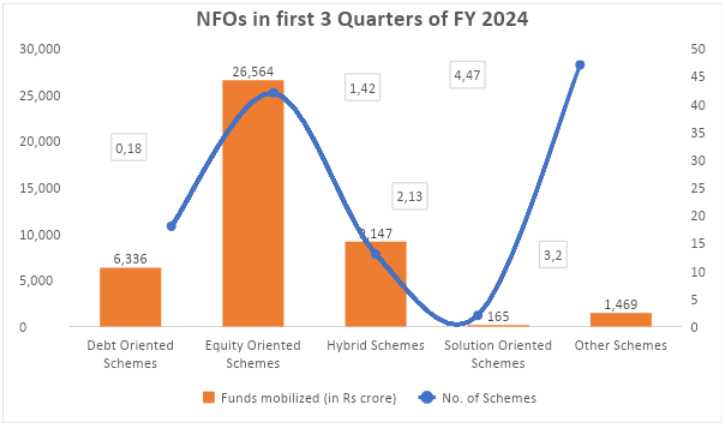

In the first three quarters of FY 2024, the mutual fund industry witnessed significant activity. Over this period, a total of 122 mutual fund schemes were operational through new fund offers (NFO), comprising a diverse range of investment options across debt, equity, hybrid, solution-oriented, and other specialized categories.

The cumulative funds mobilized during this period amounted to a substantial Rs 43,681 crore, illustrating robust investor participation and confidence in various mutual fund offerings. Notably, the majority of funds mobilized came from Equity Oriented Schemes, underscoring investor preference for the flexibility and liquidity offered by such structures. Overall, the figures portray a dynamic and thriving mutual fund landscape in the first three quarters of FY 2024, characterized by substantial funds mobilization and a diverse array of investment opportunities for investors.

Source: AMFI

The table given below and the chart above presents a comprehensive overview of funds mobilized across various categories of mutual fund schemes through NFO, delineating between open-end and closed-end funds, and providing a total summary.

In the category of Debt Oriented Schemes, there are a total of 18 schemes, with 7 open-end schemes and 11 close-end schemes. The funds mobilized in open-end schemes amount to Rs 3,538 crore, whereas close-end schemes have mobilized Rs 2,798 crore. Cumulatively, these schemes have mobilized Rs 6,336 crore.

Moving to Equity Oriented Schemes, there are exclusively open-end funds, totaling 42 schemes. These schemes have successfully mobilized a substantial sum of Rs 26,564 crore. This dominance in funds mobilization within the equity category suggests a strong investor preference for open-end equity schemes launched.

Hybrid Schemes, consisting of a combination of debt and equity instruments, comprise 13 open-end schemes. These schemes have amassed Rs 9,147 crore. There were no close-end hybrid schemes.

Solution Oriented Schemes, designed to meet specific financial goals such as retirement planning or education funding, account for 2 open-ended schemes with funds mobilized amounting to Rs 165 crore. Similarly, in the category of Other Schemes, encompassing various specialized offerings, 47 open-end schemes have mobilized Rs 1,469 crore.

Overall, Equity Oriented Schemes dominate across all categories whereas Hybrid Schemes stand at 2nd position, where both types have substantial contributions. This could be indicative of investor preferences for the flexibility and liquidity inherent in open-end structures. Additionally, the data underscores the robustness of equity-oriented schemes in attracting investor capital, reflecting confidence in the potential returns offered by equity markets.

| Particulars | Open End | Close End | Total | |||

| No. of Schemes | Funds mobilized (in Rs crore) | No. of Schemes | Funds mobilized (in Rs crore) | No. of Schemes | Funds mobilized (in Rs crore) | |

| Debt Oriented Schemes | 7 | 3,538 | 11 | 2,798 | 18 | 6,336 |

| Equity Oriented Schemes | 42 | 26,564 | – | – | 42 | 26,564 |

| Hybrid Schemes | 13 | 9,147 | – | – | 13 | 9,147 |

| Solution Oriented Schemes | 2 | 165 | – | – | 2 | 165 |

| Other Schemes | 47 | 1,469 | – | – | 47 | 1,469 |

| Total | 111 | 40,883 | 11 | 2,798 | 122 | 43,681 |

Data for the first three quarters of FY 2024

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Mar 27, 2024, 1:30 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates