Indian Railway Catering and Tourism Corporation Limited announced its results for the September quarter of FY24 after the market closed on Tuesday. Shareholders have been eagerly awaiting the company’s performance to align with the other railway stocks. Excluding gains at the time of its IPO, this popular railway stock has not lived up to expectations.

As per the report during Q2 FY24, the company’s revenue saw a substantial 23.52% increase, climbing from Rs 806 crore to Rs 995 crore. However, when compared to Q1 FY24, the revenue experienced a slight dip of 1%, going from Rs 1002 crore to Rs 995 crore.

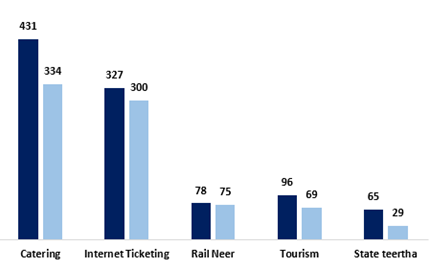

Breaking down the revenue by segment, the company derived income from five key areas. The primary contributor is the Catering business, which reported revenue of Rs 431 crore during the quarter, marking a significant 30% increase from the previous Rs 334 crore. Internet ticketing was the second-largest contributor, accounting for approximately 33% of the revenue, with the company reporting Rs 327 crore for the quarter, reflecting a 9% YoY growth from Rs 300 crore. The Tourism and State Teertha segments have displayed impressive YoY growth rates of 39% and 124%, respectively. In contrast, the Railneer segment recorded a more moderate YoY growth of 4% during the quarter.

The company’s operating profit stood at Rs 367 crore, representing a notable 20% YoY growth compared to the Rs 305 crore recorded in the same quarter the previous year. The operating margin stood at 37% for the quarter.

Looking at the company’s bottom line, the net profit surged by 30% YoY, rising from Rs 226 crore to Rs 295 crore during the quarter.

Furthermore, the company’s board has given their nod to establish a wholly owned subsidiary for the IRCTC I-Pay business, pending the necessary approvals from the registrar of companies and other relevant authorities. The company’s board has announced an interim dividend of Rs 2.50 per equity share with a face value of Rs 2 each for FY24. This represents 125% of the paid-up share capital, totalling Rs 160 crore. The board has set November 17, 2023, as the record date for the dividend payout.

Turning our attention to the stock’s performance, at the beginning of the day, it opened at Rs 694, showing a 1.9% increase compared to the previous day’s closing price of Rs 680.85 per share. However, as of the current moment, the stock is trading at Rs 680, indicating a slight dip from today’s opening price.

It’s worth noting that the stock hasn’t provided impressive returns to its shareholders, with a modest 6% return over the last three months and even a negative return of 11% over the past year. Meanwhile, other railway stocks have not only outperformed the broader market but have also delivered significant returns to their investors.

The crucial question on every investor’s mind is when the stock will start to perform well. For that, patience is required as we wait to see how the full story unfolds.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 8, 2023, 1:06 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates