In the world of stock market indices, the NIFTY 50 and NIFTY Alpha 50 are well-known benchmarks that represent the performance of the Indian stock market. While both indices are part of the NIFTY family, they serve different purposes and have distinct characteristics.

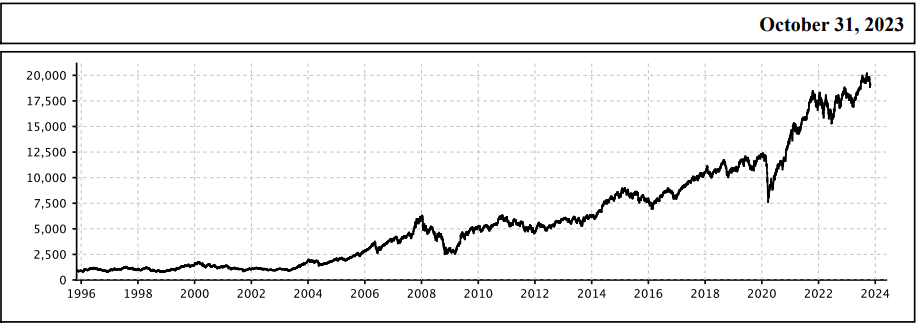

The NIFTY 50, often referred to simply as the Nifty, is one of the most prominent stock market indices in India. It was launched in April 1996 by the National Stock Exchange of India (NSE) and includes the 50 largest and most liquid stocks listed on the NSE. The Nifty serves as a barometer for the Indian equity market, reflecting the performance of large-cap companies across various sectors.

| NIFTY 50 | |

| Sector | Weight |

| Financial Services | 35.9 % |

| Information Technology | 13.6 % |

| Oil , Gas & Consumer Fuels | 11.4 % |

| Fast Moving Consumer Goods | 9.5 % |

| Automobile and Auto Components | 6.3 % |

| Construction | 4.2 % |

| Healthcare | 4.0 % |

| Metals & Mining | 3.7 % |

| Consumer Durables | 3.2 % |

| Telecommunication | 2.8 % |

| Power | 2.4 % |

| Construction Materials | 2.0 % |

| Services | 0.8 % |

| Chemicals | 0.3 % |

Source: NSE

The Nifty Alpha 50 Index tracks NSE-listed securities with high alphas, offering a well-diversified portfolio of 50 stocks. Securities are selected based on criteria like liquidity and market capitalization to ensure replicability and investibility. The index assigns weights to securities according to their alpha values, with the highest alpha receiving the highest weight. This index serves various purposes, including benchmarking fund portfolios, launching index funds, ETFs, and structured products.

| NIFTY ALPHA 50 | |

| Sector | Weight |

| Financial Services | 40.8 % |

| Capital Goods | 28.5 % |

| Information Technology | 8.6 % |

| Healthcare | 4.7 % |

| Automobile and Auto Compo | 4.5 % |

| Fast Moving Consumer Good | 3.5 % |

| Construction | 3.2 % |

| Textiles | 2.8 % |

| Metals & Mining | 1.4 % |

| Consumer Services | 1.3 % |

| Power | 0.8 % |

Source: NSE

| P/E | P/B | Dividend Yield |

| 20.45 | 3.35 | 1.41 |

| P/E | P/B | Dividend Yield |

| 14.89 | 2.19 | 1.33 |

In summary, the NIFTY 50 and NIFTY Alpha 50 represent two distinct approaches to tracking the Indian stock market. The choice between these two options depends on an investor’s risk tolerance, investment strategy, and belief in the efficiency of the market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 3, 2023, 1:47 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates