The stock market is abuzz with excitement as Lotus Chocolates Ltd. continues to make headlines with its remarkable performance. This blog delves into the reasons behind the company’s soaring stock prices and explores the factors contributing to its unprecedented growth.

Shares of Lotus Chocolates Ltd. have been locked in the upper circuit for eight consecutive trading days, with a 5% increase bringing the price to Rs 1,035.05 on the BSE as of Monday at 1:53 pm. This surge is not just a fleeting moment; it signifies a robust upward trend. The volume of shares traded has also skyrocketed, with 120,000 shares changing hands compared to less than 10,000 in the past two weeks. There were also pending buy orders for 24,000 shares, reflecting strong investor interest.

The stock price of Lotus Chocolates has rallied an impressive 52% over the past nine trading days, climbing from Rs 681.50 on July 15 to its current level.

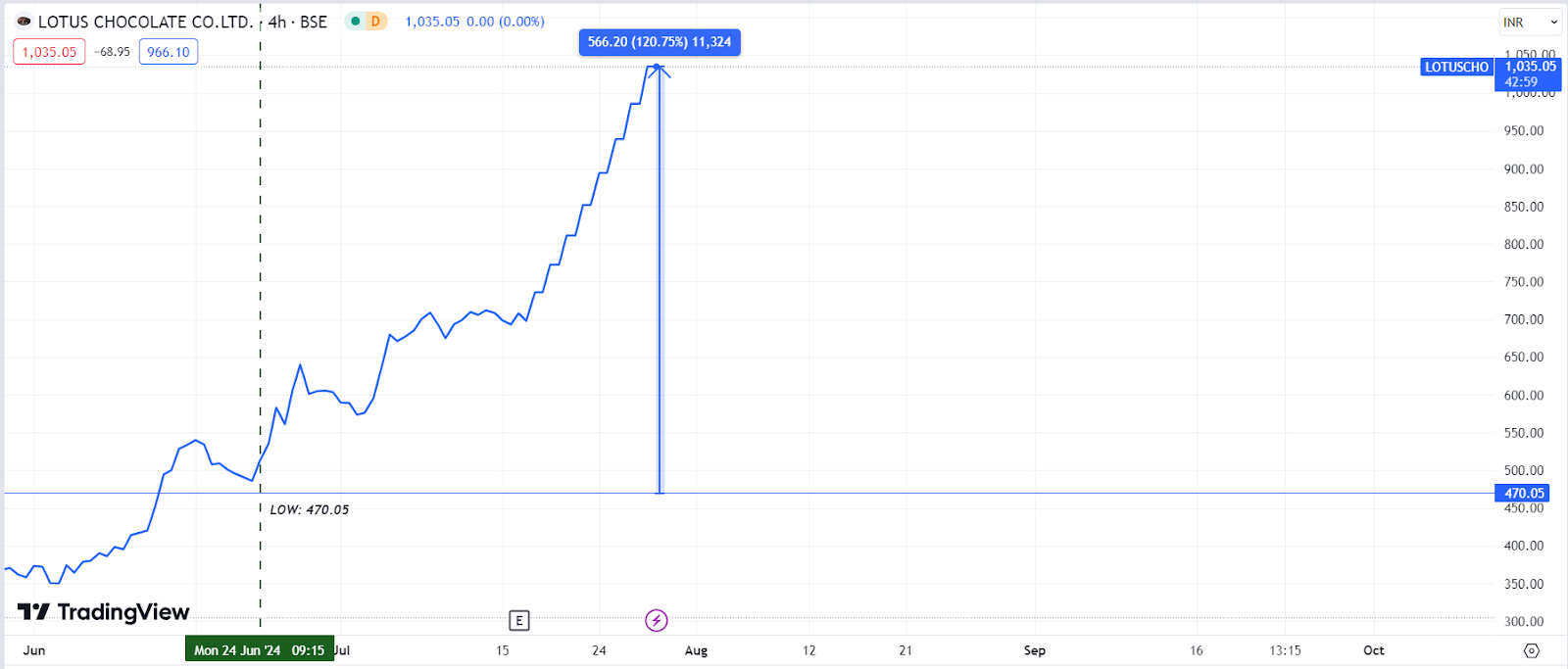

(source: tradingview)

The performance over the last five weeks, where the stock has more than doubled, rising 120% from Rs 470 on June 24. This growth is not merely a market anomaly but a testament to the company’s strong fundamentals and strategic moves.

A significant milestone in Lotus Chocolates’ journey was the acquisition of a controlling stake by Reliance Consumer Products Limited (RCPL), a subsidiary of Reliance Retail Ventures Limited (RRVL), on May 24, 2023. This strategic investment has bolstered investor confidence and provided a solid foundation for growth. As of June 30, 2024, the promoters, including RCPL, hold a substantial 72.07% stake in the company. Individual shareholders and corporate bodies hold 25.41% and 2.52%, respectively.

The recent rally in Lotus Chocolates’ stock price is underpinned by its strong financial performance. The company reported a profit of Rs 9.41 crore for the June 2024 quarter (Q1FY25), a staggering increase from the Rs 0.20 crore profit in Q1FY24 and Rs 1.18 crore in the March 2024 quarter (Q4FY24). Additionally, revenue from operations jumped over four-fold to Rs 141.3 crore from Rs 32.3 crore, reflecting the company’s successful expansion and operational efficiency.

Lotus Chocolates Ltd. is not just a company manufacturing chocolates and cocoa products; it’s a story of strategic investments, robust financial health, and remarkable stock market performance. With the backing of Reliance and a proven track record of financial growth, Lotus Chocolates is set to continue its sweet surge in the market. Investors and chocolate lovers alike have every reason to keep an eye on this promising company.

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jul 29, 2024, 6:41 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates