Maruti Suzuki, India’s largest automobile manufacturer, has achieved a significant milestone as its share price crossed the significant level of Rs 12,000 for the first time today.

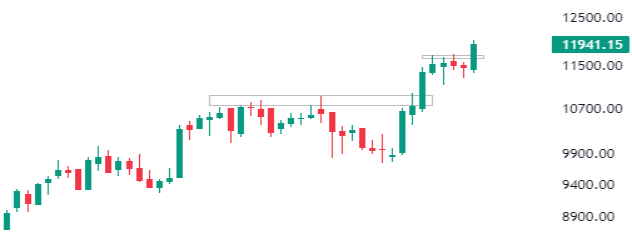

Earlier, the shares of Maruti Suzuki were facing continuous rejection or hurdles around Rs 10,800, with sellers being active at these crucial resistance levels. However, in the second week of February, an attempt was made to cross the resistance, but eventually, the week closed with the formation of a Doji candle, exhibiting wicks on both sides. Furthermore, in the following week, it finally broke through the resistance by skyrocketing around Rs 650 or 6% and closed the week at Rs 11,380 per share.

Following this breakout, the shares were stuck in consolidation for around four weeks, as shown in the weekly chart of the stock below. Eventually, the shares gave a breakout today, reaching a significant milestone of Rs 12,000 each. Furthermore, the market capitalisation of the company stands at Rs 3.75 lakh crore on the BSE.

Maruti Suzuki Share Price Journey:

When analysing the share price movement of Maruti Suzuki over the years, it took approximately two decades or 7295 days for the share price to reach Rs 10,000 from Rs 200, which was recorded in July 2003. Remarkably, it only took 259 days to reach the significant level of Rs 12,000 per share thereafter.

| Years | Jul-03 | Jan-04 | Feb-06 | Sep-09 | Oct-14 | Apr-17 | Jul-23 | Mar-24 |

| Price | 200 | 400 | 800 | 1,600 | 3,200 | 6,400 | 10,000 | 12,000 |

| Days | – | 177 | 781 | 1,299 | 1,867 | 910 | 2,261 | 259 |

| Years | – | 0.48 | 2.14 | 3.56 | 5.12 | 2.49 | 6.19 | 0.71 |

Maruti Suzuki’s share touched Rs 5,000 per share on August 16, taking roughly 7 years to double and ultimately reach Rs 10,000.

Over the past three months, Maruti Suzuki’s stock has delivered a return of 18.5%. Looking at a longer timeframe, the stock has performed impressively over the past three years, generating a substantial return of around 68%. Remarkably, in the last ten years, the stock has experienced remarkable growth, delivering a multibagger return of over 540%.

CLSA Outlook:

According to global brokerage CLSA, Maruti Suzuki is poised to emerge as a significant beneficiary of the rising demand for CNG vehicles in India. The brokerage predicts that by FY30, the share of CNG passenger vehicles (PV) is projected to increase to 22% from the previous 15%. Additionally, CLSA estimates that Maruti Suzuki’s share in the CNG passenger vehicles segment is anticipated to maintain at 72%.

Investors must keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 20, 2024, 4:23 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates