In the dynamic world of steel manufacturing, JTL Industries Limited has made waves with its recent strategic acquisition. JTL, known for its expertise in producing Black Steel Pipes, Pre-Galvanized and Galvanized Steel Pipes, and other steel products, has now taken a bold step by acquiring a controlling stake of 67% in Nabha Steels and Metals.

Nabha Steels and Metals, located in Mandi Gobindgarh, Punjab, boasts an advanced manufacturing facility with a production capacity of 200,000 tonnes. This facility focuses on producing steel coils and long steel products such as billets. The acquisition marks a significant expansion for JTL, as it enhances the company’s total backward integration capacity to 250,000 tonnes of coils and 100,000 tonnes of long products.

Source: company press release

One of the key highlights of this acquisition is the remarkable revenue growth exhibited by Nabha Steels and Metals. The company’s revenue surged from approximately Rs. 113 Crores in FY23 to about Rs. 225 Crores in FY24, showcasing its strong performance and potential for further growth under JTL’s leadership.

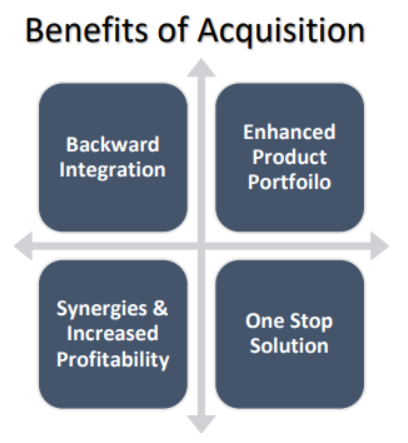

The management at JTL is enthusiastic about this strategic milestone, emphasizing the substantial strengthening of their backward integration capabilities. By integrating Nabha Steels and Metals into their operations, JTL has not only doubled its coil capacity but also expanded its product portfolio to include steel products like coils, billets, and other long products. This expansion opens up new market segments and opportunities, positioning JTL for accelerated growth and value creation in the coming years.

Investors have also taken note of JTL’s strategic move, with the stock recording a 17% increase in just seven trading sessions. Currently trading at Rs 217 (+0.21%) on the NSE, the stock’s performance reflects the market’s confidence in JTL’s growth strategy and its ability to capitalize on emerging opportunities.

A notable trend in the company is the significant increase in quarterly sales volume, which has surged by 245% since the June quarter (2021). However, the EBITDA/tonne has only increased by 13% over the same period (Jun 2021- Dec 2023). The current steel market is facing additional pressure due to China’s housing crisis, which is expected to impact steel prices further.

Conclusion

JTL Industries’ acquisition of Nabha Steels and Metals signifies a bold step towards expansion and diversification. The move not only strengthens JTL’s position in the steel manufacturing industry but also reflects its commitment to innovation and growth.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 9, 2024, 1:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates