liquidity became hard to come by and collections virtually got frozen. It may be recollected that back in 2010 Bharat Financial had run into trouble with the Andhra Pradesh Government after fresh business was frozen and the government came down heavily on aggressive recovery practices of MFIs. The situation improved only after the regulation of MFIs was brought under the RBI, but tighter regulation continues to be a challenge for the segment. Therefore MFIs are left with just two options. Either they can reinvent their entire business model or these MFIs can enter into strategic partnerships with banks either through equity sale or network sharing. That is exactly what Bharat Financial is doing.

The big benefit for IndusInd Bank will be that the merger will give it a book with an NIM of over 9%. This will be positive for the ROE and the ROA of IndusInd overall and in turn will be valuation accretive. A lot will depend on how quickly and how seamlessly the finer points of the merger process are worked out and pushed through!

Published on: Sep 13, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates