Netflix, a premium online streaming service provider that enables users to watch TV shows and movies, announced its Q3 results on October 18.

In the third quarter of 2023, the Company’s revenue saw an 8% YoY growth from USD 7.9 billion to USD 8.5 billion on both reported and foreign exchange-neutral terms, slightly surpassing the company’s initial forecast due to higher-than-anticipated member growth. This increase in revenue was mainly driven by a 9% YoY rise in average paid memberships, with a net addition of 8.8 million paid members compared to 2.4 million in Q3 of 2022. As per the management, the growth was attributed to the rollout of paid sharing, robust and consistent content offerings, and our ongoing global expansion in streaming services.

On the other hand, the company’s Average Revenue Per Member (ARM) decreased by 1% YoY, aligning with the expectations. This decline can be attributed to several factors, including a higher proportion of member growth coming from countries with lower ARM, limited price adjustments over the past 18 months, and some shifts in the subscription plans.

In the third quarter of 2023, the operating profit stands at USD 1.9 billion, a 25% increase compared to the previous year, slightly exceeding the company’s guidance forecasts due to the higher revenue and the timing of content and other expenditures. Consequently, the operating margin for the quarter reached 22.4%, up three percentage points from the same period last year, surpassing the forecasted 22.2%.

Furthermore, the net profit of the company grew by 20% YoY from USD 1.39 billion to USD 1.67 billion. The earnings per share (EPS) for Q3 stood at USD 3.73, compared to USD 3.10 in the previous year, including a non-cash unrealized gain of USD 173 million resulting from foreign exchange remeasurement on our Euro-denominated debt, which is recognized below operating income in the category of “interest and other income.

Netflix has revised its operating margin guidance for FY23, setting it at 20%, which is at the upper end of the previously provided range of 18% to 20%. Anticipating the fourth quarter of 2023, the company foresees a revenue of USD 8.7 billion, representing an 11% YoY increase or 12% on a foreign exchange-neutral basis. In terms of paid net additions for the fourth quarter, the company expects them to be in line with the figures seen in the third quarter, with minor variations.

Furthermore, it is expected that the global Average Revenue Per Member (ARM) in Q4 will remain relatively stable YoY. This is primarily due to the limited price adjustments made over the past eighteen months.

The industry has faced a tough period in the past half-year, primarily due to the simultaneous strikes by writers and actors in the United States. Although Netflix has successfully come to terms with the Writers Guild of America (WGA), discussions with SAG-AFTRA are still in progress. Netflix remains dedicated to swiftly addressing the outstanding matters, with the aim of enabling all involved parties to get back to creating movies and TV shows that will captivate audiences.

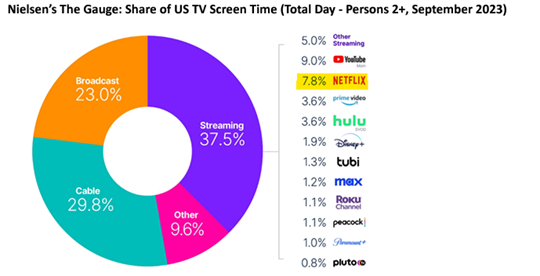

In the United States, the company had the most-watched original series for 37 out of the first 38 weeks of 2023, and the most-watched movie in 31 of those 38 weeks, as reported by Nielsen. Similarly, our share of television screen time in the US reached 8% in September, surpassing all other streaming platforms except for YouTube. We are confident that there is significant room for growth as we continue to enhance the quality of our content offerings.

The stock of the company opened the day at USD 351 per share, which was 1.32% lower than the previous day’s closing price of USD 355.72 per share. It eventually closed the day at USD 346.19 per share yesterday. The current market capitalization of the company stands at USD 153.41 billion, and the stock has delivered a return of 43.8% over the past year.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 19, 2023, 11:32 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates