JM Small Cap Fund Direct-Growth is a new fund offer (NFO) opened for investment on 27th May 2024. It is an equity small-cap mutual fund scheme that seeks to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small-cap companies. The closing date for investment is 10th June 2024 and the opening NAV of the scheme is Rs 10. The minimum investment amount is Rs 5000 and it offers flexible investment options including SIP of a minimum of Rs 100.

The primary objective of the JM Small Cap Fund is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of small-cap companies, as defined by SEBI. However, there is no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee/indicate any returns

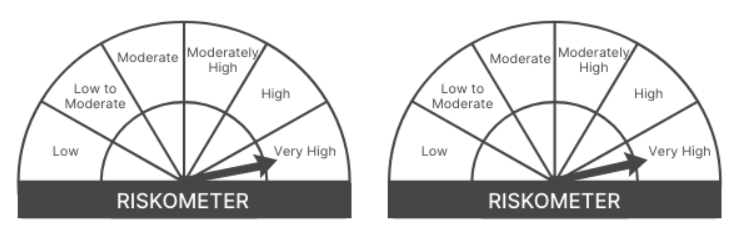

This NFO of JM Small Cap Fund is suitable for investors who are seeking long-term wealth creation and an open-ended equity scheme that aims for capital appreciation by investing predominantly in equity & equity related securities of small-cap stocks

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related instruments of small-cap companies | Very High | 65 | 100 |

| Equity and equity-related instruments of other than small-cap companies | Very High | 0 | 35 |

| Debt & Money Market instruments | Low to Medium | 0 | 35 |

| Units issued by REITs and InvITs | Medium to High | 0 | 10 |

| Units of Mutual Fund Scheme | Medium to High | 0 | 10 |

The performance of the JM Small Cap Fund is benchmarked against Nifty Smallcap 250 TRI.

Mr. Asit Bhandarkar is a Senior Fund Manager specializing in equity, with a B.Com. and MMS, aged 45. He brings 20 years of experience in equity research and fund management, having most recently served as a Fund Manager at Lotus India Asset Management Company Pvt. Ltd. Before that, he spent over two years at SBI Funds Management Pvt. Ltd. as a Junior Fund Manager. His career began as an equity analyst on the broking side, working with Jet Age Securities and Sushil Finance Consultants for nearly two years.

Mr. Chaitanya Choksi is a Fund Manager specializing in equity, holding an MMS in Finance and a CFA, aged 46. With approximately 23 years of experience in equity research and capital markets, he has been with JM Financial Asset Management Limited since 2008. Before joining JM Financial, he worked with Lotus India Asset Management Company Pvt. Ltd., Chanrai Finance Private Limited, IL & FS Investsmart, and UTI Investment Advisory Services Ltd.

Mr. Gurvinder Singh Wasan is a Senior Fund Manager and Credit Analyst specializing in debt, with an M.Com., Chartered Accountant qualification, and CFA Charter, aged 43. He has over 20 years of experience in fixed-income markets, having worked as a fund manager and credit analyst at a mutual fund, and as a structured finance manager at a rating agency and a bank. His previous employers include ICICI Bank, CRISIL, and Principal Asset Management Company.

| Scheme Name (Direct – Growth) | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 24-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Quant Small Cap | 01-01-2013 | 20164.09 | 0.64 | 20.32 | 48.05 | 11.2 | 91.73 | 76.13 |

| Bank of India Small Cap | 12-12-2018 | 1052.37 | 0.63 | 11.58 | 42.84 | 0.1 | 73.72 | 55.11 |

| Canara Robeco Small Cap | 08-02-2019 | 10085.98 | 0.44 | 11.53 | 34.09 | 8.64 | 73.82 | 44.27 |

| Edelweiss Small Cap | 01-02-2019 | 3361.40 | 0.43 | 9.86 | 44.34 | 3.41 | 70.22 | 36.94 |

| Kotak -Small Cap | 01-01-2013 | 14815.19 | 0.46 | 11.26 | 36.51 | -1.72 | 73.47 | 36.14 |

| SBI Small Cap | 01-01-2013 | 27759.65 | 0.67 | 14.26 | 26.62 | 9.29 | 49.11 | 35.17 |

Data as of May 24, 2024

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 27, 2024, 11:30 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates