Motilal Oswal Mutual Fund has launched a new open-ended equity scheme named Motilal Oswal Manufacturing Fund. The investment objective of this thematic fund is to achieve long-term capital appreciation by investing in equity and equity-related instruments of companies engaged in manufacturing activities. The new fund offering opened on July 19, 2024, and will close on August 2, 2024. There is no entry load but an exit load of 1% applies if redeemed within 3 months from the date of allotment. The minimum subscription amount is Rs 500

The investment objective of Motilal Oswal Manufacturing Fund is to achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of companies engaged in manufacturing activity. However, there can be no assurance that the investment objective of the scheme will be realized.

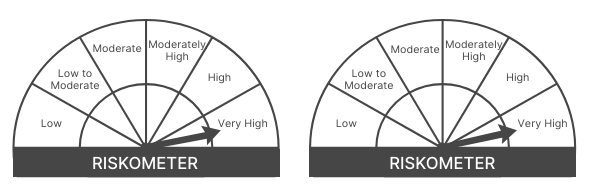

This NFO of Motilal Oswal Manufacturing Fund is suitable for investors who are seeking long-term capital appreciation. Investing in equity and equity-related securities of companies engaged in manufacturing themes.

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and equity related instruments of companies having manufacturing theme | 80 | 100 |

| Other Equity and equity related instruments of companies other than having manufacturing theme | 0 | 20 |

| Debt & Money Market instruments | 0 | 20 |

| Units of Mutual Funds (Domestic Schemes) | 0 | 5 |

| Units issued by REITs & InvITs | 0 | 10 |

The performance of the Motilal Oswal Manufacturing Fund will be benchmarked to the performance of Nifty India Manufacturing TRI.

Ajay has a 14 years’ experience in fund management and research related activity. Prior to joining Motilal Oswal Asset Management Company Limited he has worked with Canara Robeco Asset Management Company Limited handling Small Cap Fund.

Niket has 14 years of overall experience. Motilal Oswal Asset Management Company Ltd.– Vice President – Associate Fund Manager. Motilal Oswal Securities Ltd. – Head of Midcaps Research. Edelweiss Securities Ltd – Research Analyst – Midcaps. Religare Capital Markets Ltd – Associate Research Analyst – Midcaps

Mr. Singh has an overall experience of over 16 years. Mr. Singh was associated with Haitong International Securities Ltd. as Head of Research and Lead Analyst from 2015 to 2018 (years), where he was responsible for Research product and overall Research strategy. He was also associated with SG Asia Holdings as analyst from 2014 to 2015 years and also with Espirito Santo Securities as Lead analyst from 2007 to 2014 and so on. Mr. Singh was ranked No.1 analyst in India in the Asia money polls for insurance sector continuously for three years from 2015 to 2017.

Atul has over 16 years of overall experience. Motilal Oswal Asset Management Company Ltd – Senior Vice-president – Fund Manager – PMS and AIFs. (2013 – present) Edelweiss Capital Ltd – Research Analyst (2008-13)

He has more than 15 years of overall experience and expertise in trading in equity, debt segment, Exchange Trade Fund’s management, Corporate Treasury and Banking. Prior to joining Motilal Oswal Asset Management Company Limited, he has worked with Company engaged in Capital Market Business wherein he was in charge of equity and debt ETFs, customized indices and has also been part of product development

| Scheme Name | Launch Date | AUM (Crore) | TER (%) | 1 Year Returns (%) | 3 Years Returns (%) | 5 Years Returns (%) | Since Launch Return (%) |

| ICICI Pru Manufacturing Fund | 07-10-2018 | 5,942.57 | 1.82 | 65.33 | 31.38 | 28.6 | 24.72 |

| Kotak Manufacture in India Fund | 22-02-2022 | 2,337.49 | 1.97 | 52.32 | – | – | 31.29 |

| ABSL Manufacturing Equity | 31-01-2015 | 1,108.36 | 2.31 | 47.78 | 17.95 | 21.37 | 13.2 |

| Axis India Manufacturing | 21-12-2023 | 5,193.03 | 1.77 | – | – | – | 38.01 |

| Canara Robeco Manufacturing | 11-03-2024 | 1,374.49 | 2.08 | – | – | – | 27.59 |

| HDFC Manufacturing fund | 15-05-2024 | 10,345.66 | 1.69 | – | – | – | 8.18 |

| Quant Manufacturing Fund | 05-08-2023 | 786.81 | 2.28 | – | – | – | 68.7 |

Data as of July 18, 2024

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 19, 2024, 6:30 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates