During the initial stages of your investment journey, most people probably recommend trying mutual funds before diving directly into equities. You’ve likely heard this advice, and I received a similar suggestion from my mentor. The idea is to start with mutual funds, especially through Systematic Investment Plans (SIPs), before venturing into equities.

Starting small is always a wise approach, whether you’re investing directly in equities or through mutual funds. Investors who lack the time for careful market analysis often choose to invest in various funds to safeguard their investments against inflation and aim for a good return.

Active mutual funds are managed by experienced fund managers, and we entrust our money to them with the anticipation of generating impressive returns, ideally outperforming benchmark returns. However, it’s important to note that active mutual funds typically charge annual maintenance fees for their active management, unlike passive mutual funds.

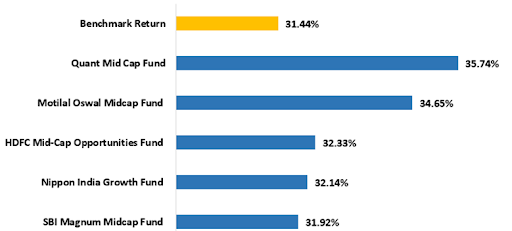

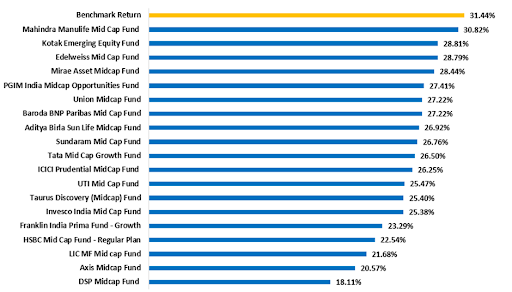

In a performance analysis of over 30 midcap mutual funds conducted over the last three years, we discovered that many of them failed to outperform their benchmark returns during the same period. Among these thirty funds, six have not completed a three-year time frame, while five managed to surpass their benchmark returns, and the remaining 19 failed to beat their respective benchmark indices.

When comparing funds with higher Assets Under Management (AUM), it’s worth noting that the HDFC Mid-Cap Opportunity Fund holds the highest AUM among all the observed funds. The most recent AUM of the fund stands at Rs 48,686 crore, and fortunately, it has outperformed its benchmark index return over the last three years, generating a return of 32.33%.

On the other hand, the fund with the lowest Assets Under Management (AUM) is the Taurus Discovery Midcap Fund, which has an AUM of Rs 102 crore. Unfortunately, the fund generated a return of 25.40% during the period and underperformed the benchmark index return during the same time.

However, investing in mutual funds is a wiser option, considering the market’s volatility, which is higher if someone opts for the equity market directly. Such a direct approach would require dedicating substantial time to analyse the purchased stocks and active management, which may not be feasible for officegoers. The timing of both office work and market activities would inevitably clash.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 7, 2023, 6:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates