Mutual funds serve as investment vehicles by pooling money from various investors, allowing them to collectively invest in a diversified portfolio of stocks, bonds, or other securities. Even small contributions from individual investors contribute to creating a substantial corpus for Asset Management Companies (AMCs). India’s leading AMC, SBI Mutual Funds, boasts an impressive Asset Under Management (AUM) of Rs 8,86,746 crore, as per the latest data. Such a significant amount is not invested in a single stock or scheme. Instead, AMCs manage multiple schemes, each designed with distinct objectives and falling into different categories to cater to the diverse investment needs of investors.

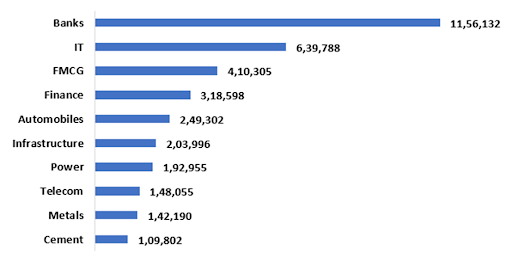

In this article, we are going to explore the sectors that have recorded the highest investments by Mutual Funds, based on the latest available data.

In India, a diverse range of Asset Management Companies offers various schemes for investors. Considering the top three AMCs based on their Asset Under Management (AUM), SBI Mutual Funds takes the lead with an AUM of Rs 8,86,746 Crore, followed by ICICI Prudential Mutual Fund with Rs 6,71,443 Crore, and HDFC Mutual Funds with Rs 5,82,553 crore. These three major AMCs collectively provide a broad spectrum of investment options, offering around 117, 122, and 95 schemes, respectively, as per the latest update.

Now, let’s explore the top two stocks from each sector, as aligned in the above chart, with the highest investment in terms of value from Mutual Fund schemes. Additionally, let’s examine how many schemes are holding each particular stock.

| Company Name | Sector | MF Holding Rs in Cr | No. of Schemes that hold stocks |

| HDFC Bank | Banking | 3,31,170.23 | 7.00 |

| ICICI Bank | Banking | 3,24,036.53 | 11.00 |

| Infosys | IT | 2,46,077.02 | 9.00 |

| TCS | IT | 1,39,314.27 | 2.00 |

| ITC | FMCG | 2,38,085.09 | 6.00 |

| Hindustan Unilever | FMCG | 70,292.69 | 2.00 |

| Bajaj Finance | Finance | 61215.61 | 3.00 |

| Power Finance Corporation | Finance | 24,101.73 | 4.00 |

| Hero MotoCorp | Automobiles | 54,792.31 | 6.00 |

| Mahindra and Mahindra | Automobiles | 53,159.19 | 6.00 |

| Larsen & Toubro | Infrastructure | 1,83,335.16 | 10.00 |

| GMR Airports | Infrastructure | 2,428.92 | 1.00 |

| NTPC | Power Generations | 87,440.08 | 6.00 |

| Power Grid | Power Generations | 33,621.28 | 6.00 |

| Bharti Airtel | Telecom | 1,33,192.72 | 5.00 |

| Tata Communications | Telecom | 5,926.20 | 3.00 |

| Hindalco | Metals | 31,713.91 | 6.00 |

| Tata Steel | Metals | 37,948.27 | 6.00 |

| Ramco Cements | Cement | 7,428.30 | 8.00 |

| UltraTech Cements | Cement | 39,075.23 | 4.00 |

If we observe the above data, the highest investments in value terms are in the banking sector (these reflect the current value of their investments), particularly in HDFC Bank and ICICI, each surpassing Rs 3 lakh crore. Additionally, in the IT sector, Infosys and ITC have attracted over Rs 2 lakh crore each from Mutual Funds.

Furthermore, three stocks, namely L&T, TCS, and Bharti Airtel, have garnered over Rs 1 lakh crore each. Moreover, both L&T and ICICI Bank are present in multiple MF schemes, with over 10 schemes each, according to the current data. This signifies that Mutual Funds show a strong preference for these stocks.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 25, 2024, 6:44 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates