Infosys is a global leader in providing digital services and consulting. Currently, the company is providing services to global clients in 54 countries. In the last four decades, the company has provided their services through their expert, highly skilled, qualified internal ecosystem. Infosys was listed on the Indian stock market in 1992 and is also listed on the NYSE in its ADRs.

Salil Parekh, CEO of Infosys since July 2, 2018, brings almost 30 years of experience in the IT services industry. His expertise includes driving digital transformations, executing business turnarounds, and managing acquisitions. Prior to Infosys, he held positions at Capgemini and Ernst & Young. Parekh holds Master of Engineering degrees in Computer Science and Mechanical Engineering from Cornell University, along with a Bachelor of Technology degree in Aeronautical Engineering from the Indian Institute of Technology, Bombay.

After Salil Parekh joined Infosys, the company saw tremendous growth in market share and sales growth in its business. Salil has worked in the best interest of stakeholders and also created wealth for the investors who trust the company.

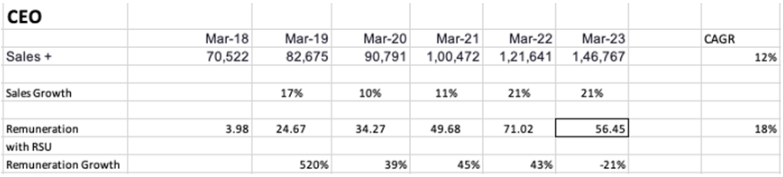

The stock price of Infosys has seen a CAGR of 25.67% in the last 6 years in his tenure as CEO. But we need to analyse whether its remuneration of Salil is justified by its sales growth and compare it with its peers in the IT Industry.

CAGR for sales and remuneration is calculated from March 2019.

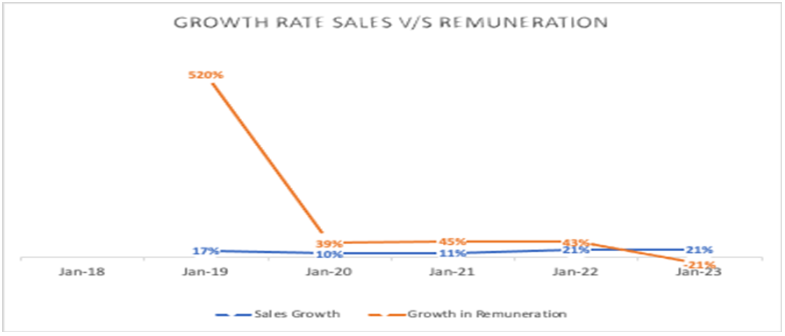

There is indifference to the growth because the sales growth of a company should justify the compensation. Similar indifference is seen in peer companies like TCS, Wipro, HCL Technologies and L&T Mindtree.

The compounded annual growth rate (CAGR) of remuneration from March 2018 to March 2023 is up to 53%. Specifically, the CAGR mentioned above is calculated from March 2019 to March 2023, considering Salil Parekh was appointed on January 2, 2018.

Salil Parekh has chosen to exercise fewer restricted stock units for the year 2022-23. There is a 21% drop in salary for the current year as shown in the graph.

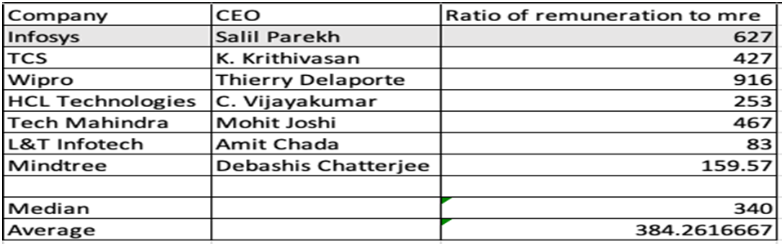

* MRE- Median remuneration to average employee salary | RSU – Restricted stock units.

Market leaders in the IT industry have a higher ratio of remuneration to MRE. However, there are outliers to the median and average ratio. If we look at Salil Parekh’s ratio it’s 627x. His annual salary consists of 55% of RSU’s. The remuneration to the Infosys CEO is quite justifiable by the company’s market share, which is around 12.86% of the overall IT industry. A significant market share in a highly competitive industry.

Conclusion

The salaries of CEOs of the IT industry in India are highly paid depending upon the size and market share of the company. It also accounts for the experience and qualification. Despite the indifference to salary, the CEOs in India are generally paid high, displaying the importance of the success of the company. However, it is equally important that CEOs are paid fairly and equitably for their work.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions

Published on: Mar 27, 2024, 10:46 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates