Perhaps you’ve seen Revolt electric bikes on the roads nearby or heard the name from someone. But have you ever wondered how to invest in this company’s shares? The company falls into the midcap category with a market capitalisation of around Rs 10,893 crore. Interestingly, the stock price is available to purchase below Rs 100 per share on the BSE. Before delving into the stock’s name, let’s briefly explore Revolt Motors.

Revolt Motors is the market leader in India’s electric motorcycle industry. The company is dedicated to democratizing clean commuting nationwide by employing next-generation mobility solutions. With a complete focus on delivering world-class electric mobility products that are affordable and accessible to every Indian, Revolt Motors is expanding its presence across India, boasting 27 dealership stores in 22 cities.

Within the EV motorcycle sector in India, Revolt Motors holds the market leadership position, predominantly with its best-selling e-bike models, the RV400 and RV300. These electric bikes boast an impressive 150 km range on a single charge, a top speed of 85 km/hr, and a full battery charge time of 4 hours. The RV400 is equipped with a 3.24 kWh battery, featuring an outstanding warranty of 1,50,000 km, the highest among all EV two-wheelers in the country.

Revolt Motors, the largest electric motorcycle company in India, proudly announced a momentous achievement of surpassing 100 dealerships across the nation. This notable expansion underscores Revolt Motors’ steadfast commitment to bringing the electric mobility revolution to the doorsteps of every Indian.

Revolt Motors operates as a subsidiary of Rattan India Enterprises Limited. Rattan India Enterprises Limited engages in diverse business activities, encompassing but not limited to software services, legal services, financial services, human resources, consultancy, manpower supply (covering skilled, semi-skilled, and unskilled labour), software design and development, design creation, and the implementation of payment systems and gateways, among others.

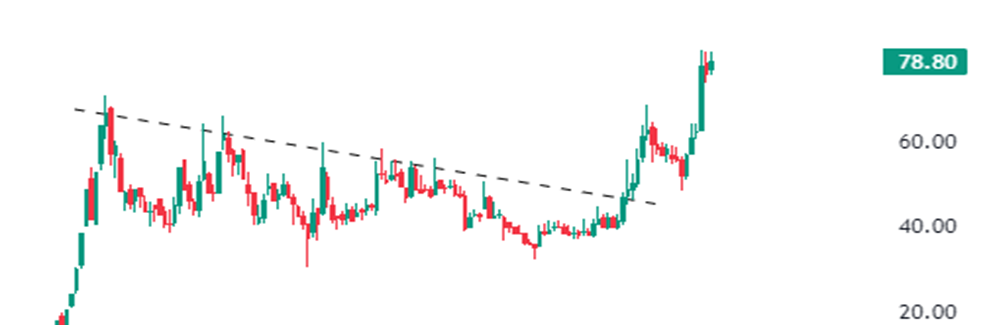

At the start of the day, the stock opened at Rs 79.64 per share on the BSE, reaching intraday highs and lows of Rs 80.98 and Rs 78.50, respectively. At the time of writing this article, it is trading at Rs 78.50 per share on the BSE.

The current market capitalization of the company stands at Rs 10,852 crore. Additionally, the stock has delivered impressive returns to its shareholders in the last six months, generating approximately a 106% return and a multibagger return of over 1,100% during the last three years. Furthermore, the stock is trading at an all-time high level.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 5, 2023, 11:56 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates