Kotak Mahindra Mutual Fund launched a close-ended income scheme named Kotak Fixed Maturity Plan Series 330 – 98 Days (NFO). The scheme aims to generate income by investing in debt and money market securities that mature on or before the plan’s maturity date. However, there is no guarantee that the investment objective will be achieved. The minimum subscription amount is Rs. 20,00,00,000, and the new fund offer (NFO) will be open for subscription from April 25th, 2024 to April 29th, 2024.

The investment objective of the Kotak Fixed Maturity Plan Series 330 – 98 Days is to generate income by investing in debt and money market securities, maturing on or before the maturity of the scheme. There is no assurance that the investment objective of the Scheme will be achieved

This NFO of Kotak Mahindra Mutual Fund is suitable for investors who are seeking income over a short-term investment horizon and investment in debt & money market securities

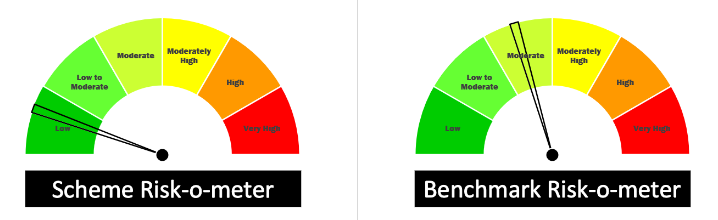

Potential Risk Class: it’s a close-ended scheme, with relativelylow interest rate risk and relatively moderate credit risk (B – I).

| Investments | Indicative Allocation | Risk Profile |

| Debt and Money Market Instruments including

Government Securities |

Minimum 0% – Maximum 100% | Low – Medium |

Kotak Fixed Maturity Plan Series 330 – 98 Days will benchmark against NIFTY Ultra Short Duration Debt Index.

Deepak Agrawal and Manu Sharma are the fund managers for several Kotak Mutual Fund schemes. Deepak Agrawal, a 43-year-old, brings a well-rounded background with qualifications in Commerce, Chartered Accountancy, and Company Secretaryship. He has extensive experience managing Kotak Mutual Funds since at least 2006.

Manu Sharma, 41, is a Chartered Accountant and holds a Master’s degree in Commerce. He boasts over 17 years of experience in the financial sector, specifically in Fixed Income Fund Management, Operations, financial audits, and taxation. He joined Agrawal in managing Kotak Mutual Funds in November 2022.

| Schemes (Regular – Growth) | NAV(Rs/Unit) | AUM (Rs Cr) | 1M Returns in % | 1Y Returns in % |

| SBI Fixed Maturity Plan – Series 6 (3668 Days) | 14.3 | 31.71 | 0.21 | 6.74 |

| SBI Fixed Maturity Plan – Series 79 (1130 Days) | 10.84 | 75.76 | 0.62 | 6.58 |

| DSP FMP Series 264 – 60M – 17D | 11.32 | 46.62 | 0.52 | 6.7 |

| SBI Fixed Maturity Plan – Series 66 (1361 Days) Regular – Growth | 11.27 | 626.73 | 0.54 | 6.8 |

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 25, 2024, 5:00 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates