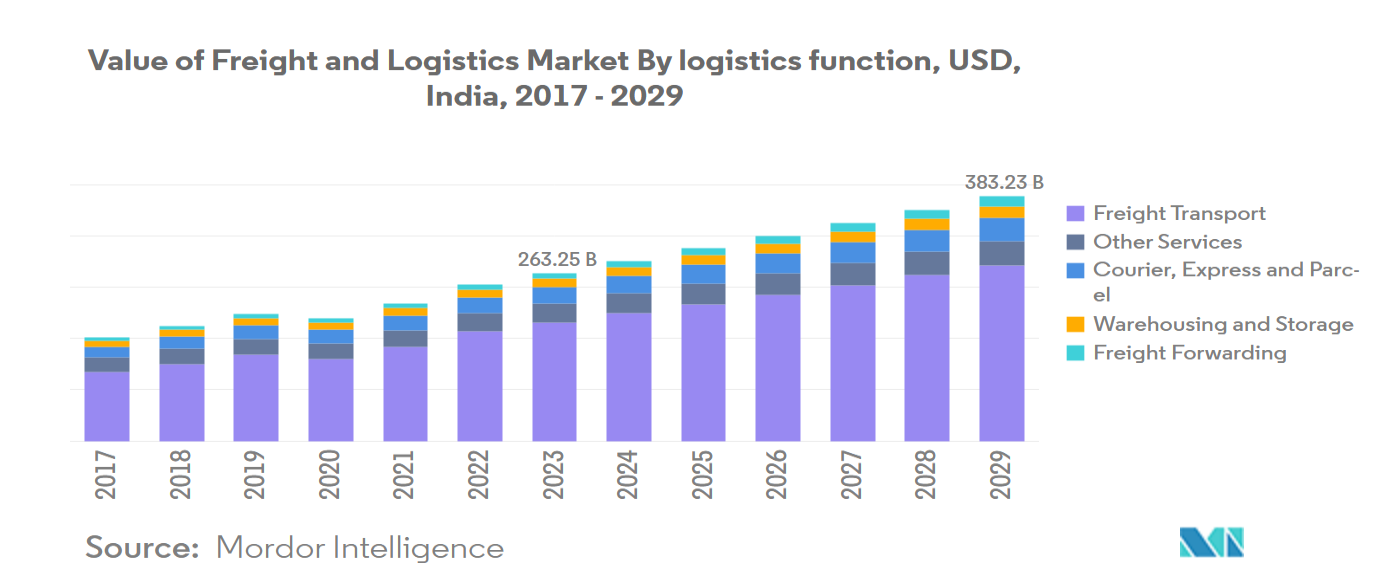

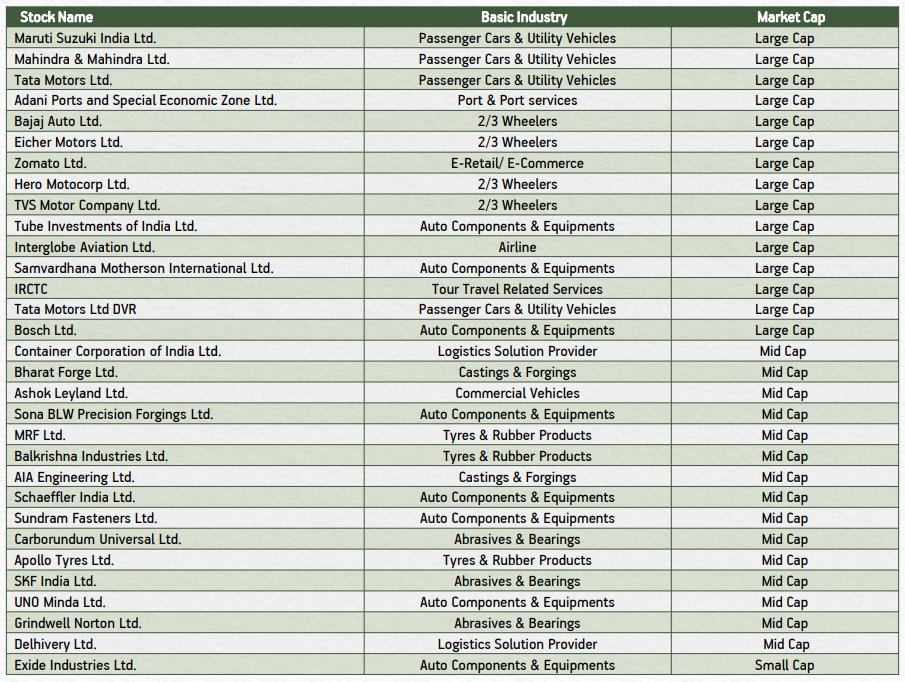

As India’s economy embarks on a vigorous growth trajectory, the transportation and logistics sector emerge as a beacon of investment opportunity. Aditya Birla Sun Life Transportation and Logistics Fund presents discerning investors with a strategic gateway to capitalize on this dynamic theme. This meticulously crafted fund harnesses the synergistic power of interconnected industries, encompassing passenger vehicles, commercial vehicles, auto components, logistics providers, e-commerce giants, ports, and airlines.

By blending structural and cyclical investment opportunities, the fund caters to diverse risk appetites through urban-rural and domestic-international diversification. Embracing the transformative edge of innovation, it positions your portfolio for the future. Join us on this exhilarating journey of wealth creation.

| Category | 2020-21 | 2021-22 | 2022-23 | 3 Year CAGR |

| Passenger Vehicles | 30,62,280 | 36,50,698 | 45,78,639 | 14.3% |

| Commercial Vehicles | 6,24,939 | 8,05,527 | 10,35,626 | 18.3% |

| Three Wheelers | 6,14,613 | 7,58,669 | 8,55,696 | 11.7% |

| Two Wheelers | 1,83,49,941 | 1,78,21,111 | 1,94,59,009 | 2.0% |

| Quadricycles | 3,836 | 4,061 | 2,897 | -8.9% |

| Grand Total | 2,26,55,609 | 2,30,40,066 | 2,59,31,867 | 4.6% |

Source – SIAM

This open-ended equity scheme follows the Transportation and Logistics theme. Its investment objective is to achieve long-term capital appreciation by investing in equity and equity-related securities of companies within this theme. The fund doesn’t guarantee or indicate any returns, but its track record suggests promising growth.

This fund employs an active management strategy and allocates a minimum of 80% (up to 100%) to equity and equity-related instruments of companies in the Transportation and Logistics theme. The Automobiles sector accounts for 57% of the total, followed by the Auto Ancillary sector with 25%, and the Logistics & Others sector with 18%.

Aditya Birla Sun Life Transportation & Logistics Fund is managed by a dynamic pair of fund managers. Dhaval Gala, focused on harnessing the growth potential of the transportation and logistics sector, partners with Dhaval Joshi, who manages overseas investments within the fund. This dynamic duo has collectively overseen several funds within the same company, delivering exceptional returns over the past years. The performance details for these funds are provided below.

| Fund | Fund Manager | 1 Year Returns (%) | 3 Year Returns (%) |

| Aditya Birla SL Banking & Financial Services Fund-Reg(G) | Dhaval Gala | 15.68 | 21.8 |

| Aditya Birla SL Dividend Yield Fund(G) | Dhaval Gala | 23.8 | 25.55 |

| Aditya Birla SL PSU Equity Fund-Reg(G) | Dhaval Gala | 29.51 | 37.57 |

| Aditya Birla SL CEF-Global Agri-Reg(G) | Dhaval Joshi | -3.01 | 19.45 |

| Aditya Birla SL Intl. Equity Fund(G) | Dhaval Joshi | 4.45 | 4.64 |

The fund’s NFO is open from October 27, 2023, to November 10, 2023, and it does not charge any entry load. However, an exit load of 1% of applicable NAV is applicable for redemption/switch-out of units on or before 365 days from the date of allotment.

In conclusion, Aditya Birla Sun Life Transportation and Logistics Fund is strategically positioned to leverage the burgeoning opportunities within the Indian transport and logistics sector, presenting a lucrative path in India’s robust economic landscape.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 9, 2023, 1:36 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates