In the world of IPOs, Indian Mutual Funds (MFs) are stealing the spotlight for the second consecutive year, outshining their foreign counterparts.

In the high-stakes game of Initial Public Offerings, domestic Mutual Funds are proving to be the real MVPs, subscribing a whopping Rs 5,577 crore in the anchor category so far in 2023. Move over, Foreign Portfolio Investors (FPIs), it’s the MFs’ time to shine!

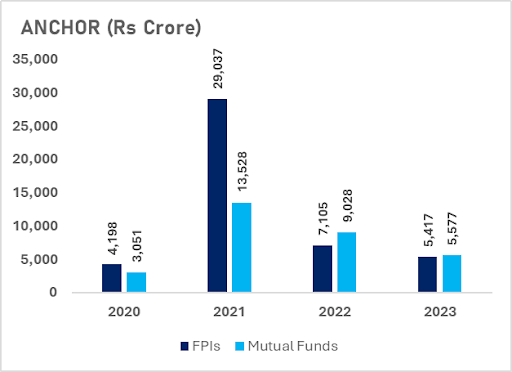

For the second year in a row, MFs are poised to surpass FPIs in anchor investments. With an investment of Rs 5,577 crore, they’ve left FPIs trailing at Rs 5,417 crore.

Rewind to 2022, a year that rewrote the IPO rulebook. MFs invested a whopping Rs 9,026 crore in anchor investment, a jaw-dropping 21% more than what FPIs threw into the ring.

Not just satisfied with IPO glory, MFs are flexing their financial muscles in secondary markets. They’ve assumed a pivotal role in both the anchor and main books, dictating the equity market narrative for two consecutive years.

MFs, with a colossal Rs 27 lakh crore in current equity-oriented assets, are on a roll. In 2023, they covered a staggering 65% of the anchor book on average. FPIs, time to step up your game!

The dip in anchor investments by both MFs and FPIs last year can be traced back to LIC’s colossal IPO. With a whopping Rs 4,355 crore, LIC secured 48% of the anchor money.

In the race of fund houses, ICICI Prudential MF steals the thunder with an investment of Rs 801 crore, followed closely by Nippon India and HDFC, both at Rs 556 crore. These fund houses are giving us serious investment goals!

As the curtain falls on this financial showdown, MFs emerge as the undisputed champions, reshaping the IPO landscape and leaving FPIs to contemplate their next move. In the world of finance, it seems the home team has the home advantage.

Disclaimer:This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 14, 2023, 3:46 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates