The Nifty 50 index is the crown of the Indian capital market, tracking the 50 largest and most liquid companies listed on the National Stock Exchange of India. It is a highly selective index, with companies chosen based on their free-float market capitalization and liquidity, measured by average impact cost. This ensures that the Nifty 50 is a representative benchmark for the Indian market as a whole. The index constituents should have derivative contracts available on NSE. Free-float methodology is a method of calculating the market capitalization of a stock market index’s underlying companies by taking the equity’s price and multiplying it by the number of shares readily available in the market. The free-float method excludes locked-in shares, such as those held by insiders, promoters, and governments.

The price-to-book (PB) ratio is a popular valuation tool used by investors and analysts to assess whether a company is trading at a fair price. PB ratio is calculated as Index market capitalization divided by Gross book value or net worth. The PB ratio is often preferred by value investors because it is less volatile than the price-to-earnings (PE) ratio, which is another popular valuation metric. This is because the PB ratio is based on the company’s book value, which is a more stable measure of a company’s worth than its earnings.

The index market capitalisation is calculated by multiplying the number of outstanding shares of each constituent company, adjusted for free-float, capping factors, and other relevant factors, by the company’s last traded price. This gives us a measure of the total value of all the shares in the index. In other words, the index market capitalisation is like the total market value of the index’s basket of stocks. It is a reflection of the size and importance of the companies in the index.

The equity capital and the reserves and surplus (Net worth), computed for each index constituent, is cumulated and adjusted for factors such as free-float, capping factor etc. depending upon the index methodology to arrive at the gross book value.

A PB ratio below 1 indicates that the company is trading below its book value, which means that investors may be able to buy the company for less than its assets are worth. This can be a sign that the company is undervalued.

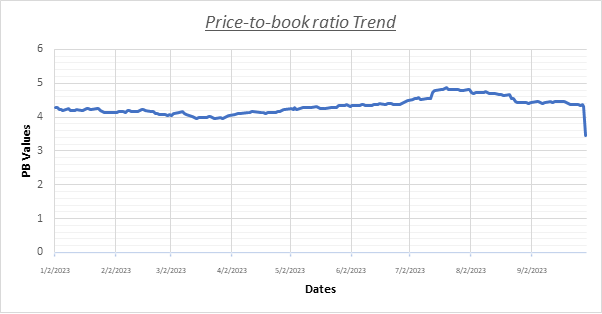

Index’s underlying companies have significantly higher consolidated book values as compared to their standalone values. Previously, the equity capital and the reserves & surplus (Book value) were computed on a standalone basis of each index constituent in the annual financial report cumulated and adjusted for factors such as free-float, capping factor etc. However, effective September 29, 2023, the Nifty50 index has switched to calculating the book value of its constituents on a consolidated basis. This change has led to a significant increase in the recognition of the book value of many of the Nifty 50 constituents while calculating the index PB ratio. As a result, the overall PB ratio of the index has fallen from 4.31x to 3.45x.

The following table shows the consolidated and standalone book values of the popular constituents of the Nifty 50 index.

| Constituent | Consolidated (a) | Standalone (b) | Difference (a-b) |

| Reliance Industries | 7,15,872.00 | 4,79,094.00 | 2,36,778.00 |

| HDFC Bank | 2,89,437.50 | 2,80,199.00 | 9,238.50 |

| ITC | 69,155.26 | 67,593.80 | 1,561.46 |

| TCS | 90,424.00 | 74,538.00 | 15,886.00 |

| L&T | 49,509.00 | 46,881.00 | 2,628.00 |

| Axis Bank | 1,29,355.62 | 1,24,993.25 | 4,362.37 |

| Bajaj Finance | 54,371.98 | 51,493.13 | 2,878.85 |

| Asian Paints | 15,992.23 | 15,585.56 | 406.67 |

| Maruti Suzuki India | 6,179.13 | 6,038.20 | 140.93 |

| State Bank of India | 3,58,931.32 | 3,27,608.45 | 31,322.87 |

All information is for the year ended 2022-2023. Figures are in Rs. Crore

As the above table shows, the consolidated book value of Reliance Industries is significantly higher than its standalone book value. This is due to the fact that Reliance has a number of subsidiaries, and their book values are included in the consolidated book value. The difference between the consolidated and standalone book values of Reliance Industries is the largest among the top 10 constituents of the Nifty50 index. This difference between consolidated and standalone book values is the major factor that has contributed to the recent fall in the Nifty50 index’s price-to-book ratio.

However, it is important to note that the PB ratio is just one of many factors that investors should consider when making investment decisions. Other factors, such as the company’s earnings growth potential and its management team, should also be considered.

Disclaimer: The above information is for educational purposes only. It is based on several secondary sources on the internet and is subject to changes. Securities mentioned are not a recommendation to buy or sell. Please consult with a financial advisor before making any investment decisions.

Published on: Oct 3, 2023, 6:55 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates