Mahindra Manulife mutual fund filed a draft to launch Mahindra Manulife Build India Fund on April 2, 2024.

Mahindra Manulife Build India Fund is an open-ended equity scheme aimed at capital appreciation by primarily investing in equity and equity-related securities of companies operating in the manufacturing and infrastructure sectors. The scheme is designed to cater to investors seeking exposure to India’s burgeoning manufacturing and infrastructure themes.

The primary objective of the scheme is to generate long-term capital appreciation for investors. By strategically investing in companies within the manufacturing and infrastructure sectors, the fund aims to capitalize on India’s growth potential. However, it’s important to note that there is no assurance that the scheme’s objective will be achieved.

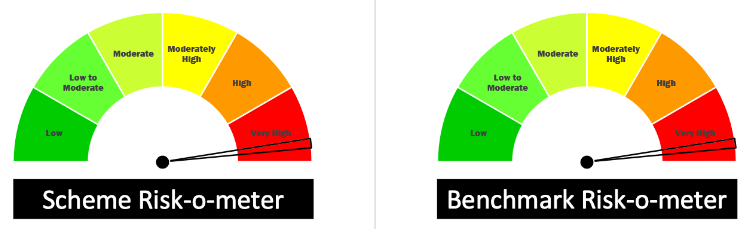

The scheme offers units for subscription and redemption at NAV-based prices on all business days, ensuring liquidity for investors. Redemption proceeds are dispatched within three working days from the date of receipt of the redemption request. The benchmark for the scheme is a blend of 50% S&P BSE India Manufacturing TRI and 50% S&P BSE India Infrastructure TRI, reflecting the fund’s focus on these sectors.

As per SEBI regulations, there is no entry load applicable to the scheme. However, an exit load of 0.5% is payable if units are redeemed or switched out within three months from the date of allotment. After three months, no exit load is applicable.

Investors can start with a minimum application amount of Rs. 1,000 and invest in multiple amounuts greater than that thereafter.

The scheme is managed by experienced professionals who bring a blend of expertise to the table:

Mr. Renjith Sivaram Radhakrishnan: With 43 years of experience and qualifications in MBA (Finance) and B-Tech (Mechanical Engineering), Mr. Radhakrishnan plays a crucial role in steering the fund towards its objectives.

Mr. Manish Lodha: With 48 years of experience and qualifications including B. Com (H), CS, and CA, Mr. Lodha’s expertise adds depth to the management team.

Mr. Pranav Nishith Patel (Dedicated Fund Manager for Overseas Investments): With 39 years of experience and qualifications in B.E. (IT) and M.Sc, Mr. Patel focuses on managing overseas investments, and diversifying the fund’s portfolio.

Conclusion

Mahindra Manulife Build India Fund presents an opportunity for investors to participate in India’s growth story, particularly in the manufacturing and infrastructure sectors. With a focus on long-term capital appreciation and managed by a team of seasoned professionals, the scheme aims to deliver value to investors while navigating the dynamic landscape of equity markets.

Investors may keep an eye on the new fund offer (NFO) of this mutual fund scheme.

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 3, 2024, 1:16 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates