Over the past decade, the financial industry has witnessed an extraordinary surge in the Assets Under Management (AUM) of mutual funds. This monumental growth has not only reshaped the investment landscape but also redefined the way individuals approach wealth accumulation.

Mutual funds once considered a relatively obscure investment vehicle, have steadily risen to prominence, attracting a diverse range of investors seeking a convenient and diversified way to participate in the markets. This blog will delve into the remarkable trajectory of mutual fund AUM, exploring the driving factors behind this surge, evaluating their performance, and shedding light on the challenges and considerations that both new and experienced investors should be aware of in this dynamic financial arena.

The Indian Mutual Fund Industry has achieved significant milestones in terms of Assets Under Management (AUM). It crossed Rs. 10 trillion in May 2014, Rs. 20 trillion in August 2017, and Rs. 30 trillion in November 2020.

Over the past decade, the industry has witnessed remarkable growth, expanding from Rs. 7.66 trillion in August 2013 to Rs. 46.63 trillion in August 2023, marking a more than 6-fold increase.

In just five years from August 2018 to August 2023, the industry’s AUM doubled from Rs. 25.20 trillion to Rs. 46.63 trillion, reflecting a significant upswing.

The number of investor folios has also seen substantial growth, increasing from 7.66 crore folios in August 2018 to 15.42 crore folios in August 2023, more than doubling in a span of 5 years.

Systematic Investment Plans (SIPs) have played a pivotal role in this growth. In April 2016, the number of SIP accounts surpassed 1 crore, and as of August 2023, there are a staggering 6.97 crore SIP accounts, with an average addition of 12.95 lakh new folios every month in the past 5 years.

The data provided has been sourced from AMFI India.

This data underscores the rapid expansion of the Indian Mutual Fund Industry, making it a popular choice among investors, with AUM and folios continually on the rise, thanks to the growing popularity of SIPs and the industry’s overall performance.

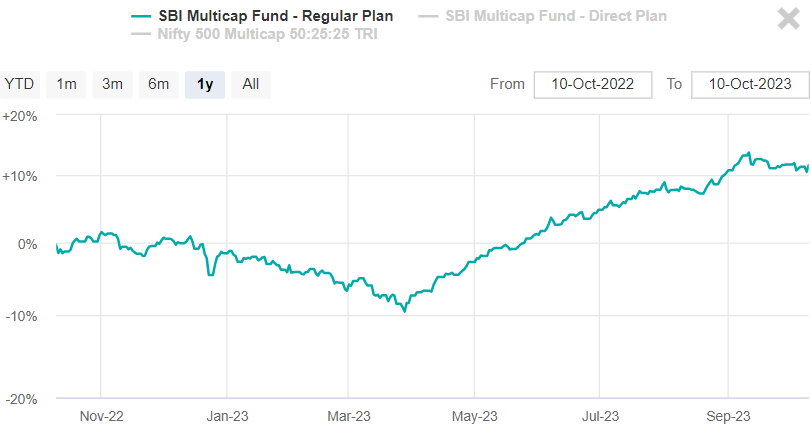

SBI Mutual Fund recorded the highest growth in AUM, increasing from Rs. 7.62 Lakh crore to Rs. 8.26 Lakh crore in just a quarter.

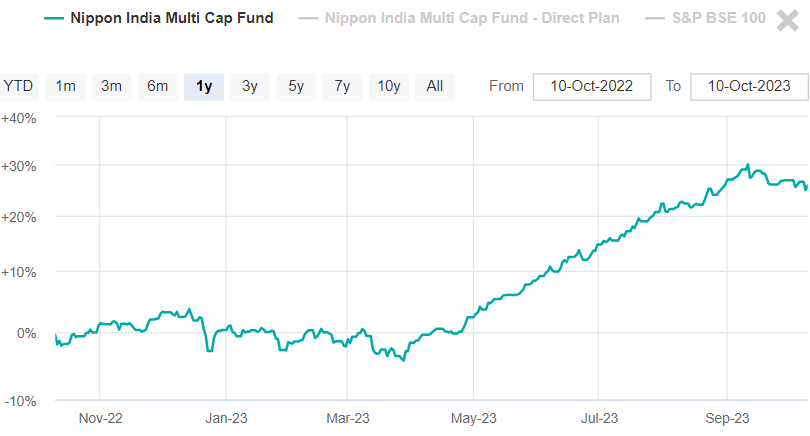

ICICI Prudential and Nippon India also witnessed substantial AUM growth, with ICICI Prudential’s AUM rising from Rs. 5.31 lakh crore to Rs. 5.82 Lakh crore, and Nippon India’s AUM increasing from Rs. 3.13 lakh crore to Rs. 3.50 lakh crore.

Aditya Birla Sunlife and UTI Mutual Fund also showed positive AUM growth, though the increase was relatively moderate.

Mirae Asset displayed healthy growth in AUM, reaching Rs. 1.39 lakh crore in the latest quarter.

Overall, the data indicates a positive trend in AUM for most of the mentioned mutual fund companies, reflecting investor confidence and the growth of the mutual fund industry in India.

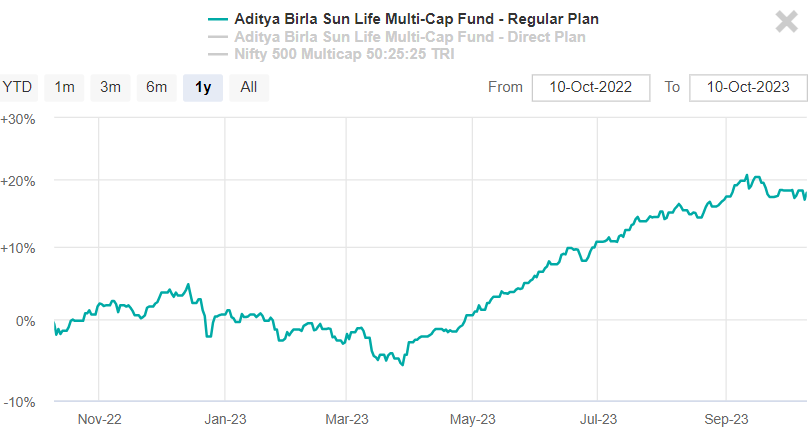

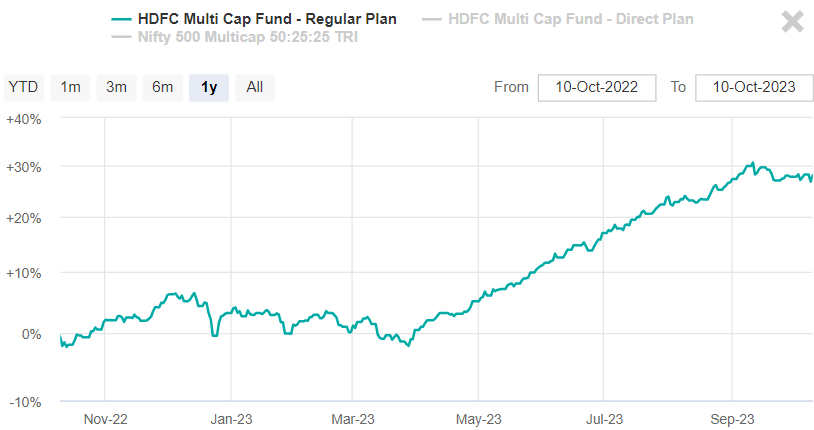

ICICI Prudential Multi Cap

ICICI Prudential Multi Cap

SBI Multi Cap

SBI Multi Cap

The meteoric rise of mutual fund Assets Under Management (AUM) in India, from Rs 10 lakh crore in May 2014 to a remarkable Rs 46.63 lakh crore in August 2023, reflects the growing trust and preference of investors for this investment avenue. The doubling of AUM in just five years, coupled with a surge in investor folios and SIP accounts, highlights the profound impact of mutual funds on the Indian financial landscape.

This journey of financial growth and prosperity demonstrates the enduring appeal of mutual funds, offering diversification and disciplined investment strategies to a broad range of investors. The future holds even more promise, as mutual funds continue to evolve and play a pivotal role in helping individuals secure their financial futures.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 11, 2023, 7:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates