Motilal Oswal Mutual Fund has launched a new open-ended equity multi-cap fund named “Motilal Oswal Multi Cap Fund”. This fund aims for long-term capital appreciation by investing in a mix of large, mid, and small-cap companies through equity and equity-related instruments. The New Fund Offer (NFO) is open for subscription starting today, May 28th, 2024, and will close on June 11th, 2024. There is a minimum investment of Rs 500 and an exit load of 1% if redeemed within 15 days from allotment, but no exit load after that.

The primary objective of the Motilal Oswal multi-cap fund is to achieve long-term capital appreciation by predominantly investing in equity and equity-related instruments of large, mid, and small-cap companies. However, there can be no assurance that the investment objective of the scheme will be realized.

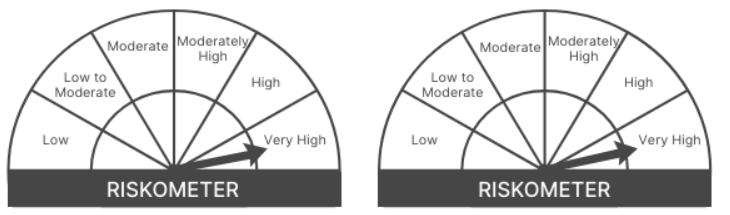

This NFO of Motilal Oswal multi-cap fund is suitable for investors seeking long-term capital growth and investments in equity and equity-related instruments across large-cap, mid-cap, and small-cap stocks.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity related instruments as follows:

Equity & Equity related instruments of Large Cap companies Equity & Equity-related instruments of Mid Cap companies Equity & Equity related instruments of Small Cap companies |

Very High |

75 25

25

25 |

100 50

50

50 |

| Debt and Money Market instruments

(including cash and cash equivalents), Liquid and Debt Schemes of Mutual Fund. |

Low to Moderate | 0 | 25 |

| Units issued by REITs and InvITs | Very High | 0 | 10 |

The performance of the Motilal Oswal multi-cap fund is benchmarked against Nifty 500 Multicap 50:25:25 Index TR.

Ajay Khandelwal, aged 44, is a seasoned fund manager with 13 years of experience in fund management and research. He holds a CFA Level 3 certification, a PGDM (MBA) from TAPMI, Manipal, and a B.E. in Electrical Engineering from MITS, Gwalior. Before joining Motilal Oswal Asset Management Company Limited, he worked with Canara Robeco Asset Management Company Limited, handling their Small Cap Fund.

Niket Shah, aged 37, is an experienced finance professional with a Masters in Business Administration (MBA – Finance) and 13 years of overall experience. He currently serves as Vice President – Associate Fund Manager at Motilal Oswal Asset Management Company Ltd. His previous roles include Head of Midcaps Research at Motilal Oswal Securities Ltd., Research Analyst at Edelweiss Securities Ltd., and Associate Research Analyst at Religare Capital Markets Ltd.

Santosh Singh, aged 44, is a Chartered Accountant (CA) and a CFA charterholder with over 15 years of experience. He is currently associated with the Motilal Oswal Balanced Advantage Fund. Previously, he was Head of Research and Lead Analyst at Haitong International Securities Ltd. from 2015 to 2018. He also worked as an analyst at SG Asia Holdings and as Lead Analyst at Espirito Santo Securities. Notably, he was ranked the No. 1 analyst in India for the insurance sector in the Asia Money polls from 2015 to 2017.

Atul Mehra, aged 35, is a CFA Charterholder with a Masters in Commerce from Mumbai University and a Bachelor’s in Commerce from HR College of Commerce and Economics. He brings over 15 years of overall experience to his role, demonstrating significant expertise in the financial sector.

Rakesh Shetty, aged 42, holds a Bachelor’s degree in Commerce and serves as Fund Manager for several funds at Motilal Oswal, including the Ultra Short Term Fund, 5 Year G-Sec Fund of Fund, Liquid Fund, Nifty 5 Year Benchmark G-Sec ETF, and Gold and Silver ETFs Fund of Fund. With more than 14 years of experience, he has a strong equity and debt trading, ETF management, and corporate treasury background.

Ankush Sood, aged 25, is the Fund Manager for Foreign Securities at Motilal Oswal. He holds a B.Tech in Electronics & Telecommunications from MPSTME, NMIMS Mumbai, and an MBA (Tech) with a major in Finance and a minor in Analytics from SBM, NMIMS Mumbai. His prior experience is primarily in Institutional Sales Trading Function.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 27-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Equity: Multi Cap | – | – | – | 13.47 | 32.77 | 3.94 | 42.67 | 15.41 |

| NIFTY500 MULTICAP 50:25:25 TRI | – | – | – | 11.9 | 33.74 | 2.84 | 40.62 | 21.19 |

| Nippon India Multi Cap | 25-03-2005 | 30500.56 | 1.61 | 18.52 | 38.13 | 14.12 | 48.91 | 0.04 |

| SBI Multicap Fund | 05-03-2022 | 15791.68 | 1.72 | 10.69 | 22.48 | – | – | – |

| HDFC Multi Cap | 07-12-2021 | 13424.86 | 1.69 | 12.32 | 40.19 | 9.61 | – | – |

| ICICI Pru Multi | 01-10-1994 | 11881.69 | 1.76 | 13.29 | 35.38 | 4.65 | 36.38 | 9.21 |

| Kotak Multicap Fund | 29-09-2021 | 11090.22 | 1.69 | 15.49 | 39.77 | 9.92 | – | – |

| Quant Active Fund | 21-03-2001 | 9790.63 | 1.72 | 19.43 | 24.88 | 10.44 | 55.64 | 43.55 |

Data as of May 27, 2024

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 28, 2024, 11:16 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates