Larsen & Toubro Limited, a prominent name in the infrastructure sector, is involved in engineering, procurement, and construction (EPC) projects, advanced manufacturing, and a range of services. The company consistently wins attention for its frequent and significant order wins from various clients across the country. Whether through news channels or various articles and blogs, Larsen & Toubro often remains in the spotlight. Moreover, L&T is the 11th largest company in India by market capitalization and the largest company in the infrastructure space.

But, have you ever wondered about the company’s primary business segments and where its revenue comes from? In this article, we will explore the company’s revenue streams and analyse the contribution of each segment to the company’s total revenue during the September quarter.

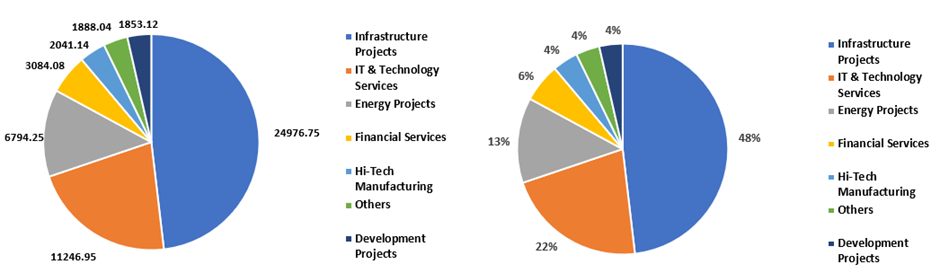

First of all, the company’s business diversified amongst Infrastructure Projects, Energy Projects, Hi-Tech Manufacturing, IT and Technology Services, Financial Services, Development Projects, and Other areas. Within the Infrastructure Projects segment, the company undertakes the engineering and construction of various structures such as buildings, factories, transportation facilities, power transmission systems, water treatment plants, and mineral and metal projects. The Energy Projects division focuses on delivering EPC solutions in hydrocarbons, power generation, and green energy.

The Hi-Tech Manufacturing segment specializes in designing, producing, and supplying customized critical equipment and systems for various industries, including defence and aerospace. Moreover, it is involved in the design, construction, repair, and refit of defence vessels. Larsen & Toubro operates in more than 50 countries globally.

| Segments | FY24 Q2 (Rs in Cr) | FY23 Q2 (Rs in Cr) | YoY Growth % |

| Development Projects | 1853.12 | 1344.6 | 38% |

| Others | 1888.04 | 1457.06 | 30% |

| Hi-Tech Manufacturing | 2041.14 | 1588.94 | 28% |

| Infrastructure Projects | 24976.75 | 19668.21 | 27% |

| Energy Projects | 6794.25 | 5593.41 | 21% |

| IT & Technology Services | 11246.95 | 10470.02 | 7% |

| Financial Services | 3084.08 | 3151.86 | -2% |

| Total | 51884.33 | 43274.1 | 20% |

Upon analysing the data provided, the company’s total revenue exhibited a noteworthy 20% year-on-year (YoY) growth, surging from Rs 43,274 crore to Rs 51,884 crore in the second quarter of FY24. Delving into the segment-wise performance, the Development projects segment stood out with an impressive 38% YoY growth, followed by another segment showcasing a commendable performance, while the Hi-Tech Manufacturing segment displayed a robust 28% YoY growth during the same quarter.

In terms of individual segment contributions to the company’s overall revenue, the infrastructure segment emerged as the primary contributor, accounting for 48% of the total revenue. On the other hand, IT and Technology services made up 22% of the total revenue, whereas the Energy sector constituted the third-largest contribution at 13% YoY. Contrarily, the other segment made a single-digit contribution to the company’s total revenue.

The L&T shares commenced trading at Rs 3089 per share, remaining unchanged compared to the previous day’s closing price of Rs 3088 per share on the BSE. Throughout the day, it reached an intraday high of Rs 3097.55 and a low of Rs 3063. As of the current writing, the stock is trading at Rs 3079.85 per share on the BSE. The current market capitalisation of the company stands at Rs 432,964 crore, reflecting an impressive return of 50% over the past year.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 21, 2023, 3:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates