India’s plans to auction its newly discovered lithium blocks, estimated at a substantial 5.9 million tonnes, have ignited interest among both domestic and international mining giants. Adani Enterprises, Vedanta Ltd, Reliance Industries, Jindal Steel and Power Ltd, Himadri Chemicals, and South Korea’s LX International are among the prominent participants in this resource race. As the world increasingly recognizes lithium as the “white gold” fuelling the electric vehicle surge, the mining industry’s strategic significance is more apparent than ever.

Economies of Scale: Large mining companies benefit from economies of scale, spreading overheads and reducing per-ton production costs. They have greater bargaining power, increased financial stability, and can maintain a steady supply to customers.

Operational Efficiency: Mining companies invest in mechanization and automation to improve operational efficiency and increase production throughput, gaining a competitive edge.

Vertical Integration: Vertically integrated mining companies that produce minerals and refine them into finished metal in-house enjoy higher profit margins and reduced transportation costs.

Lack of Pricing Power: The mining industry primarily deals in non-differentiable, commoditized products, leading to intense price-based competition. Even the largest players are price-takers, with no control over product pricing.

Capital-Intensive Nature Developing mines requires substantial investments, and the long lead time to start ore extraction poses a challenge to new entrants. Continuous investment is needed to replenish depleting ore reserves.

Cyclical Business The mining industry is highly cyclical and closely tied to economic cycles. Demand peaks during economic upswings but leads to overcapacity when new mines become operational during downturns.

High Regulatory Burden Mining operations face extensive regulatory requirements, which include approvals from multiple government agencies. Violating regulations can lead to production disruptions and significant financial penalties.

Operational Efficiency and Low-Cost Production Ongoing investments in technology and operational efficiency can help mining companies reduce costs and maintain profitability during economic fluctuations.

Renewable Energy Transition As governments focus on renewable energy, the demand for coal and other hydrocarbon minerals may decrease in the long term. Mining companies can diversify into sustainable minerals or adapt to changing market demands.

Integration into Downstream Activities Forward integration into value-added products can lower dependence on specific industries or customers, reducing cyclicality. Companies can explore product diversification to mitigate risks.

Global Expansion: The industry’s shift from developed to developing countries presents opportunities for growth. Stable regulations and tax regimes in these nations can attract mining investments.

Environmental and Social Risks: Mining activities significantly impact the environment, including habitat disruption, pollution, and deforestation. Non-compliance with environmental regulations can result in legal action and penalties.

Public Opposition Protests and opposition from local communities can disrupt mining operations, necessitating engagement and agreements with affected populations. Challenges in land acquisition, rehabilitation, and resettlement can lead to project delays.

Volatility and Political Risk: Mining companies face volatility due to commodity price fluctuations and high political risk, including changes in taxation, royalties, and regulatory frameworks. These changes can happen suddenly and affect a company’s economics.

Government Control: The mining industry is highly regulated, with governments imposing various levies and taxes. Any deviation from mining laws can lead to production disruptions and significant financial penalties.

It’s worth noting that the World Coal Association estimates more than one trillion tonnes of coal reserves worldwide, enough to last 150 years at current rates of production, further solidifying coal’s position as the most-mined mineral globally. To date, the world has not depleted its reserves of any mineral.

While the mining industry directly contributes around 2% to 5% of the gross domestic product (GDP), its significance within the broader industrial sector is notable, accounting for approximately 10% to 11% of the industrial sector’s GDP.

In 2021, China and India dominated global coal consumption, collectively using twice as much as the rest of the world combined. Looking ahead to 2023, their combined share is set to reach nearly 70%.

In stark contrast, the United States and the European Union, which once represented 40% of global coal consumption three decades ago and over 35% at the turn of the century, now contribute less than 10%. This shift underscores the evolving dynamics of coal demand, with Asia taking the lead.

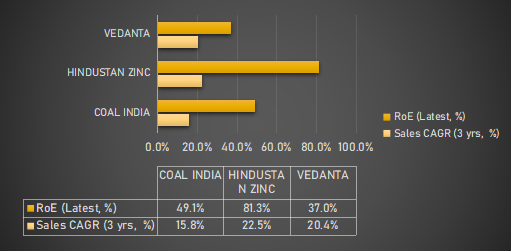

TOP 3 Companies – ROE and Sales CAGR

Given the inherent cyclicality of this industry, it’s worth noting that Return on Equity (ROE) figures can experience periodic spikes. To provide a more stable assessment, we recommend utilizing the average ROE in relation to the latest book value.

In conclusion, the mining industry faces a complex landscape with strengths like its scale and vertical integration, counterbalanced by weaknesses such as cyclicity and stringent regulations. To navigate this terrain effectively, businesses should focus on operational efficiency and long-term strategies, accounting for environmental and social responsibilities. By understanding these facets, mining companies can chart a more sustainable and profitable course in this challenging sector.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 12, 2023, 6:19 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates