The world may be grappling with volatility and valuation worries, but for Indian stocks, it’s raining foreign money! Overseas inflows have hit record highs, making India the darling of emerging markets. Buckle up as we dive into why investors are choosing India over all others.

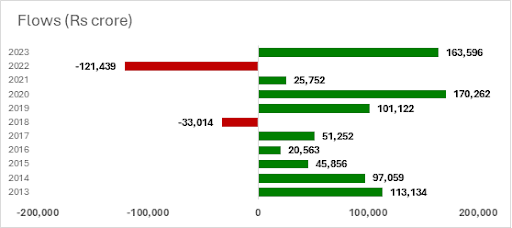

Forget Wall Street blues – Indian stocks are dancing to a different tune. Despite global market anxiety, foreign portfolio investors have pumped a whopping Rs 1.62 lakh crore (over $20 billion) into Indian equities so far this year. That’s second only to the pandemic-fuelled frenzy of 2020, and a clear signal of foreign faith in India’s resilience.

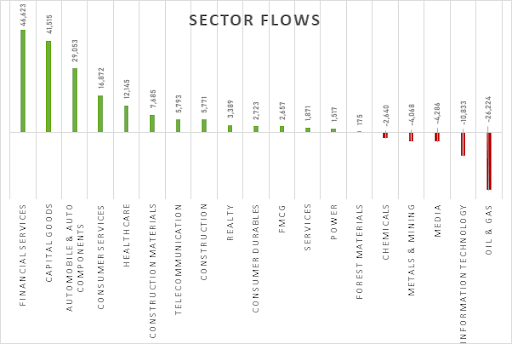

So, where’s the party happening? Financial services and capital goods are leading the charge, followed by autos and auto components. Not surprisingly, sectors deemed as key drivers of India’s growth story are attracting the most attention. Interestingly, though, some traditional favourites like oil & gas and IT saw outflows. Perhaps some profit-taking after a stellar run?

Now, let’s talk about bragging rights. Compared to its emerging market peers, India is basking in the sunshine. We’ve received the highest foreign inflows, leaving other emerging markets in the dust. This vote of confidence from global investors speaks volumes about India’s economic attractiveness.

Emerging Market Performance

| Emerging Market Countries | Flows (Year-to-date) $ millions |

| India | 20,113.40 |

| South Korea | 9,062.40 |

| Brazil | 8,514.40 |

| Taiwan | 4,107.60 |

| Sri Lanka | 12.1 |

| Indonesia | -539.9 |

| Malaysia | -553.1 |

| Vietnam | -824.5 |

| Philippines | -869.4 |

| Thailand | -5,600.10 |

It’s not just foreign investors – even domestic players are singing India’s praises. Our stock markets have scaled record highs this year, with the Nifty 50 and Sensex soaring nearly 18% and 16% respectively. Why the optimism? It’s a potent cocktail of factors:

Resilient Economy: India’s economy has weathered global headwinds remarkably well, shaking off geopolitical tensions, rising oil prices, and even the US yield shock. This stability is music to investors’ ears.

Growth Potential: India’s growth story remains compelling, with a young population, rising disposable incomes, and a commitment to reforms. This future potential is highly alluring.

Attractive Valuations: Compared to some overheated Western markets, India’s valuations offer relative bargain hunting opportunities. This makes it a sweet spot for investors.

While global markets may be uncertain, India’s stock market is shining bright. With record inflows, resilient growth, and attractive valuations, it’s no wonder investors are flocking to the land of opportunity. So, buckle up, folks, the Indian bull market might just be getting started!

In 2023, the financial services sector emerged as the frontrunner, attracting the highest inflow of Rs 46,623 crore, constituting approximately 28% of the total investments. Following closely, the capital goods sector secured the second position with an impressive inflow of Rs 41,515 crore, representing nearly a quarter of the total flows. The automobile and auto components sector experienced a substantial inflow of Rs 29,053 crore, contributing 17% to the overall investment landscape.

However, not all sectors thrived, as both the Oil & Gas and Information Technology sectors witnessed significant outflows.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 26, 2023, 6:17 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates