Invesco India Manufacturing Fund is a new open-ended equity fund offered by Invesco Mutual Fund. Launched on 25 July 2024 and closing on 8 August 2024, the fund aims to generate capital appreciation by investing in equity and equity-related instruments of manufacturing companies. It falls under the sectoral/thematic category and requires a minimum investment of Rs. 1,000 per application.

The investment objective of Invesco India Manufacturing Fund is to generate capital appreciation from a diversified portfolio of Equity and Equity Related Instruments of companies following the manufacturing theme. There is no assurance that the investment objective of the Scheme will be achieved.

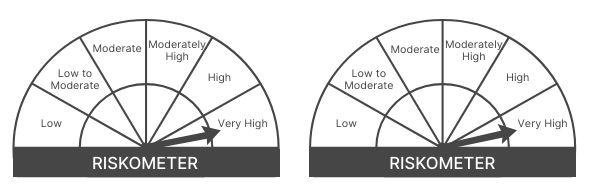

This NFO of Invesco India Manufacturing Fund is suitable for investors who are seeking long-term capital appreciation. Investing in equity and equity-related securities of companies engaged in manufacturing themes.

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and equity related instruments of companies having manufacturing theme | 80 | 100 |

| Other Equity and equity related instruments of companies other than having manufacturing theme | 0 | 20 |

| Debt & Money Market instruments | 0 | 20 |

| Units issued by REITs & InvITs | 0 | 10 |

The performance of the Invesco India Manufacturing Fund will be benchmarked to the performance of Nifty India Manufacturing TRI.

Mr. Amit Ganatra is 42 years old and hold B. Com, CA and CFA degrees. He has more than 16 years of experience in the Indian equity markets.

Mr. Dhimant Kothariis 41 years old and holds a B. Com. and A.C.A. degrees. He has more than 16 years of experience in industry and equity research

| Scheme Name | Launch Date | AUM (Crore) | TER (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Return (%) |

| ICICI Prudential Manufacturing Fund | 07-10-2018 | 5,942.57 | 1.82 | 65.33 | 31.38 | 28.6 | 24.72 |

| Kotak Manufacture in India Fund | 22-02-2022 | 2,337.49 | 1.97 | 52.32 | – | – | 31.29 |

| ABSL Manufacturing Equity | 31-01-2015 | 1,108.36 | 2.31 | 47.78 | 17.95 | 21.37 | 13.2 |

| Axis India Manufacturing | 21-12-2023 | 5,193.03 | 1.77 | – | – | – | 38.01 |

| Canara Robeco Manufacturing | 11-03-2024 | 1,374.49 | 2.08 | – | – | – | 27.59 |

| HDFC Manufacturing fund | 15-05-2024 | 10,345.66 | 1.69 | – | – | – | 8.18 |

| Quant Manufacturing Fund | 05-08-2023 | 786.81 | 2.28 | – | – | – | 68.7 |

Data as of July 18, 2024

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 25, 2024, 5:59 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates