It’s been over 16 years since the global financial crisis of 2008 turned the world of finance upside down. The collapse of Lehman Brothers and the ensuing panic led to a massive sell-off in stock markets worldwide, while gold prices surged as investors sought safe havens.

In this article, we’ll dive into how investments in India’s Nifty 50 index and gold have performed since that tumultuous time and what it means for investors today.

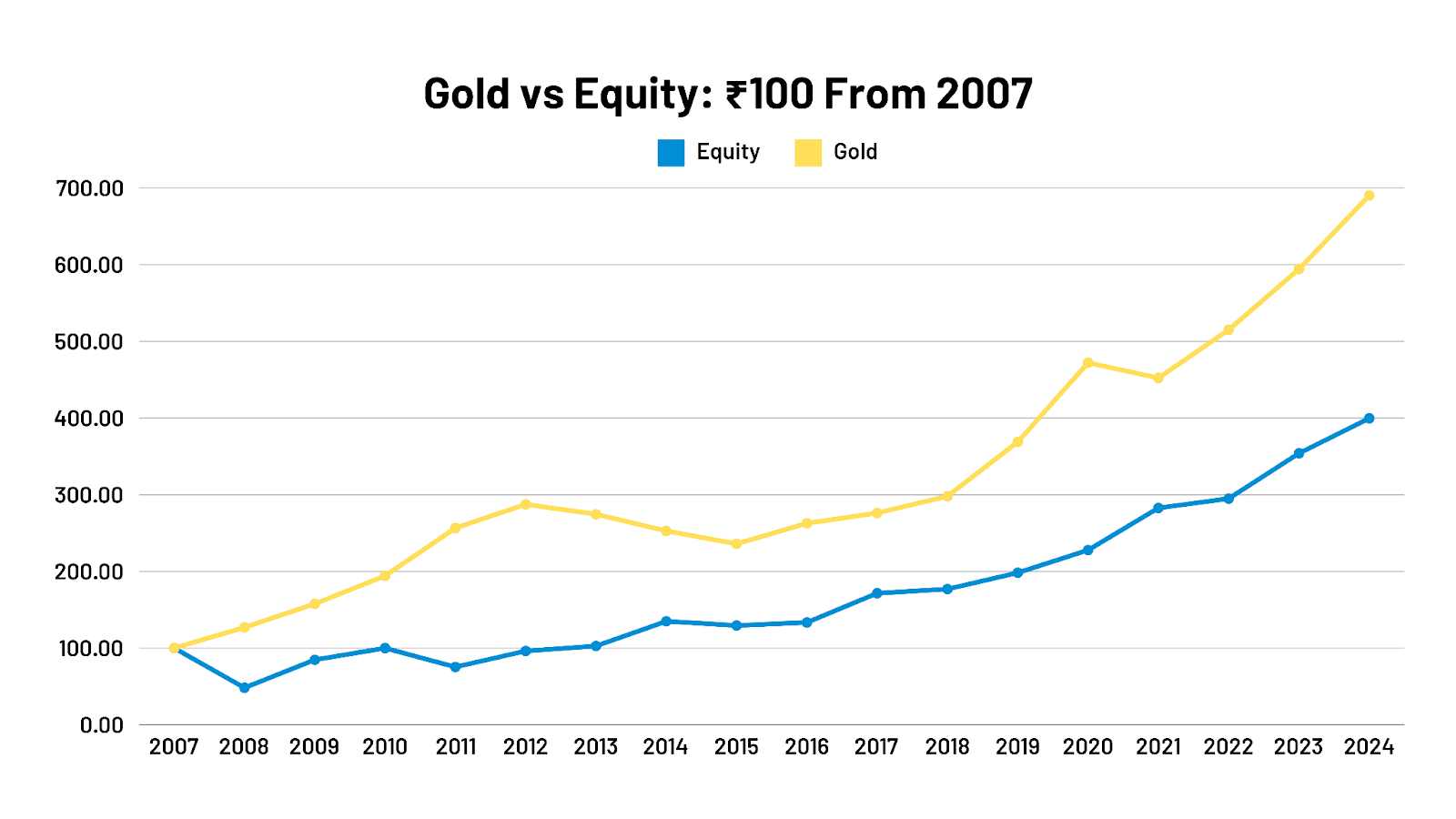

Let’s imagine you had ₹100 to invest at the end of 2007. Where would it be today if you had put it in the Nifty 50 index versus gold? Here’s a detailed year-by-year look at the returns from both investments:

Gold has long been considered a safe haven, especially in times of economic uncertainty. The financial crisis of 2008 was a prime example of why. While equity markets were in free fall, gold prices surged as investors sought stability.

If you had invested at the end of 2007, by the end of 2008, your ₹100 investment in gold would have grown to ₹126.94, while the same investment in the Nifty 50 would have dropped to just ₹48.21. This stark contrast highlights gold’s role in preserving value during turbulent times.

Over the next few years, gold continued its upward trajectory, driven by factors such as central bank buying, low interest rates, and economic uncertainty. By 2024, your ₹100 investment in gold would have grown to a staggering ₹690.29.

On the other hand, equities, represented by the Nifty 50 index, took a different path. After the initial shock of the financial crisis, the Nifty 50 began to recover in 2009. This recovery was supported by coordinated efforts from central banks and governments worldwide aimed at reviving economic growth.

The Nifty 50’s performance over the past 16 years reflects the resilience of the Indian economy and the growth of its corporate sector. Factors such as improved corporate earnings, strong reforms, rising urbanisation, and digital transformation have all played a role.

By the end of 2024, your ₹100 investment in the Nifty 50 would have grown to ₹399.62. While this is a significant return, it’s clear that gold has outperformed equities during this period. But is it actually true?

When it comes to investing, timeframes can tell a very different story. Each timeframe gives a different best investment in terms of returns. Let’s have a look.

1-Year Performance

In the past year, the Nifty 50 has surged with a 24% CAGR, driven by economic growth, improved corporate earnings, and increased foreign investments. Gold has also performed well, with a 17% CAGR, reflecting its role as a hedge against inflation and economic uncertainty.

5-Year Performance

Over the last 5 years, gold has slightly outperformed the Nifty 50, achieving an 18% CAGR compared to Nifty’s 15% CAGR. This period highlights gold’s consistent returns amid economic uncertainties and geopolitical tensions, while equities benefited from corporate growth and the COVID rebound.

10-Year Performance

In the long term, the Nifty 50 has outperformed gold with a 14% CAGR versus gold’s 10% CAGR. Equities have shown substantial growth driven by economic expansion and corporate profitability, while gold has provided stability and protection against market volatility.

Overall, the returns from Nifty 50 and gold depend on the timeframe you’re looking at. So, how can you invest in these assets to minimise risks and maximise returns? Let’s find out.

Gold and equities serve distinct but complementary purposes in a diversified investment portfolio. Equities allow investors to participate in the economic growth of a country. They provide the potential for high returns, which can significantly grow wealth over time.

On the other hand, gold has long been revered for its role as a store of value, as it helps preserve purchasing power and provides stability and protection against losses. Together, they can create a balanced portfolio that aims for growth while managing risk.

The significant returns generated by gold can be attributed to several factors:

The Nifty 50 index’s performance has been influenced by several key factors:

Over the past 16 years, both gold and the Nifty 50 index have provided strong returns to investors. However, gold has outperformed equities, offering greater returns and acting as a hedge during financial turmoil. Understanding the performance dynamics of these asset classes can help investors make informed decisions and create a balanced portfolio that aims for growth while managing risks.

Disclaimer: This article has been written for educational purposes only. The securities quoted are only examples and not recommendations.

Published on: Jul 23, 2024, 4:53 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates