Kotak Mahindra Mutual Fund has launched a new open-ended fund named Kotak BSE PSU Index Fund. The objective of this scheme is to provide returns that mirror the total returns of the underlying index, BSE PSU TRI, before accounting for expenses. There is no guarantee that the scheme will achieve its objective. The minimum investment amount is Rs 100 and the new fund offer will be open for subscription till July 24th, 2024.

The investment objective of the Kotak BSE PSU Index is to provide returns that, before expenses, correspond to the total returns of the securities as represented by the underlying index, subject to tracking errors. However, there is no assurance that the objective of the scheme will be achieved.

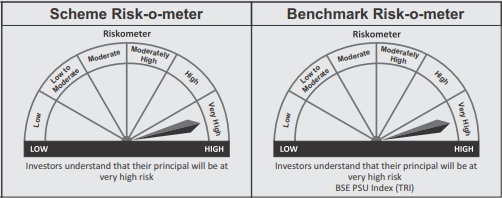

This NFO of Kotak BSE PSU Index is suitable for investors who are seeking long-term capital appreciation and return that corresponds to the performance of BSE PSU Index subject to tracking error.

| Instruments | Indicative allocations (% of total assets) |

| Equity and Equity related securities covered by BSE PSU Index | 100 – 95 |

| Debt and Money Market Instruments | 5 – 0 |

The performance of the Kotak BSE PSU Index Fund will be benchmarked to the performance of the BSE PSU Index (Total Return Index).

Mr. Abhishek Bisen has been associated with the company since October 2006 and his key responsibilities include fund management of debt schemes. Prior to joining Kotak AMC, Abhishek was working with Securities Trading Corporation of India Ltd where he was looking at Sales & Trading of Fixed Income Products apart from doing Portfolio Advisory. His earlier assignments also include 2 years of merchant banking experience with a leading merchant banking firm.

Mr. Devender Singhal is managing the equity funds for Kotak AMC since Aug 2015. He is managing assets across multicap and hybrid strategies. He has more than 22 years of experience in fund management and equity research of which last 15 years have been with Kotak. Before joining Kotak AMC, He was part of various PMS like Kotak, Religare, Karvy, and P N Vijay Financial Services.

Mr. Satish Dondapati has over 16 years of experience in ETFs. He joined Kotak AMC in March 2008 in Product Department. Prior to joining Kotak AMC, he was in the MF Product Team of Centurion Bank Of Punjab.

| Funds | 1 Yr Ret (%) | Expense Ratio (%) | Launch | Net Assets (Cr) |

| Aditya Birla Sun Life Nifty PSE ETF | — | — | 2024-05-17 | 31.00 |

| Aditya Birla Sun Life PSU Equity Fund – Direct Plan | 93.08 | 0.45 | 2019-12-30 | 4,711 |

| CPSE ETF | 121.37 | 0.05 | 2014-03-28 | 42,632 |

| ICICI Prudential PSU Equity Fund – Direct Plan | 85.29 | 0.63 | 2022-09-09 | 2,589 |

| Invesco India PSU Equity Fund – Direct Plan | 99.38 | 0.93 | 2013-01-01 | 1,363 |

| Quant PSU Fund – Direct Plan | — | 0.83 | 2024-02-20 | 917.00 |

| SBI PSU Fund – Direct Plan | 98.59 | 0.82 | 2013-01-01 | 3,695 |

Data As of July 09, 2024

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 10, 2024, 5:38 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates