In the dynamic landscape of India’s stock market, renewable energy stocks have been riding a scorching rally for the past two years, capturing the attention of retail investors. However, as the sector experiences unprecedented growth, there are warning signs that warrant careful consideration.

The Hype Train: 9,000% Returns and Counting

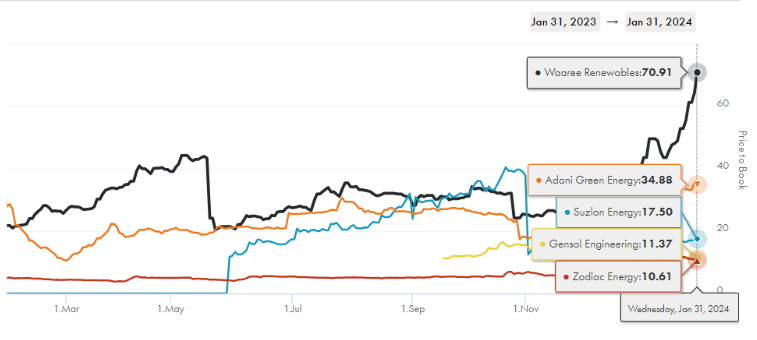

Green energy stocks, particularly those in the solar solutions sector, have witnessed meteoric rises. Companies like SG Mart have stunned investors with over 9000% returns in the past five years, while Waaree Renewable Technologies Ltd, Suzlon Energy, and KPI Green Energy boasted returns of 700%, 400%, and 300%, respectively, in the past year alone.

Price to Book (Nifty PB: 3.8)

Source: Tijorifinance

The Solar Boom and Its Shadows

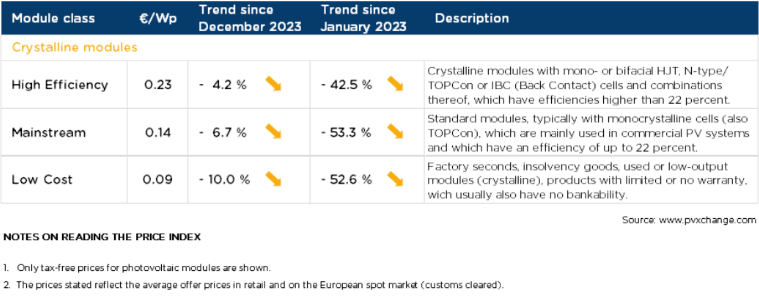

The surge in returns has been fuelled by a boom in the solar industry, with solar module prices plummeting in the past year. While this may seem like good news for end consumers, it poses challenges for companies in the green energy space.

Over-supply and rapid technological advancements could lead to increased competition, particularly affecting smaller players and potentially leading to closures.

Promoters Exiting: Are Retail Investors Left Holding the Bag?

Amid soaring valuations, a growing trend is emerging – promoters of some leading companies are lowering their stakes. This move raises questions about whether retail investors are being left to hold the bag as insiders cash out. It’s a situation worth monitoring as it could indicate concerns among those who know the companies best.

Directors of Waaree Renewables, the promoter of SG Mart, and the promoter of Gensol Engineering have been observed engaging in small-selling activities.

Finance Minister’s Support: A Boost or a Mirage?

Finance Minister Nirmala Sitharaman’s recent announcement of funding plans to support renewable energy may provide a boost to the sector. However, the risks associated with the overvaluation of small stocks cannot be ignored. Investors must weigh the potential benefits of government support against the growing headwinds in the industry.

Insights for Investors

In conclusion, while the renewable energy sector in India is experiencing unprecedented growth, investors must approach it with a discerning eye.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 2, 2024, 12:31 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates